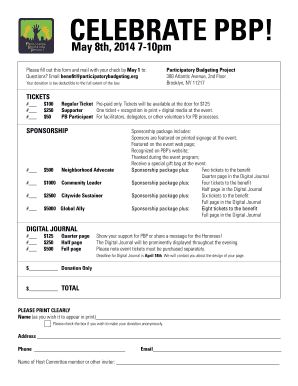

Get the free how to submit 15g online hdfc form

Show details

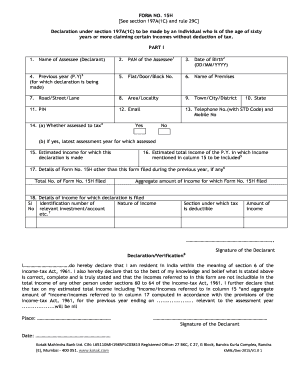

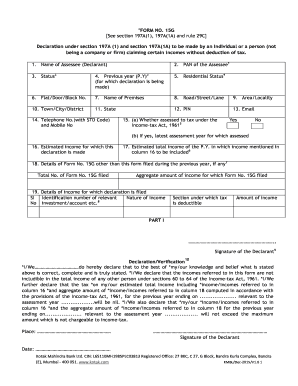

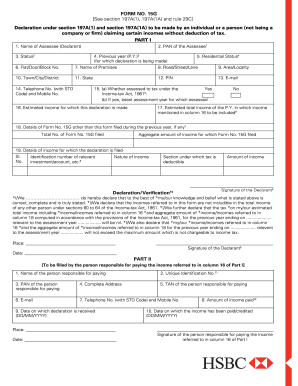

A(LA) of the Income tax Act, 1961 to be made by an individual or a person. (not being a company or ... Checklist for Form 15 G (For individual less than 60 years).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your how to submit 15g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to submit 15g form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to submit 15g online hdfc online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hdfc form 15g. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out how to submit 15g

How to fill out how to submit 15g:

01

Obtain Form 15G: You can download Form 15G from the official website of the income tax department or collect it from your nearest income tax office.

02

Carefully read the instructions: Before filling out the form, carefully go through the instructions provided. It is important to understand the eligibility criteria and conditions for submitting Form 15G.

03

Provide personal details: Fill in your personal details such as name, address, PAN (Permanent Account Number), and contact information accurately.

04

Mention previous year's assessment: Provide details of the previous year's assessment relevant to the current financial year for which you are submitting Form 15G.

05

Disclose estimated income details: Include details of the estimated income for the current financial year for which you are submitting the form.

06

Mention other income sources: Declare any other sources of income you may have apart from the estimated income mentioned in the previous step.

07

Provide declaration under section 197A: Read the declaration carefully and sign it to certify that the information provided in the form is correct and that you fulfill the eligibility criteria for submitting Form 15G.

08

Attach necessary documents: If required, attach supporting documents such as proof of PAN, income details, and other relevant documents as specified in the instructions.

09

Submit the filled form: After filling out the form completely and accurately, submit it to the appropriate income tax authority either electronically or physically as instructed.

Who needs to submit Form 15G:

01

Individuals below the age of 60: Individuals who are below 60 years of age and have income that is below the taxable limit can submit Form 15G to avoid tax deduction at source (TDS).

02

Resident individuals or Hindu Undivided Families (HUF): Residents who are not senior citizens or not eligible for senior citizen benefits can submit Form 15G to prevent TDS on certain income like interest on fixed deposits, recurring deposits, or EPF withdrawals.

03

Non-resident individuals: Non-resident individuals can also submit Form 15G if they meet the eligibility criteria and want to avoid TDS on specific income earned in India.

Fill hdfc submit form 15g online : Try Risk Free

People Also Ask about how to submit 15g online hdfc

How to fill Form 15G step by step?

How can I get 15G form from HDFC Bank?

Can we submit Form 15G online in HDFC Bank?

How do I submit Form 15G online?

How to form 15G online?

How can I upload my 15G form online?

How can I check my HDFC 15G status online?

How to fill 15G form online?

When to submit Form 15G in HDFC Bank?

What is the form 15G of HDFC Bank?

