Deposit Payment Notice Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

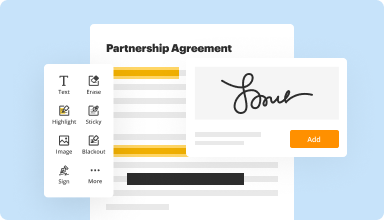

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

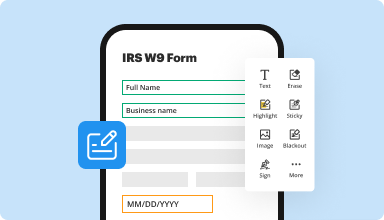

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

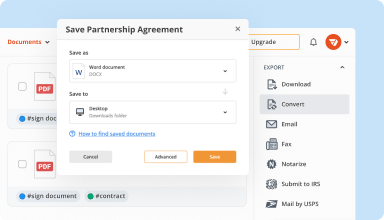

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

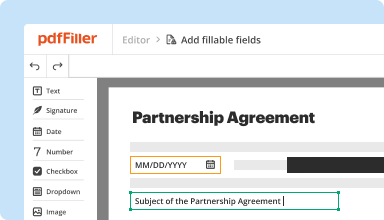

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

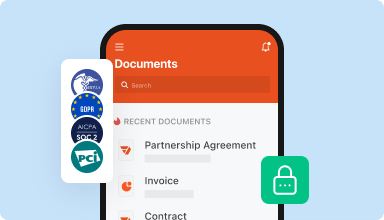

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

As a Realtor I am constantly having to merge PDF files, or fill in forms, or add notes to contracts, or rotate pages from horizontal to vertical. My hand writing is not very legible, but PDFfiller makes all of my docs look professional.

2018-06-06

I needed to print but had to wait to get ink for printer. Two days later I couldn't find the document to print and one of the Reps from your company helped me find the documents and I was able to print them. Thank you.

2019-12-19

What do you like best?

Such fillable forms usually cost $700 for a year's service. This is less than $150 per year. Easy to use and effective.

What do you dislike?

Some of the protocols are cumbersome. For instance, when you want a standard form, it makes you go through a process instead of taking you right to the form.

What problems are you solving with the product? What benefits have you realized?

Attorney running small practice in which I need fillable California Judicial Council forms

Such fillable forms usually cost $700 for a year's service. This is less than $150 per year. Easy to use and effective.

What do you dislike?

Some of the protocols are cumbersome. For instance, when you want a standard form, it makes you go through a process instead of taking you right to the form.

What problems are you solving with the product? What benefits have you realized?

Attorney running small practice in which I need fillable California Judicial Council forms

2019-01-28

I have only used it to get the 1500 form used in billing. I like that you can save your info.

You can save your documents and print them. It is easy to use. I like the ability to fax and mail from the site.

I have not used it yet to develop a form. I hope to do so before the New Year. It is nice to be able to mail and fax from the site.

2017-11-24

I think you should be able to hit the…

I think you should be able to hit the tab and go to the next number box and it center it. There is probably a way to do that but I just don't know how.

2021-04-09

Great Experience and Efficient PDF's

I only needed to use it for a few items I needed to update. The experience was easy and great. I enjoyed using it for what I needed in the moment. Once I cancelled my subscription they handled it promptly and professionally. If I am ever in need of PDF services again, I will definitely consider their services and so should you!!! THANKS PDF FILLER!

2021-01-05

PDFiller... Where have you been all my life ?

User friendly. Check!

Quality of software for your buck. Check!

Customer service that actual cares. Check!

Seriously. Look no further. PDFiller is the best thing I have ever stumbled upon!

This product is SO easy to use! I struggled with other software for my needs of filling in PDF forms. I stumbled across PDFiller one day while on a quest for software in order to do so. I looked NO further and started with a free trial. I instantly paid for the subscription no questions asked. I had found the program for me! If you have any conerns or questions the customer service is top notch and very helpful. Everything is labled for ease of use. I use PDFiller EVERYDAY! Buy the subscription .... you will thank me later.

