Estate Planning Questionnaire Templates

What are Estate Planning Questionnaire Templates?

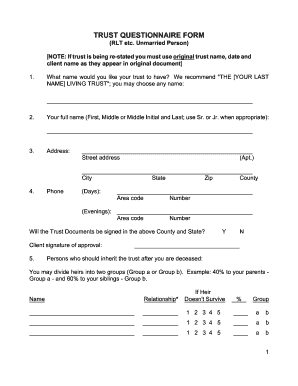

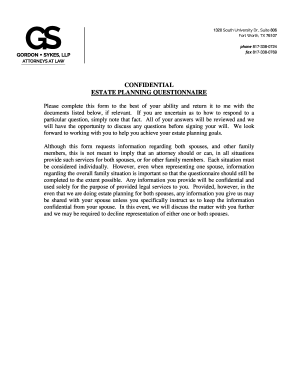

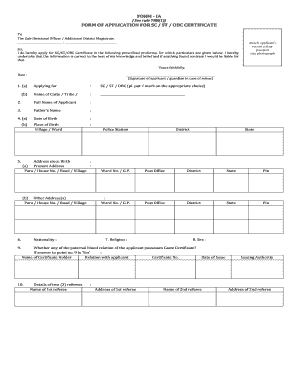

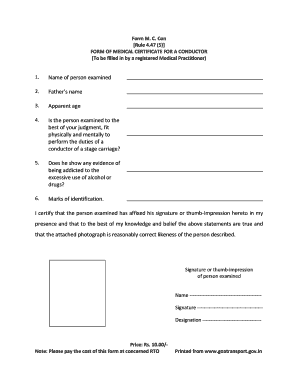

Estate Planning Questionnaire Templates are pre-designed forms that help individuals gather and organize important information needed for creating an estate plan. These templates typically include sections for personal details, financial information, asset inventory, and beneficiaries.

What are the types of Estate Planning Questionnaire Templates?

There are several types of Estate Planning Questionnaire Templates available, including: 1. Basic Estate Planning Questionnaire 2. Comprehensive Estate Planning Questionnaire 3. Will and Trust Questionnaire 4. Healthcare Directive Questionnaire 5. Power of Attorney Questionnaire

How to complete Estate Planning Questionnaire Templates

Completing Estate Planning Questionnaire Templates is a simple process that can help you organize your estate planning documents efficiently. Here are the steps to follow: 1. Gather all relevant financial and personal information. 2. Carefully review the questions and provide accurate answers. 3. Update the template regularly to reflect any changes in your circumstances. 4. Keep a copy of the completed questionnaire in a secure location for easy access when needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.