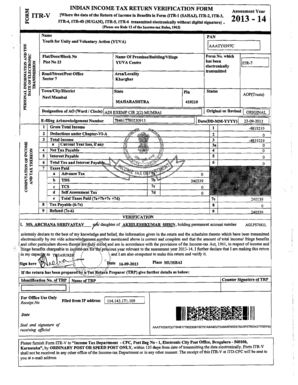

Itr Forms For Ay 2021-22

What is ITR forms for AY 2021-22?

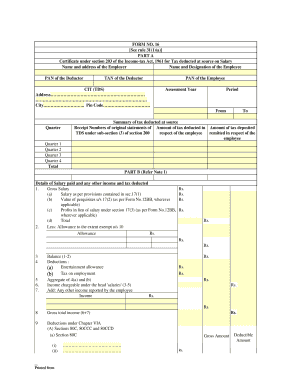

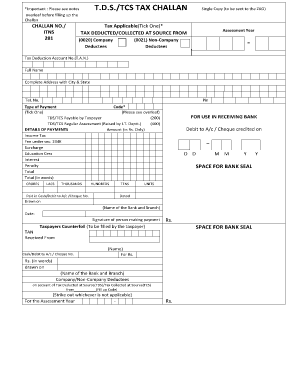

Itr forms for AY 2021-22 refer to the Income Tax Return forms that individuals need to fill out to report their income, deductions, and taxes for the assessment year 2021-22. These forms are essential for taxpayers to comply with the tax laws and ensure accurate filing of their tax returns.

What are the types of ITR forms for AY 2021-22?

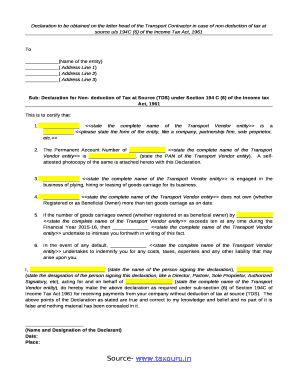

There are several types of ITR forms for AY 2021-22, each catering to different categories of taxpayers. The types of ITR forms for AY 2021-22 include:

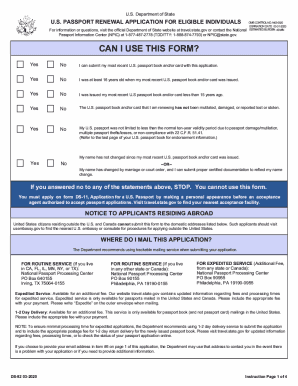

How to complete ITR forms for AY 2021-22

Completing ITR forms for AY 2021-22 can seem daunting, but with the right guidance, it can be a straightforward process. Here are some tips to help you complete your ITR forms:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.