Who can submit Form 15G in bank?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

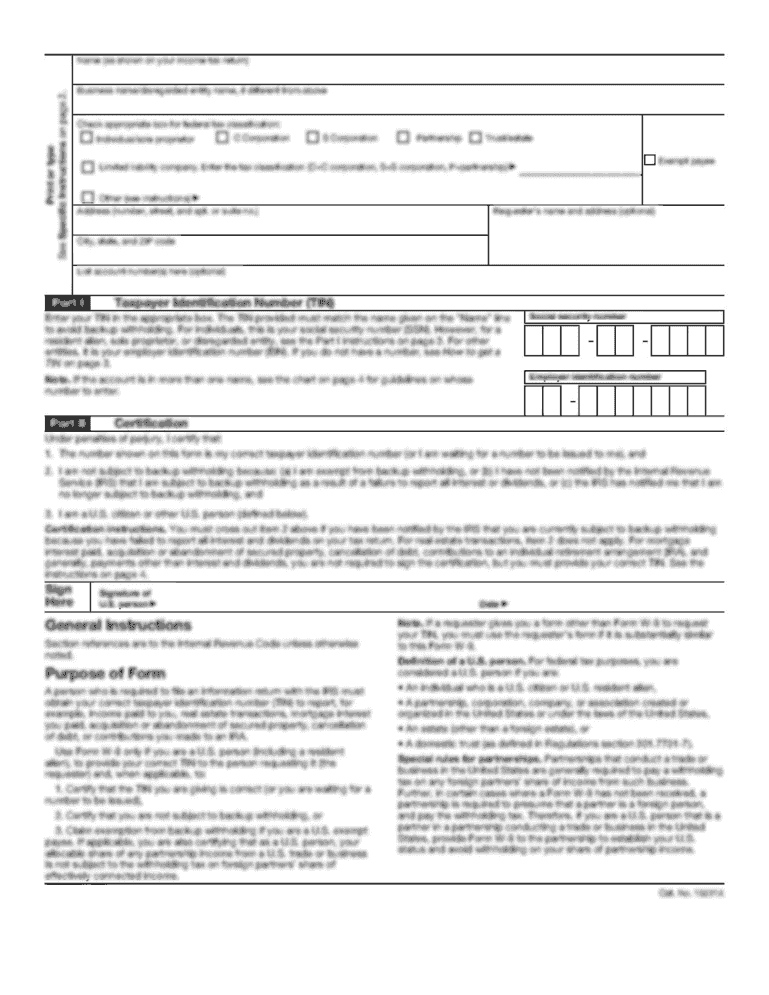

What is how to submit 15g?

Form 15G is a self-declaration form used by individuals to avoid the deduction of tax at source (TDS) on their income if they meet certain criteria. To submit Form 15G, follow these steps:

1. Obtain Form 15G: Download or obtain a physical copy of Form 15G from the official website of the Income Tax Department or collect it from the bank where you hold your account.

2. Fill in the details: Fill in all the required details in the form, including your name, PAN (Permanent Account Number), contact details, and financial year for which the declaration is being made.

3. Mention previous assessment year: Specify the previous assessment year in which your total income was assessed.

4. Mention previous estimated total income: State the estimated total income for the current financial year. This includes income from all sources like salary, interest, dividends, etc.

5. Provide investment details: Mention the details of investments you have made to arrive at the total income calculated above. This includes details of fixed deposits, savings account interest, etc.

6. Declare other income: Mention any other income you may have earned during the financial year, such as rental income or other sources.

7. Verification: Sign and date the declaration in the form.

8. Submit the form: Submit the filled-in Form 15G to the bank or financial institution where you hold your account. Retain a copy of the form for your records.

Please note that Form 15G can only be submitted by individuals who are below 60 years of age or Hindu Undivided Families (HUFs). Also, you must satisfy the conditions mentioned in the form to be eligible for tax exemption at source. It is advisable to consult a tax professional or accountant if you have any doubts or specific circumstances.

Who is required to file how to submit 15g?

Form 15G is a self-declaration form that is submitted by individuals to the Income Tax Department in India to claim exemption from tax deduction at source (TDS) on certain incomes. The following individuals are required to file Form 15G:

1. Resident individuals (including HUF - Hindu Undivided Family) who are below 60 years of age.

2. Resident individuals (including HUF) who are 60 years or above but below 80 years of age.

3. Resident individuals (including HUF) who are 80 years or above.

To submit Form 15G, individuals can follow these steps:

1. Obtain the Form: Form 15G can be obtained from the Income Tax Department website or from the branches of the bank where the income is generated.

2. Fill in the details: Fill in all the required details in the form, including name, PAN (Permanent Account Number), address, etc.

3. Mention previous year's total income: Specify the estimated total income of the previous financial year for which the Form 15G is being filed.

4. Declare eligibility: Declare that you are eligible for not deducting TDS on income as per the provisions of Section 197A of the Income Tax Act.

5. Sign and submit: Sign the form and submit it to the concerned bank or financial institution responsible for the deduction of TDS. Retain a copy for your reference.

