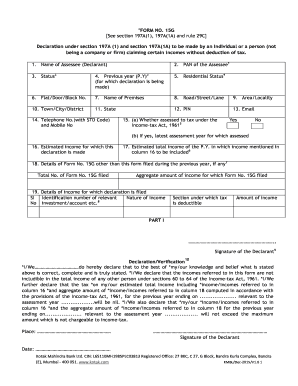

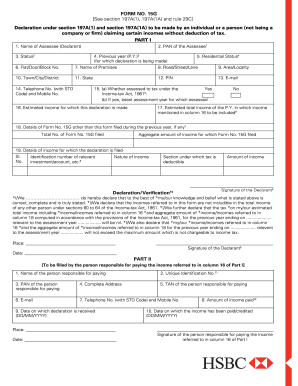

Form 15g Download In Pdf

What is Form 15g download in pdf?

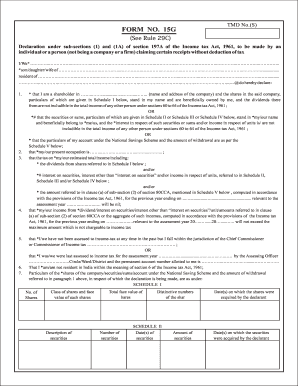

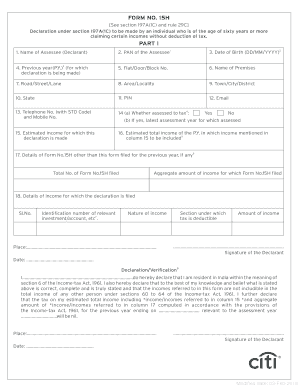

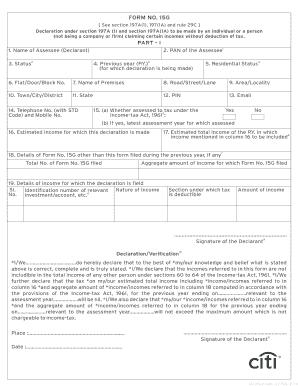

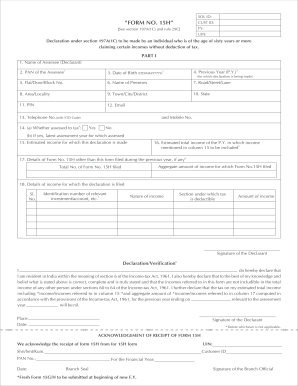

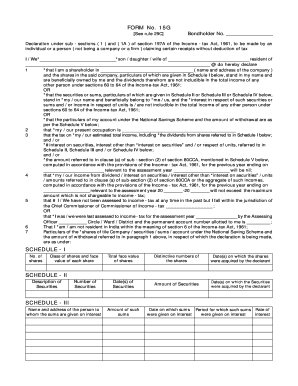

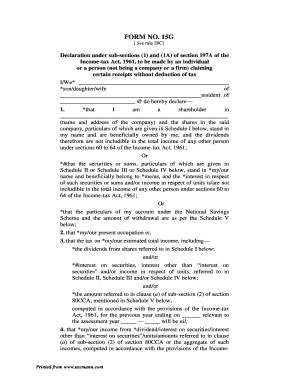

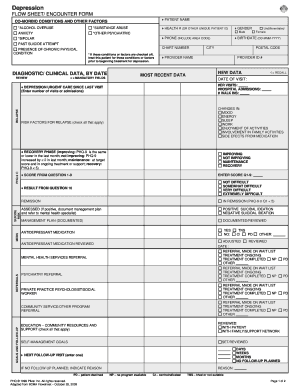

Form 15g in pdf is a declaration form filled by individuals to ensure that no TDS (Tax Deducted at Source) is deducted on the interest income they earn. It is for those individuals whose total income is below the taxable limit, and it helps them avoid TDS deduction.

What are the types of Form 15g download in pdf?

There are two main types of Form 15g: Form 15g for interest income from banks or financial institutions and Form 15g for interest income other than interest on securities.

Form 15g for interest income from banks or financial institutions

Form 15g for interest income other than interest on securities

How to complete Form 15g download in pdf

To complete Form 15g in pdf, follow these steps:

01

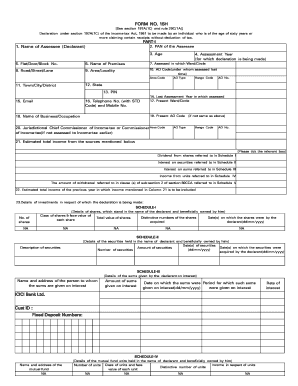

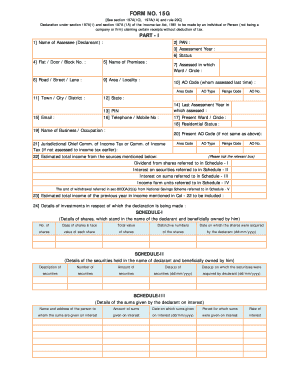

Fill in your personal details such as name, PAN (Permanent Account Number), and address.

