Itemized List For Insurance Claim Template

What is Itemized list for insurance claim template?

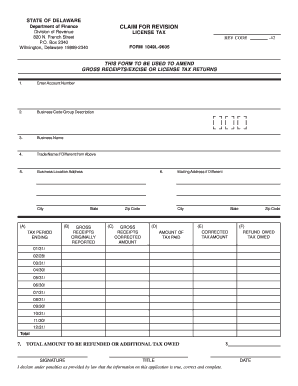

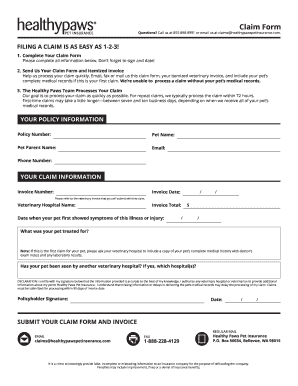

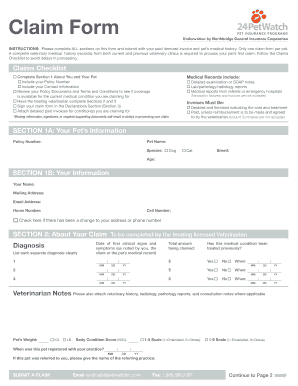

An itemized list for insurance claim template is a detailed breakdown of the items or expenses being claimed for reimbursement from an insurance company. This document helps organize and clarify the information provided to ensure a smooth and efficient claims process.

What are the types of Itemized list for insurance claim template?

There are several types of itemized lists for insurance claim templates, including but not limited to:

Personal Property Itemized List

Medical Expenses Itemized List

Vehicle Damage Itemized List

Home Repair Itemized List

How to complete Itemized list for insurance claim template

Completing an itemized list for an insurance claim template is straightforward with the right approach. Here are some tips:

01

Gather all relevant documentation and receipts related to the claim.

02

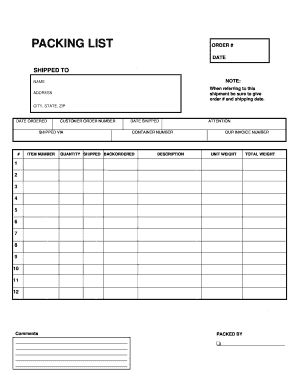

Begin by listing each item or expense individually, including a brief description, quantity, and value.

03

Be thorough and accurate in your documentation to avoid delays or disputes with the insurance company.

04

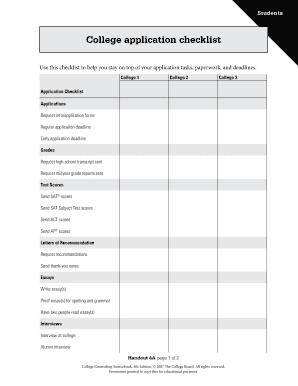

Organize the list in a clear and easy-to-follow format to make it simpler for the claims adjuster to review.

05

Review and double-check the completed itemized list before submitting it to ensure accuracy.

pdfFiller empowers users to create, edit, and share documents online, providing unlimited fillable templates and powerful editing tools to streamline the document creation process.

Video Tutorial How to Fill Out Itemized list for insurance claim template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a content list for insurance?

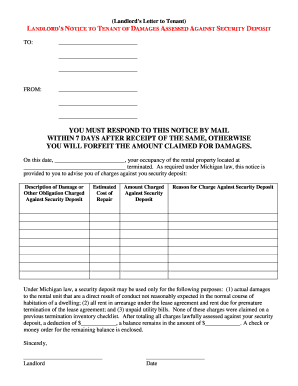

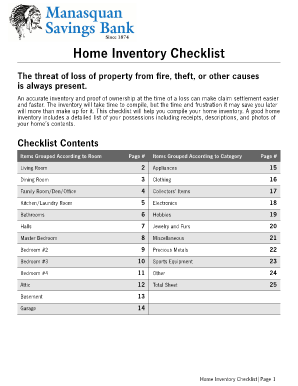

Begin your list by documenting each room separately. Write down each item under the categorical name of the room (i.e., Living Room, Kitchen, Bedroom, etc.). Items such as “clothing” or “shoes” can be grouped together following a more specific amount of quantity. Such as, “Clothing – 25 shirts and 15 pants.”

How do you write inventory of your personal belongings?

A written inventory: A comprehensive home inventory list catalogs your belongings and should include the item description (make, model and serial number, if applicable), value and purchase date. You can create your own list using a spreadsheet or fill out a home inventory checklist that's ready to go.

Why is a detailed household inventory helpful if you need to submit an insurance claim?

Not having a home inventory could delay your claims payment. Most insurance companies will want a record of your lost or damaged items before they will pay a personal property claim. Ask your agent what documentation is needed to make a claim.

What happens when you make a contents insurance claim?

What happens after I start my claim? If the home insurance claim is for a larger amount, your insurer is likely to inspect further by sending an investigator (or loss adjuster) to your home. They will confirm the loss or damage you state in your claim and assess how much it would cost to replace or repair.

Do you need to show receipts for insurance claims?

If you need to file an insurance claim, your insurer may ask for a list of items that have been lost or damaged. You might be asked to provide some type of proof that you own these items, like receipts or bills. It may help to think ahead and create an inventory of your belongings and periodically update it..

What is a list of contents for insurance claims?

Also referred to as a personal property inventory list, it dictates the item's name, a brief description, the date it was purchased, an estimated value with a receipt (if you have it). It's important to take photos or videos of the personal belongings on your personal property inventory list.