Dernière mise à jour le

Jan 16, 2026

Document Application For Tax Online Gratuit

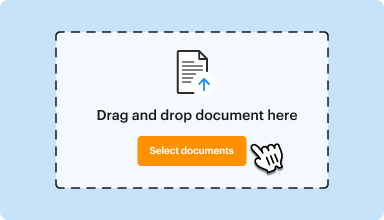

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Try these PDF tools

Edit PDF

Quickly edit and annotate PDFs online.

Start now

Sign

eSign documents from anywhere.

Start now

Request signatures

Send a document for eSignature.

Start now

Share

Instantly send PDFs for review and editing.

Start now

Merge

Combine multiple PDFs into one.

Start now

Rearrange

Rearrange pages in a PDF document.

Start now

Compress

Compress PDFs to reduce their size.

Start now

Convert

Convert PDFs into Word, Excel, JPG, or PPT files and vice versa.

Start now

Create from scratch

Start with a blank page.

Start now

Edit DOC

Edit Word documents.

Start now

Discover the simplicity of processing PDFs online

Upload your document in seconds

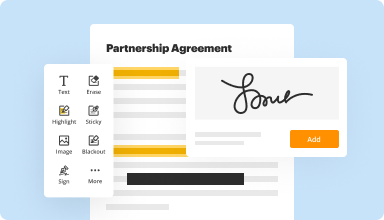

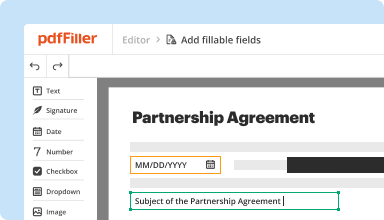

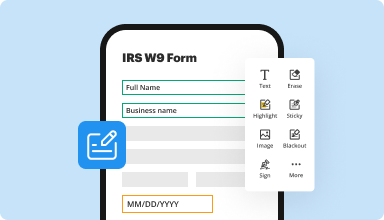

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

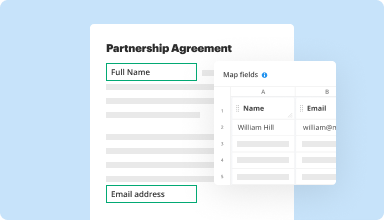

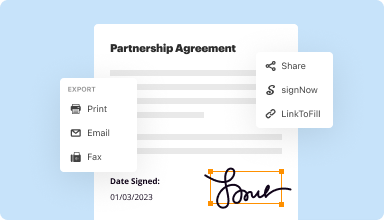

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

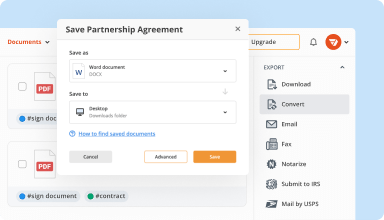

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

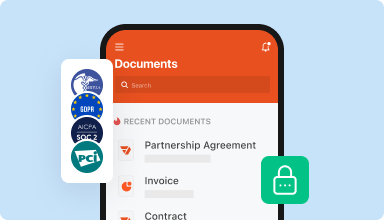

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

- Document load speeds need to be increased

- Cannot send multiple documents for signature in one shot

- Add audio feature to attach custom audio messages to documents

- Integration with Google docs for collaboration

- The listing feature with check boxes is old-fashioned. Use icons based on file type.

2015-12-19

OVERALL FAIR-GOOD EXPERIENCE. MAJOR FLAW: FORMATTING IS NOT CONSISTENT FROM TABLET TO LAPTOP.SIGNIFICANT EDITING REQUIRED. VERY TIME CONSUMING AND NON-PRODUCTIVE.

2016-09-06

In my opinion this application is very powerful, however not so intuitive, and I had to spend an inordinate amount of time in chat with technical support personnel. I would be happy to explain further.

2016-12-29

Site could be more mobile friendly. I'm still learning but so far it has done exactly what I needed and greatly improved my ability to get the docs back I send.

2018-07-14

Easy to use. Lots of Features. Need to pay a few more dollars to use everything, but great value if you need to combine different documents to create one.

2018-10-26

What do you like best?

I have several forms that need to be filled out and faxed back to companies. I love that I can fill them out online and fax the PDF back, rather than fill in and fax by hand.

What do you dislike?

The home screen can be confusing to find all my documents sometimess

What problems are you solving with the product? What benefits have you realized?