Con: I cant draw lines on surveys with ease! That is something that I wish I was able to do. There are options to draw but no straight edge lines. That is really the only con that I have.

2020-10-06

PDF Filler makes it very easy to modify and create pdfs from anywhere. I specifically like their simplified process for editing. Their customer worked with me on an issue I was having and I'm satisfied with the result.

2020-08-21

Honest business practices

Like many other online products, they make it VERY easy to sign up, and not so easy to cancel. But once I found the correct place, they did allow me to cancel and refunded my money quickly. While the product did not fit my needs, the company appears to be legitimate and honest.

2020-07-22

Deposit Payment Notice Feature

The Deposit Payment Notice feature enhances your payment processes by keeping you informed about deposit due dates. This tool simplifies tracking and management, ensuring you never miss a payment.

Key Features

Automated notifications for upcoming deposit deadlines

Customizable payment schedules based on your needs

User-friendly interface for easy navigation

Secure data handling to protect your information

Potential Use Cases and Benefits

Ideal for property managers monitoring tenant deposits

Helpful for businesses handling client retainers

Supports individuals keeping track of personal payments

Encourages timely payments, improving cash flow

By using the Deposit Payment Notice feature, you address the common challenge of missed payments. With timely alerts and organized information, this tool allows you to manage deposits efficiently, reduce stress, and maintain strong financial oversight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a cp161 notice?

IRS Notice CP161: Notice of Unpaid Balance Due Payment Requested. A CP161 notice is issued by the IRS if the taxpayer failed to pay their full tax balance. Once they have calculated your income, tax credits, and deductions, they may deem that your original amount was less than what you owed.

What is a cp220 notice?

The Notice shows the adjustments which have been made to the account. The IRS also combines Notice CP-210 with Notice CP220 to make Notice CP210/220 (see below). A major problem with these unilateral business tax adjustments is that the IRS penalties are so high they can cripple a business.

What is a cp504b notice?

IRS Notice CP504B is an URGENT notice to inform you the IRS intends to levy against the business assets. It is very similar in effect to the other Notices of Intent to Levy. After 30 days they can seize practically anything owned by the business, including accounts receivable.

What is a Given?

Trust fund recovery penalty, also called CIV PEN on a Federal Tax Lien, may be uncollectible. ... Generally, the amount of the trust fund recovery penalty charged to the individuals is equal to the taxes deducted from employee paychecks but not paid to the IRS, plus interest.

What is a Notice of Intent on property?

An IRS intent to levy notice is a notice the IRS sends if it plans to seize your assets. ... The IRS must send you a notice the first time, for each tax and period, it intends to collect by taking your property. The IRS typically cannot take your property unless it provides you notice in advance.

What is Final Notice of Intent Levy?

A Final Notice of Intent to Levy is the notice a taxpayer is given that they have 30 days to a right to claim something known as a Collection Due Process hearing.

What type of payment does the IRS accept?

One of our safe, quick and easy electronic payment options might be right for you. If you choose to mail your tax payment: Make your check, money order or cashier's check payable to U.S. Treasury. Please note: Do not send cash through the mail.

Can I pay the IRS with a credit card?

You'll Pay Fees The IRS doesn't accept credit card payments directly; instead, it has licensed several payment processors to accept credit card payments on its behalf. These companies charge an additional fee on top of your tax bill usually around 2%. ... But keep in mind, that's on top of the taxes you already owe.

How do I make a payment to the IRS?

Direct Pay. Taxpayers can pay tax bills directly from a checking or savings account free with IRS Direct Pay. ...

Credit or debit cards. Taxpayers can also pay their taxes by debit or credit card online, by phone or with a mobile device. ...

Installment agreement.

#1 usability according to G2

Try the PDF solution that respects your time.