It is important to note that incorrect or false declarations in Form 15G can attract penalties and legal consequences. Therefore, one must ensure accurate information is provided while filing the form.

How to fill out how to submit 15g?

To correctly fill out Form 15G for submission, follow these steps:

1. Download Form 15G: Visit the official Income Tax Department website or search for "Form 15G" on a search engine. Download and print the form.

2. Personal Information: Fill out your personal details, such as your name, address, PAN (Permanent Account Number), and contact information.

3. Previous Assessment Year: Mention the previous assessment year for which you are filing this form.

4. Financial Year: State the relevant financial year for which you are submitting this form.

5. Nature of Income: Indicate the source of income for which you are seeking an exemption. For example, interest from a savings account, fixed deposit, or recurring deposit, etc.

6. Estimated Total Income: Mention the estimated total income for the relevant financial year.

7. Estimated Total Income for current year: Provide the estimated total income for the ongoing financial year.

8. Details of Investment: If you have made any investments that are eligible for tax deductions, enter the relevant details, such as the name of the investment, amount invested, and the section under which the deduction is claimed.

9. Declaration: Read the declaration carefully and sign the form. If the form is being filed on behalf of a Hindu Undivided Family (HUF), the Karta (head) should sign the form.

10. Verification: Fill in the date and place and provide your contact details. Additionally, if the form is being filed on behalf of an HUF, mention the Aadhaar number of the Karta.

11. Submission: After completing the form, make a photocopy for your records, then submit the original form to the respective financial institution where your income is generated. Ensure you receive an acknowledgment copy for future reference.

Note: It is essential to fill out the form accurately and ensure that you meet the eligibility criteria to submit Form 15G. Consult a tax professional or the official Income Tax Department website in case of any doubts or specific instructions for your situation.

What is the purpose of how to submit 15g?

The purpose of the form 15G is to declare that an individual's total income for the financial year is below the taxable limit, and hence, they are not liable to pay any tax on their income. By submitting this form to the financial institution (such as a bank), the individual is seeking exemption from tax deduction at source (TDS) on certain investments or interest income, thereby avoiding unnecessary tax deductions. This allows individuals with low or no taxable income to receive their income without any tax deductions being made at the source.

What information must be reported on how to submit 15g?

To submit a Form 15G, which is a declaration for the purpose of claiming a tax exemption on interest income, the following information must be reported:

1. Personal details: Name of the individual making the declaration, permanent account number (PAN), residential address, and contact information.

2. Financial institution details: Name and address of the financial institution where the interest income is earned, along with their tax deduction and collection account number (TAN).

3. Previous assessment year: The financial year for which the individual is making the declaration. This is usually the previous year in which the income is earned.

4. Estimated income details: Details of the anticipated interest income for the current financial year, including the name of the payer, nature of the investment, and estimated amount of income.

5. Eligibility criteria: The individual must meet certain eligibility criteria to submit Form 15G. These include being a resident individual, being less than 60 years old, and the total estimated income for the financial year should be below the minimum taxable limit.

6. Declaration and signature: The individual must declare that the information provided is true and correct, and submit the form with their signature and date.

It is important to note that the specific requirements and form format may vary between countries. The above information is a general guideline, and it is recommended to consult the tax authorities or a qualified professional in your jurisdiction for accurate and specific details.

When is the deadline to file how to submit 15g in 2023?

The deadline to file and submit Form 15G typically depends on the recipient and the specific financial institution involved. Form 15G is a declaration for individuals claiming exemption from TDS (Tax Deducted at Source) on specific income. The deadline is usually mentioned by the financial institutions themselves, and it can vary. Therefore, it is recommended to check with your specific financial institution to know the exact deadline for submitting Form 15G in 2023.

What is the penalty for the late filing of how to submit 15g?

The penalty for the late filing of Form 15G varies depending on the country and its tax regulations. In India, for example, if Form 15G/15H is not filed on time, the payer is required to deduct tax at source and pay the amount to the government. Additionally, a penalty of 1% per month on the tax deducted at source may be imposed for delayed submission. However, it is important to check the specific regulations and penalties applicable in your country or consult with a tax professional for accurate information.

How do I modify my how to submit 15g online hdfc in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign hdfc form 15g and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send hdfc 15g online to be eSigned by others?

Once you are ready to share your hdfc 15g form online, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my hdfc online 15g submission in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your how to submit 15g form online hdfc and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your how to submit 15g online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc 15g Online is not the form you're looking for?Search for another form here.

Keywords relevant to hdfc 15g form online submission

Related to hdfc 15h form online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.