Solving having to do things by hand. Easily reproduced when needed.

I have several forms that need to be filled out and faxed back to companies. I love that I can fill them out online and fax the PDF back, rather than fill in and fax by hand.

What do you dislike?

The home screen can be confusing to find all my documents sometimess

What problems are you solving with the product? What benefits have you realized?

Solving having to do things by hand. Easily reproduced when needed.

2019-05-28

What do you like best?

User friendly, simple easy to use. Makes sending and receiving documents easy and professionals .

What do you dislike?

Nothing really. Easy way to handle PDF's.

What problems are you solving with the product? What benefits have you realized?

Getting documents signed.

User friendly, simple easy to use. Makes sending and receiving documents easy and professionals .

What do you dislike?

Nothing really. Easy way to handle PDF's.

What problems are you solving with the product? What benefits have you realized?

Getting documents signed.

2019-05-28

excellent pdf file editing tools

Today it is much easier to work on pdf, no need for physics. pdf filler saves us paper

pdf filler is a great tool for editing pdf files online. with many features like add text, note, watermark, add image, spell checker etc. the software supports the largest platforms such as Dropbox, one drive, google drive which makes this software an essential tool for storing and classifying its documents

by its many features that the software brings together, a learning curve is essential. the software tends to become slow during sessions on very large documents.

2022-03-25

I signed up originally to utilise this service. Whilst I did not wish to continue with the service (just wouldnt need it again) I did struggle to cancel the service. I sent an email outlining my issue and got the quickest response back and my account fixed and funds returned. Great service if you do require all the time. Easy to use. Highly recommend.

2020-07-25

Document Application For Tax Feature

The Document Application for Tax feature simplifies your tax preparation process. It allows you to organize and manage all necessary documents in one place, making your tax season less stressful and time-consuming.

Key Features

Organized document storage for easy access

Automatic categorization of tax-related files

Secure sharing options with tax professionals

Reminder notifications for important deadlines

Integration with popular tax software

Potential Use Cases and Benefits

Individuals preparing their own taxes who need a better system for document management

Freelancers and contractors managing multiple income sources

Small business owners seeking to streamline tax preparation

Families needing a comprehensive overview of their finances

Tax professionals looking for an efficient way to handle client documents

This feature addresses common challenges such as document clutter and missed deadlines. By streamlining your tax document management, you gain peace of mind, save valuable time, and enhance your overall tax experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I apply for an ITIN?

You can file Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return. You must also include original documentation or certified copies from the issuing agency to prove identity and foreign status.

How can I get an ITIN number quickly?

You will need to fill out an IRS Form W-7, Application for IRS Individual Taxpayer Identification and mail it in. You can also fill this application out in person. Within seven weeks of submitting your ITIN application, you should receive your approval letter and a letter containing your ITIN in the mail.

Can I get an ITIN number online?

Can I apply for an ITIN online? U.S. resident and non-resident aliens, as well as their dependents or spouses, can fill out all the necessary paperwork for an ITIN number online. Applications are accepted by mail or in person at the IRS anytime you need an ITIN number throughout the year.

How can I get my ITIN number fast?

Option 1. Mail your W-7, tax return, proof of identity, and foreign status documents to: Internal Revenue Service.

Option 2. Apply for an ITIN in-person using the services of an IRS-authorized Certifying Acceptance Agent.

Option 3. Make an appointment at a designated IRS Taxpayer Assistance Center.

How do I get an ITIN for a non-resident?

Yes, non-resident aliens need an Individual Taxpayer Identification Number (ITIN) if they are required to file a U.S. tax return with the Internal Revenue Service (IRS). Fortunately, applying for an ITIN is convenient. You can complete a W7 form online.

How much does an ITIN number cost?

Subject to $125 minimum charge. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

Can I get an ITIN online?

Can I apply for an ITIN online? U.S. resident and non-resident aliens, as well as their dependents or spouses, can fill out all the necessary paperwork for an ITIN number online. Applications are accepted by mail or in person at the IRS anytime you need an ITIN number throughout the year.

How long does it take to get an ITIN?

However, because most ITIN applications must be filed with tax returns, they are typically filed during peak processing times. As a result, it can take 8 to 10 weeks to receive an ITIN. Any original documents or certified copies submitted in support of an ITIN application will be returned within 65 days.

#1 usability according to G2

Try the PDF solution that respects your time.