Donation Form Pdf

What is Donation form pdf?

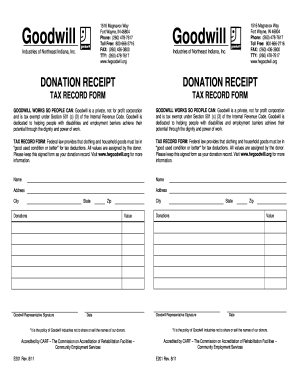

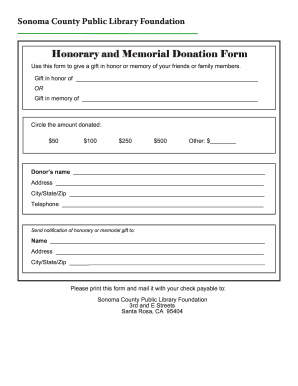

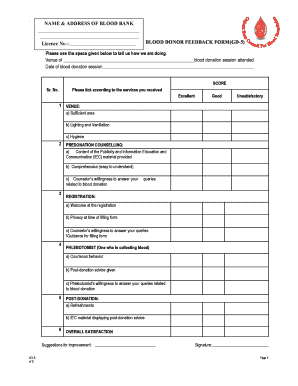

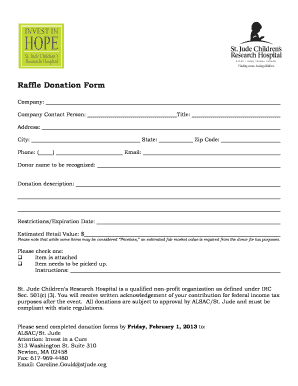

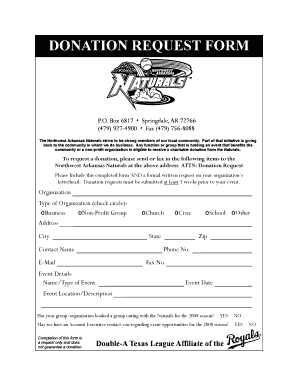

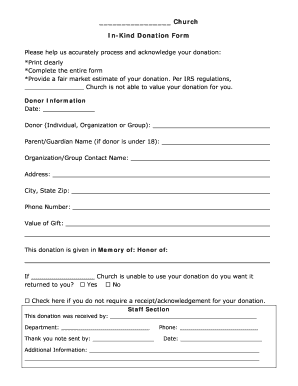

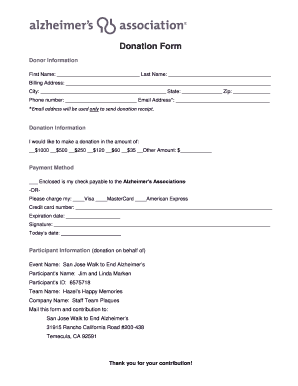

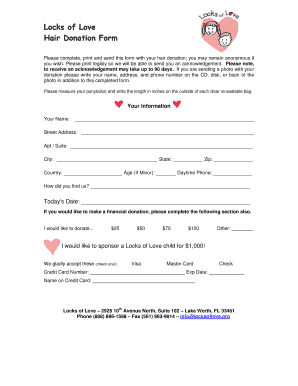

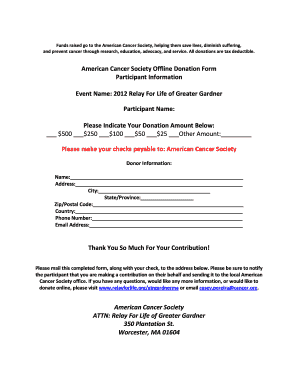

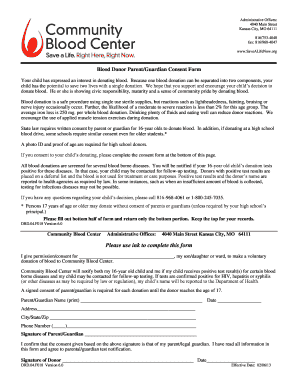

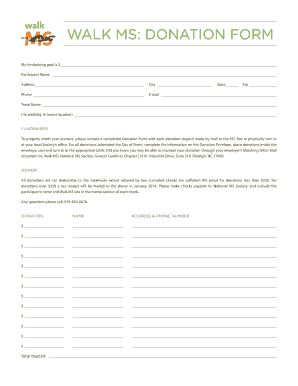

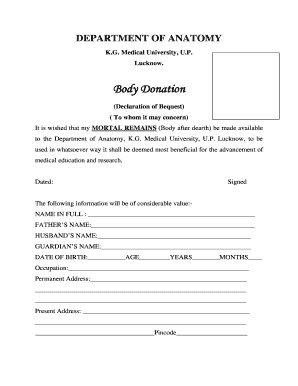

A Donation form pdf is a document used to collect information from donors who are making a donation to a specific cause or organization. This form typically includes fields for the donor's name, contact information, donation amount, and any special instructions or designations for how the donation should be used.

What are the types of Donation form pdf?

There are several types of Donation form pdf, including:

Single donation form pdf - for one-time donations

Recurring donation form pdf - for recurring donations on a schedule

In-kind donation form pdf - for donations of goods or services instead of money

How to complete Donation form pdf

Completing a Donation form pdf is a simple process that involves the following steps:

01

Open the pdfFiller editor and upload the Donation form pdf.

02

Fill in your name, contact information, and donation amount in the appropriate fields.

03

Review the form for accuracy and make any necessary changes.

04

Save the completed form or share it with the organization via email or by printing it out and mailing it.

05

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Donation form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What if my charitable donations are more than 500?

Over $500 to $5,000: Contemporaneous written acknowledgment and you must file Form 8283 with your tax return. 12. Over $5,000: Contemporaneous written acknowledgment, a written appraisal of the property from a qualified appraiser, and filing Form 8283 with your tax return. 13.

What are the IRS guidelines for donations?

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

What should a donation form include?

What's included in a nonprofit donation form template Branded form. For a basic form, without any additional messaging or imagery, it's important to brand the experience. Gift amount. Recurring gift option. Personal information. Payment information. Donor-covered fees option. Thank you message.

What IRS form do I use for charitable donations?

Purpose of Form Use Form 8283 to report information about noncash charitable contributions. Do not use Form 8283 to report out-of-pocket expenses for volunteer work or amounts you gave by check or credit card. Treat these items as cash contributions.

What is the IRS rule for donations over $500?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

What is a proof of donation letter?

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.