Last updated on

Jan 19, 2026

Customize and complete your essential Payment Guaranty template

Prepare to streamline document creation using our fillable Payment Guaranty template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

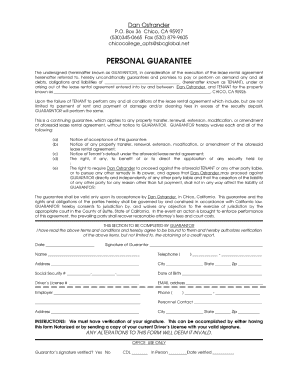

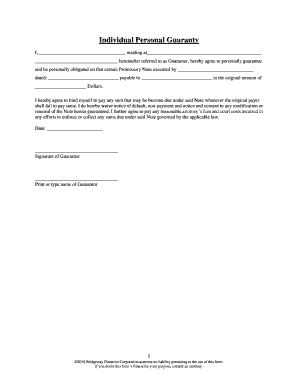

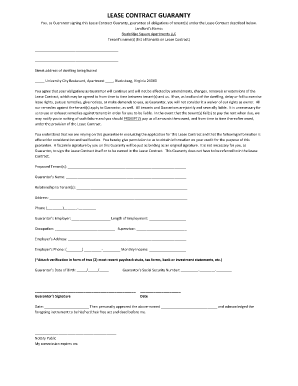

Customize Your Essential Payment Guaranty Template

With our customizable Payment Guaranty template, you can ensure secure transactions and build trust with clients. This feature streamlines the payment process, giving you peace of mind and protecting your interests.

Key Features

Easy customization to fit your specific needs

User-friendly interface for quick updates

Clear terms that enhance understanding

Secure digital signatures for verified agreements

Automatic reminders for due payments

Potential Use Cases and Benefits

Freelancers needing assurance of payment from clients

Businesses aiming to enhance customer confidence during transactions

Contractors working on large projects with upfront costs

E-commerce platforms ensuring buyer and seller protection

This Payment Guaranty template addresses concerns related to non-payment or disputes. By clearly stating terms and ensuring both parties agree, you lay the groundwork for smooth transactions. Your customers will appreciate the transparency, and you will reduce stress over payment issues.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Payment Guaranty

Crafting a Payment Guaranty has never been so easy with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller offers an intuitive platform to build, modify, and handle your paperwork effectively. Use our versatile and editable web templates that line up with your precise demands.

Bid farewell to the hassle of formatting and manual customization. Utilize pdfFiller to easily create accurate forms with a simple click. Begin your journey by using our comprehensive guidelines.

How to create and complete your Payment Guaranty:

01

Create your account. Access pdfFiller by signing in to your profile.

02

Find your template. Browse our comprehensive collection of document templates.

03

Open the PDF editor. When you have the form you need, open it in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Add fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight areas, add images, and make any necessary changes. The user-friendly interface ensures the process remains smooth.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to sign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you efforts and ensures accuracy. Start using pdfFiller right now to take advantage of its robust features and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the difference between payment guaranty and collection guaranty?

With a guaranty of payment, you can collect payment from the guarantor without first trying to collect from the primary debtor. With a guaranty of collection or performance, you must first attempt (and fail) to collect from the primary debtor before you can collect from the guarantor.

What is the difference between payment and performance guarantee?

Payment bonds protect the rights and interests of those providing labor and materials on a construction project (e.g., subcontractors, suppliers, and laborers). On the other hand, performance bonds safeguard the project owner's investment and mitigate potential financial losses due to contractor non-performance.

What is the difference between payment and collection guaranty?

A guarantor for payment is subject to suit merely upon a showing that the debt remains unpaid; but to sustain an action against a guarantor for collection requires a showing that the creditor has been unable to gain satisfaction of his debt from the debtor by the use of due diligence.”); Forsyth County Hosp.

What is a full guaranty?

Full or Absolute Guaranty. It requires the guarantor to cover all of the tenant's obligations under the lease, without limitation.

What is a payment guaranty for a loan?

