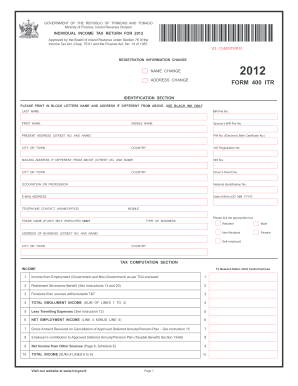

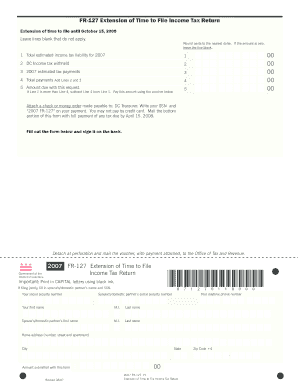

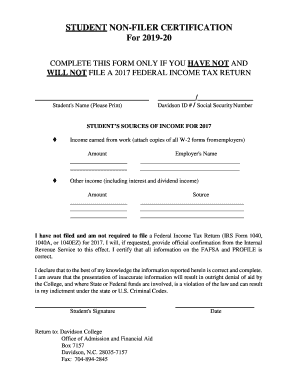

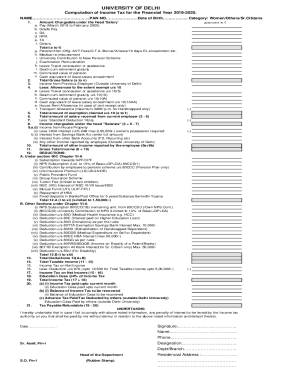

Income Tax Return Form 2019-20 Pdf

What is Income tax return form 2019-20 pdf?

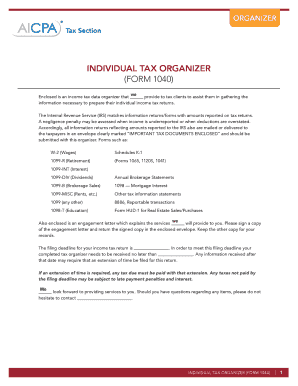

The Income tax return form 2019-20 pdf is a document that individuals use to report their income and tax details to the government for the financial year 2019-20. This form is essential for filing your tax return accurately and timely.

What are the types of Income tax return form 2019-20 pdf?

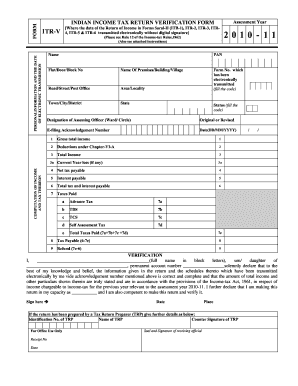

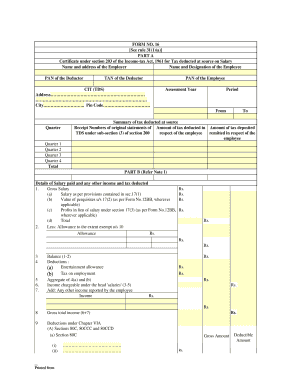

There are different types of Income tax return form 2019-20 pdf based on the taxpayer's source of income and category. The common types include ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7.

ITR-For individuals having income from salaries, one house property, and other sources.

ITR-For individuals and HUFs not having income from profits and gains of business or profession.

ITR-For individuals and HUFs having income from profits and gains of business or profession.

ITR-For individuals and HUFs having income from a business or profession under presumptive taxation scheme.

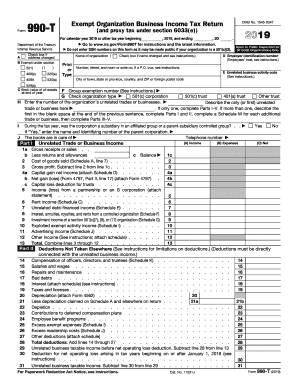

ITR-For firms, LLPs, AOPs, BOIs, artificial juridical persons, co-operative societies, and local authorities.

ITR-For companies other than companies claiming exemption under section 11.

ITR-For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D).

