Itr Download

What is Itr download?

Itr download refers to the process of downloading Income Tax Return forms from the official government website to file your income tax returns.

What are the types of Itr download?

There are several types of Itr download forms available for different types of taxpayers. Some common types include:

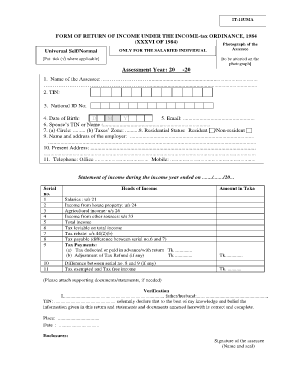

ITR-1 (Sahaj) for individuals having income from salaries, one house property, and other sources.

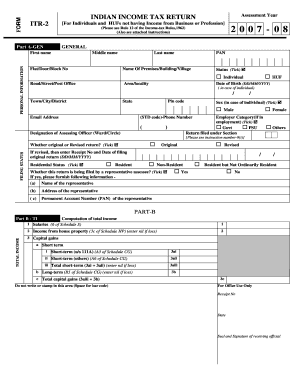

ITR-2 for individuals and HUFs not having income from business or profession.

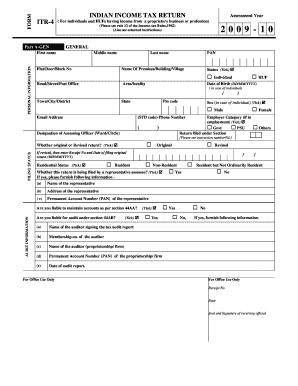

ITR-3 for individuals and HUFs having income from a proprietary business or profession.

ITR-4 (Sugam) for individuals, HUFs, and firms (other than LLP) being a resident having a total income of up to Rs.50 lakhs.

ITR-5 for persons other than individuals, HUF, company, and person filing Form ITR-7.

How to complete Itr download

Completing Itr download is a simple process with the following steps:

01

Visit the official Income Tax Department website.

02

Select the appropriate ITR form based on your income sources.

03

Download the form in PDF format.

04

Fill in the form with accurate details.

05

Verify the information provided and save the completed form for future reference or submission.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Itr download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

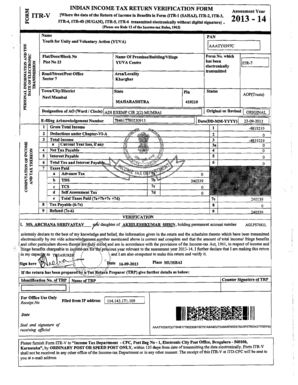

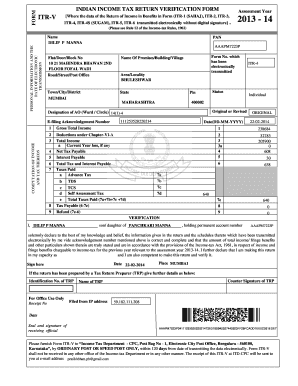

How can I download fill ITR form?

Step 1: Go to the income tax India website at www.incometax.gov.in and log in. Step 2: Select the 'e-File'>'Income Tax Returns'>'View Filed Returns' option to see e-filed tax returns. Step 3: To download ITR-V click on the 'Download Form' button of the relevant assessment year. The ITR-V will be downloaded.

Can I fill my ITR myself?

If you are over 80 years of age, you are allowed to file ITR manually. You can either download the relevant documents from the I-T department's website or get it directly from the income tax office. After you fill it, you should submit it at the applicable jurisdictional income-tax office.

How do I download a ITR form?

Step 1: Go to the income tax India website at www.incometax.gov.in and log in. Step 2: Select the 'e-File'>'Income Tax Returns'>'View Filed Returns' option to see e-filed tax returns. Step 3: To download ITR-V click on the 'Download Form' button of the relevant assessment year. The ITR-V will be downloaded.

Where can I get a copy of my ITR?

Here is a detailed discourse on how to get an ITR copy online. Step 1: Visit the official income tax e-filing portal and click on “Login Here.” Step 2: Enter your user ID, password, and the security code to sign in to your account. Step 3: On the next page, click on “View Returns/Forms.”

Can I get a copy of my tax return online?

To get a transcript, taxpayers can: Order online. They can use the Get Transcript tool on IRS.gov. Users must authenticate their identity with the Secure Access process.

Is ITR form available?

The CBDT has notified 7 new ITR forms ITS-1 to ITR-7 for AY 2021-2022. This has been done to facilitate the taxpayers during the ongoing covid pandemic. Additionally, no significant changes have been made in the ITR forms.

How do I open a fillable tax form?

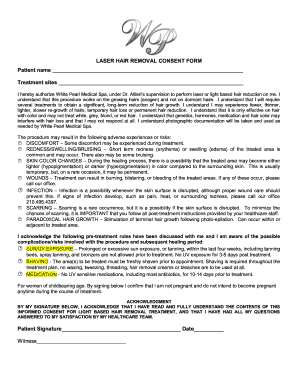

Instructions and Utility for Fillable Forms Please download Setup file, extract on your system and double click on the extracted exe file, it will install fillable file opener on your system. After installing the utility now you have to download the required form.

How do I download my tax return as a PDF?

From a desktop computer Click on the menu icon in the upper-right corner. Select My tax forms. Click View PDF for the year you would like to see. Print or save the PDF as needed.

Are 2020 1040 forms available?

IRS Income Tax Forms, Schedules, and Publications for Tax Year 2020: January 1 - December 31, 2020. 2020 Tax Returns were able to be e-Filed up until October 15, 2021. Since that date, 2020 Returns can only be mailed in on paper forms.

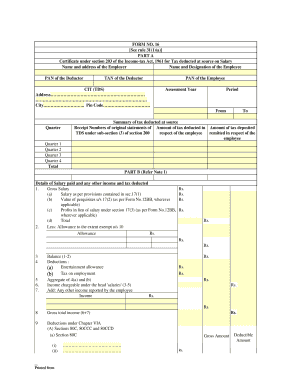

Can I download Form 16 online?

You can download the form from the online website of the Income Tax department as well. This form is available in the PDF format, which can be printed. How to Download Form 16?

Can I print a 1040 tax form?

If you prefer to have all tax returns print on Form 1040, even when Form 1040A, Form 1040EZ or 1040-SR would be acceptable, from the Main Menu of TaxSlayer Pro on the transmitting computer select: Configuration. Printer/Copies Setup. Edit Individual Print Options.

What Are Free File fillable forms?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: ... Enter your tax information online. Electronically sign and file your return. Print your return for recordkeeping.

How can I get a free copy of my tax return?

Complete and mail Form 4506 to request a copy of your tax return. Mail your request to the IRS office listed on the form for your area. If you live in a federally declared disaster area, you can get a free copy of your tax return. Visit IRS.gov for more disaster relief information.