How To Fill Form 15g For Pf Withdrawal 2021 - Page 2

What is How to fill form 15g for pf withdrawal 2021?

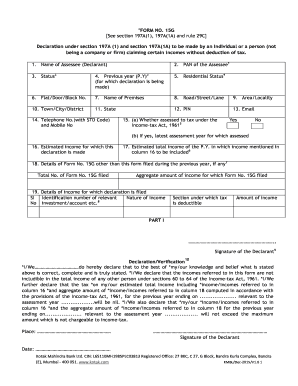

Form 15G is a self-declaration form that can be filled by individuals below the age of 60 to avoid TDS on their income. When it comes to filling Form 15G for PF withdrawal in 2021, it is essential to provide accurate information to ensure smooth processing.

What are the types of How to fill form 15g for pf withdrawal 2021?

There are two main types of Form 15G for PF withdrawal in 2021: 1. Form 15G for individuals below the age of 60 2. Form 15H for senior citizens above the age of 60. It is crucial to choose the correct form based on your age to avoid any discrepancies.

How to complete How to fill form 15g for pf withdrawal 2021

Follow these simple steps to complete Form 15G for PF withdrawal in 2021: 1. Fill in your personal details correctly 2. Provide accurate financial information 3. Sign the declaration at the end of the form. By ensuring all the details are filled correctly, you can avoid any issues during the withdrawal process.

pdfFiller is a powerful tool that empowers users to easily create, edit, and share documents online. With unlimited fillable templates and robust editing features, pdfFiller is the go-to PDF editor for getting documents done efficiently.