How to complete Income tax return form 2019-20 pdf

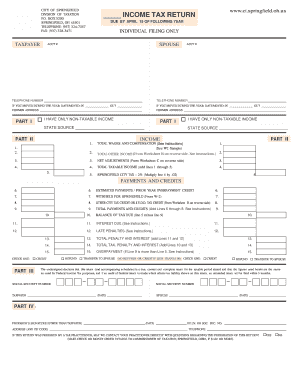

To complete the Income tax return form 2019-20 pdf, follow these steps:

01

Gather all relevant financial documents like salary slips, bank statements, investment proofs, etc.

02

Choose the appropriate type of ITR form based on your income sources and category.

03

Fill in the necessary details accurately in the form, including personal information, income details, deductions, and tax payments.

04

Verify the information provided before submitting the form to avoid errors or discrepancies.

05

Utilize online tools like pdfFiller to create, edit, and share the form easily and efficiently.

pdfFiller empowers users to create, edit, and share Income tax return forms online seamlessly. With its unlimited fillable templates and powerful editing tools, pdfFiller is your go-to PDF editor for all document needs.

Video Tutorial How to Fill Out Income tax return form 2019-20 pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you file a pdf tax return?

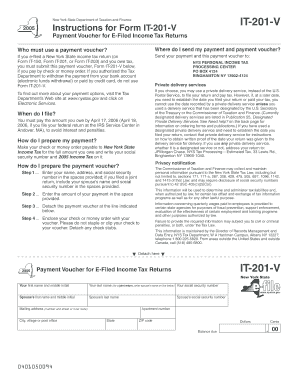

Some return types require that you attach supporting documents as PDF files when you electronically file a return. You can attach the PDF files using the Federal > General > Electronic Filing worksheet. The PDF files are embedded in the return so that you can view them any time you access the return.

Can you fill out tax forms electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Can you print a 1040EZ form online?

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

How do I download IRS forms?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Can I get a PDF of my tax return?

Sign into Turbotax.com. select tax home scroll to tax returns and documents. select the 2018 tax return. click download/PDF tax return.

Can I print a 1040 tax form?

If you prefer to have all tax returns print on Form 1040, even when Form 1040A, Form 1040EZ or 1040-SR would be acceptable, from the Main Menu of TaxSlayer Pro on the transmitting computer select: Configuration. Printer/Copies Setup. Edit Individual Print Options.

How do I get IRS tax forms by mail?

By Mail. You can call 1-800-TAX-FORM (800-829-3676) Monday through Friday 7:00 am to 10:00 pm local time – except Alaska and Hawaii which follow Pacific time – to order current year forms, instructions and publications as well as prior year forms and instructions by mail.

Is there a fillable 1040 Sr form?

The document is released by the Internal Revenue Service (IRS) and was last updated in 2020. A fillable 1040-SR is available for download through the link below.

Where can I get a blank 1040 form?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Does the IRS use free fillable forms?

Free File Fillable Forms is free for preparing and e-filing your federal return regardless of your income or any other criteria.

Are IRS forms fillable?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need.

Where can I get IRS tax forms for 2020?

You can access forms and publications on the IRS website 24 hours a day, seven days a week, at http://www.irs.gov. Taxpayer Assistance Centers. There are 401 TACs across the country where IRS offers face-to-face assistance to taxpayers, and where taxpayers can pick up many IRS forms and publications.

Are 2020 1040 forms available?

IRS Income Tax Forms, Schedules, and Publications for Tax Year 2020: January 1 - December 31, 2020. 2020 Tax Returns were able to be e-Filed up until October 15, 2021. Since that date, 2020 Returns can only be mailed in on paper forms.

How do I get paper tax forms?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Can I print tax forms online?

Can I Print Tax Forms Online? Yes, you can print the tax forms you download for free from the IRS website. You can also print forms from other sites that offer free downloads. If you use an online filing software, you can usually print the forms after you use the software to complete all the information.

How do I print my Mygov tax return?

If you scroll to the bottom of the Return, there is a 'Printer-friendly version' button. Click this button and from there you will be able to either print a copy of the Return or save a PDF copy of the Return.

How can I download my Income Tax Return?

Income Tax Department Go to the 'My Account' menu and Click 'View e-Filed Returns / Forms' hyperlink. Select the applicable option from the dropdown and click 'Submit' to view the details of the e-Filed Return/Forms.