NOTICE TO PAYMENT GUARANTOR If the borrower does not pay the debt, you will have to. Be sure you can afford to, and that you want to accept this responsibility. You may have to pay up to the full amount of the debt if the borrower does not pay.

What is a payment guaranty?

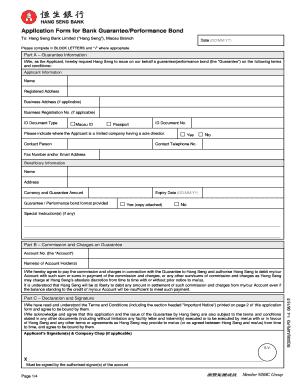

A payment guarantee provides the beneficiary with financial security should the applicant fail to make payment for the goods or services supplied.

What is a guarantee form of payment?

A deed guaranteeing the performance of a party's payment obligations under a commercial agreement. For drafting purposes, one party agrees to guarantee to the other party the payment obligations of a third party under a commercial agreement.

What is the meaning of payment guarantee method?

A payment guarantee sometimes offers a type of collateral in exchange for the promise of payment at a future time, effectively minimising the risk for the company conducting the sale. It usually takes the form of an agreement or contract, and there are a variety of different types.

What is a full guarantee?

A full warranty often covers repair or replacement for all product parts. In general, full warranties don't cover normal wear and tear. They give customers a way to fix substantial problems with the product. Any company offering a full warranty must repair or replace the product during the specified warranty period. What's the Difference Between a Full Warranty and a Limited - FindLaw FindLaw consumer-transactions diffe FindLaw consumer-transactions diffe

What's the difference between a guarantee and a guaranty?

In contrast, the noun forms of guaranty and guarantee are similar, but guaranty has a narrower meaning. Companies make written or verbal guarantees all the time, but guaranty refers specifically to a written agreement that one party will pay the money required if another party fails to do so. Guaranty vs. Guarantee: Assuring the Correct Spelling | YourDictionary YourDictionary articles guaranty-gu YourDictionary articles guaranty-gu

What is the purpose of a guaranty?

In short, it means an assurance of the future payment of another person's debt. Thus, a guaranty clause would involve three parties. guaranty | Wex | US Law | LII / Legal Information Institute - Cornell University wex guaranty - Cornell University wex guaranty

What is a full recourse guaranty?

A full-recourse provision grants the lender the right to seize any additional assets that the borrower may own and use them to recoup the remaining amount due to them. Depending on the terms of the full-recourse loan, lenders could gain the authority to tap a borrower's bank accounts, investment accounts, and wages. Full-Recourse Debt: What It Means, How It Works - Investopedia Investopedia terms full-recourse Investopedia terms full-recourse

How does a guaranty work?

It is an enforceable form of promise for the guarantor as there is a consideration for the guarantor. A guaranty is not actionable and cannot be of the basis of a claim by the guarantee against the guarantor until there is a breach of contract or failure of performance by the debtor. guaranty | Wex | US Law | LII / Legal Information Institute LII / Legal Information Institute Wex LII / Legal Information Institute Wex

What is the difference between payment and performance guaranty?

Purpose: The primary purpose of an APG is to protect the principal's advance payment, while a Performance Guarantee aims to ensure the satisfactory completion of the project or contract. Advance Payment Guarantee vs. Performance Guarantee: Claims LinkedIn pulse advance-payment-gu LinkedIn pulse advance-payment-gu

What is the difference between payment guaranty and collection?

With a guaranty of payment, you can collect payment from the guarantor without first trying to collect from the primary debtor. With a guaranty of collection or performance, you must first attempt (and fail) to collect from the primary debtor before you can collect from the guarantor. When to Insist on a Personal Guaranty | Collection Companies Michigan Muller Law Firm learnmore personal-guar Muller Law Firm learnmore personal-guar

What is a guaranty of payment clause?

The guarantor unconditionally guarantees the payment obligations of the obligor (the borrower or debtor) for the benefit of the beneficiary (the lender or creditor). This Standard Clause has integrated notes with important explanations and drafting and negotiating tips. General Contract Clauses: Guaranty | Practical Law - Westlaw Westlaw document General- Westlaw document General-