Pag-ibig Remittance Form Excel Format 2020 - Page 2

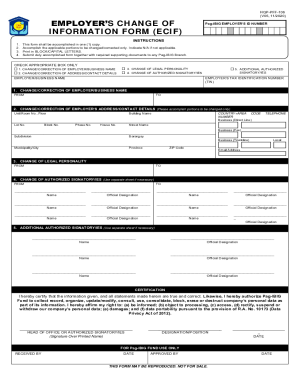

What is Pag-ibig remittance form excel format 2020?

Pag-ibig remittance form excel format 2020 is a document used by employers to report their employees' monthly contributions to the Pag-ibig Fund. It serves as a way to ensure that employees' contributions are accurately recorded and remitted to the fund.

What are the types of Pag-ibig remittance form excel format 2020?

There are three main types of Pag-ibig remittance form excel format 2020, namely:

MCRF (Membership Contribution Remittance Form) - used for reporting and remitting employees' contributions

SBR (Summary of Collection and Remittance) - used for summarizing the total contributions remitted for the month

PMS (Pag-ibig Multi-purpose Loan Payment Order Form) - used for remitting payments for multi-purpose loans

How to complete Pag-ibig remittance form excel format 2020

To complete the Pag-ibig remittance form excel format 2020, follow these simple steps:

01

Fill in the employer information section with your company details

02

Input the employees' names, Pag-ibig numbers, and contribution amounts

03

Double-check the information for accuracy and completeness before submission

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

When can I stop paying Pag-IBIG contribution?

Membership maturity after 20 years, equivalent to 240 monthly contributions. Retirement at age 60 (optional retirement age) or at 65 (mandatory retirement age). Separation from service due to health reasons.

What is the deadline for Pag-IBIG remittance?

Pag-ibig (HDMF) Payment Deadlines First Letter of Employer/Business NameDue DateA to D10th to 14th day of the monthE to L15th to 19th day of the monthM to Q20th to 24th day of the monthR to Z, Numeral25th to at the end of the month

What is the maximum contribution to the Pag-IBIG?

MEMBERSHIP CONTRIBUTIONS With this, Pag-IBIG contribution is pegged at Php100 per month as the maximum monthly compensation of an employee shall be not more than Php5,000. Employed members can immediately double their monthly savings because of the counterpart share of their employers.

What is remittance in Pag-Ibig?

Monthly contributions of employees to Pag-IBIG Fund shall be collected through payroll deductions. All employers shall remit to the Pag-IBIG Fund their contributions and the contributions of their covered employees. Self-employed and voluntary members may remit their monthly contributions on a monthly or quarterly

How much is the monthly contribution for pag-ibig?

The Pag-IBIG monthly membership savings is pegged at just Php100. Employed members immediately double their monthly savings with the counterpart share of their employees. Your savings grows even more with the dividends it earns annually.

What is F1 in Pag-Ibig?

Pag-IBIG 1 (F1) – mandatory contribution.