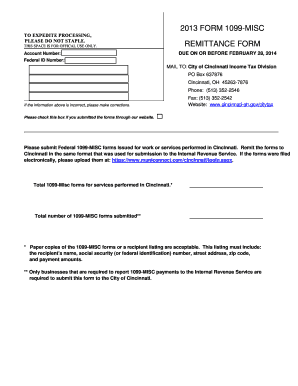

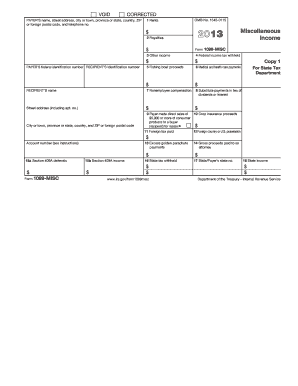

1099-misc Form 2013

What is 1099-misc Form 2013?

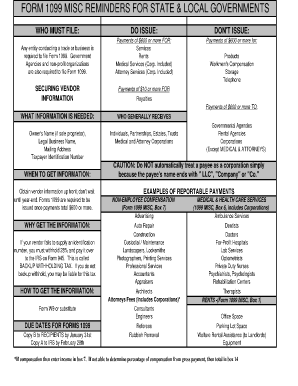

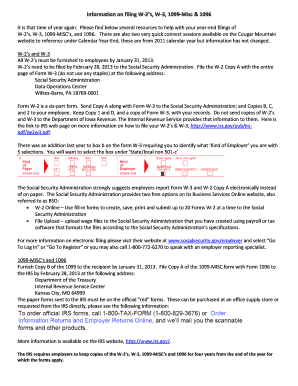

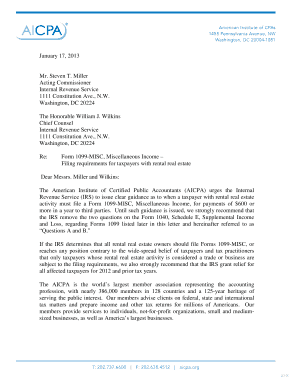

The 1099-misc Form 2013 is a tax form used by businesses to report payments made to non-employees, such as independent contractors, freelancers, and vendors. It is an important document for both the payer and the recipient as it helps track income and expenses for tax purposes. This form is specifically designed for the tax year 2013 and should be accurately filled out and filed by the appropriate deadline.

What are the types of 1099-misc Form 2013?

There are several types of payments that can be reported on the 1099-misc Form 2013. Some common examples include: - Compensation for services performed - Rent payments - Royalties - Prizes and awards - Attorneys' fees - Fishing boat proceeds - Medical and healthcare payments It is important to categorize the payments correctly to ensure accurate reporting and avoid any potential penalties or audits.

How to complete 1099-misc Form 2013

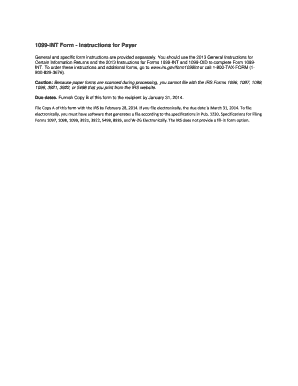

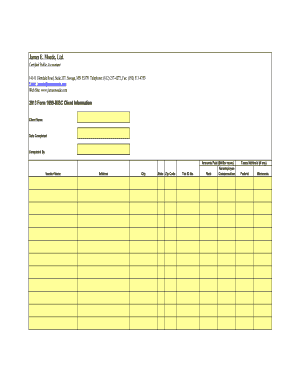

Completing the 1099-misc Form 2013 requires careful attention to detail. Here are the steps to properly fill out the form:

It's important to note that using an online platform like pdfFiller can greatly simplify the process of completing and filing the 1099-misc Form 2013. pdfFiller offers unlimited fillable templates and powerful editing tools, empowering users to create, edit, and share documents online. By leveraging pdfFiller, you can save time and ensure accuracy in your tax reporting.