02

Provide details of your income for which you are submitting the form.

03

Mention the previous years in which you submitted Form 15g (if applicable).

04

Sign and date the form.

05

Submit the completed Form 15g to the concerned authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

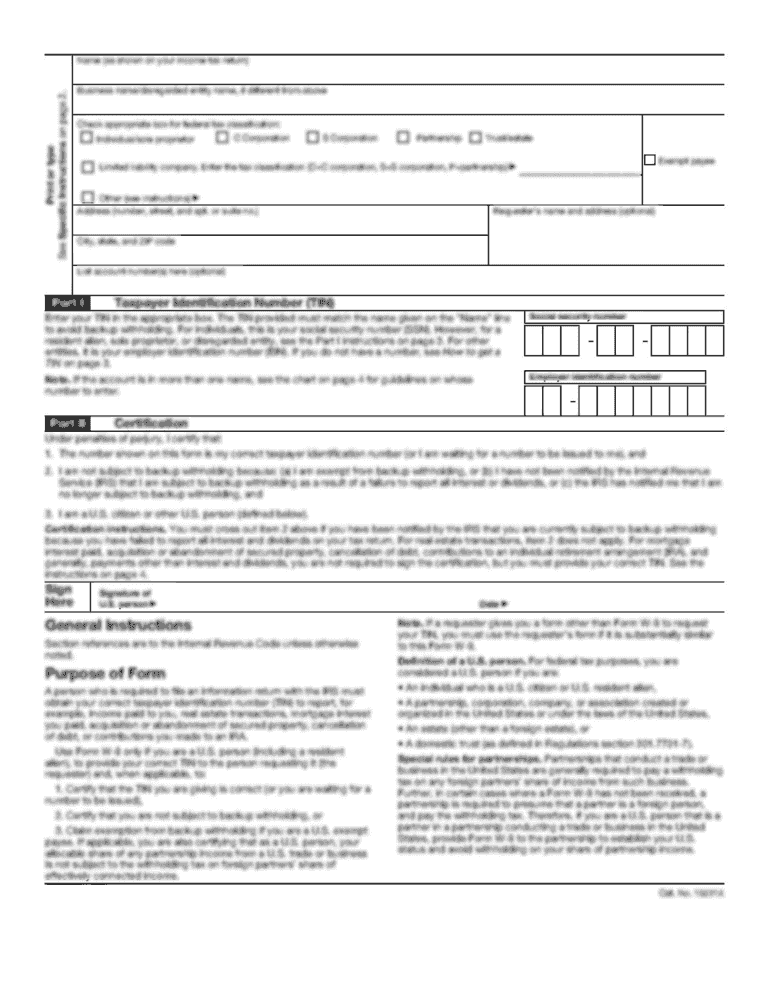

How can I download and fill Form 15G?

How to fill Form 15G Online Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

Is 15G form required for PF withdrawal PDF download?

Field (2) PAN of the Assessee: Valid PAN card is mandatory to file Form 15G. If you don't have valid PAN details, your declaration will be treated as invalid.... PDF NameForm 15G For PF Withdrawal PDFPDF CategoryGovernmentPublished/UpdatedJanuary 28, 2022Source / CreditsIncometaxindia.gov.inComments ✎55 more rows • Jan 28, 2022

How do I fill out a g15 form?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

How can I download Form 15G for PF?

Where to Get Form 15G? Form 15G can be easily found and downloaded for free from the website of all major banks in India as well as the official EPFO portal. Additionally, this form can also be easily downloaded from the Income Tax Department website.

How can I download Form 15G?

Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website. You also have the option of submitting Form 15G online on the website of most major banks in India.

What is Form 15G PDF?

Form 15G PF Withdrawal PDF to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for PF Withdrawal.

What is Form 15G for PF withdrawal PDF?

Download 15G Form PDF For PF Withdrawal Form 15G is meant for individuals who want to claim no-deduction of TDS on certain incomes. It should be filled out by fixed deposit holders (less than 60 years) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

How can I download Form 15G for EPF?

Form 15G can be easily found and downloaded for free from the website of all major banks in India as well as the official EPFO portal. Additionally, this form can also be easily downloaded from the Income Tax Department website.

Can I fill 15G form online?

Account holder to login internet banking www.onlinesbi.com. Under “e-services” select > Submit form 15G/H option as applicable to you. Select 15G if you are below 60 years and 15H if above 60 years. Select the CIF number and click on submit.

Related templates