H&R Block Edit PDF shortcut alternative Gratuit

Use pdfFiller instead of H&R Block to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

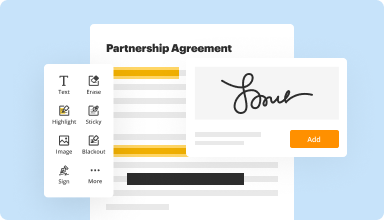

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

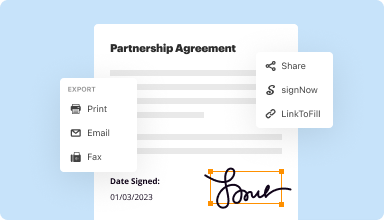

Fill out & sign PDF forms

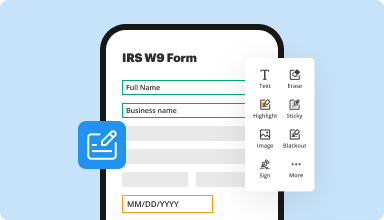

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

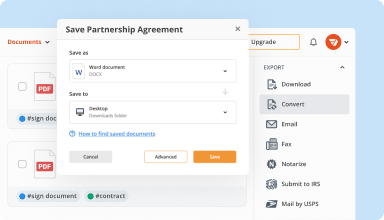

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

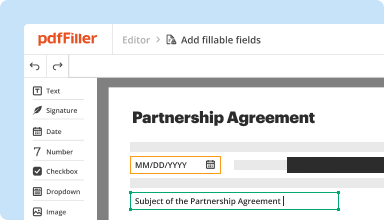

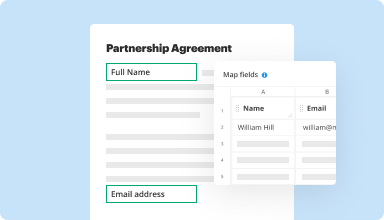

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

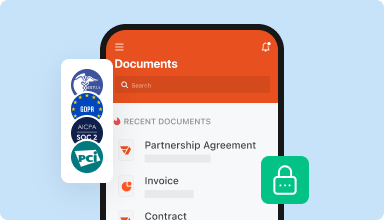

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

At first, I didn't understand what I needed to do first. I filled out the form I pulled up and then

submitted it, but was sent to a page to choose which plan I wanted. When I realized I needed to

choose a plan, I chose one, but then I had to fill out the form all over again! Then I submitted it, but

the form again, but it wouldn't appear on my list of filled forms. My list only lhad a previous form from 7/15/2015. I chatted with a representative and she helped me get my second version on my list.

This rep was extremely patient and nice, and did all she could to help me. I'm very happy I spoke with her.

2016-01-08

I found the system complicated for someone not very experienced with computers. I still do not know how to find, on your system, the forms that I have completed. Where are they? How do I save them to my computer? I will keep working to find the answers.

2016-04-02

This has made my life 100x easier. I'm able to complete and sign documents. Then file them with the court & it saves ink and paper cost. Thank you!!!!

2017-06-16

very easy to use and you can send it right away when your finished . Also all your forms are in one place. I like it a lot, I would definitely recommend

2017-12-20

It is very user friendly. I do not like that you have to use the eraser to delete text but otherwise it is way better than other programs I tried. I am also having problems opening pdf filler links on my business account because it goes to my personal account every time because it's on the same computer. I will call customer to fix the problem. Otherwise we are very happy with it!

2019-03-10

pdfFiller has wonderful support. You can email them or use a chat feature. From the chat feature, I was able to do a remote session through zoom to get my issues resolved quickly. Through email they always respond within 20 minutes. Great customer service!

2022-05-26

AND They '' LISTENED "...Before they OPENED thier Mouths! wow SUPER COOL! THANK YOU!

super fast and responsive support team you guys are fast, curteous supportive and knowledgeable about your positions. my experience with your support team has been exceptional..they all were kind and courteous and fast with getting me back on. Thank You! in days that were are experienceing it is good to know that there are a few companies that still utilise our citisens exceptional skills in their business in the United States, that know english well, can do thier jobs over the phone and are "present" so to speak, and use English well. Your support team appear to be knowledgeable and savey of the product they are supporting and can help all of us out quickly and efieciently with any communitcation barriers and that means

((SO MUCH TO US). 10+++++++10+++++...

.Thank You so Very Much!

2021-11-19

Kara to the rescue

I received a email today say my PdfFiller was paid! I cancelled that subscription July 2020 but it wasn’t received and I panicked!! Kara took care of cancelling the subscription and got me refunded immediately! She was a lifesaver!! Thanks PdfFiller and Kara!!

2021-09-07

Best docs tool ever

Best customer service ever, very prompt response with 24hrs manned online support, this tool is the best and very convenient to use. Had an issue with my account so they did refund money i paid for the premium subscription in less than an hour.

2020-06-14

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can you edit tax return once submitted?

If you want to make changes after the original tax return has been filed, you must file an amended tax return using a special form called the 1040X, entering the corrected information and explaining why you are changing what was reported on your original return. You don't have to redo your entire return, either.

How do I update my H&R Block software?

Under the State Updates section, click the Windows Program Updates link.

From the drop-down list, choose the appropriate state program, then click Download Update.

Save the update file to your desktop.

Close the H&R Block Tax Software program.

Can you Unsubmit a tax return?

Once a return has been submitted electronically, there is no way to stop it. If your return is rejected, you can correct any errors and resubmit the return at no additional charge. If your return is accepted, you can file an amended return with the necessary changes.

Can I edit a submitted tax return?

If you've made a mistake on your Self Assessment tax return, you can make an amendment or correction. You must do this by the year after the filing deadline for the tax year you're amending. For example: For the 2016-17 tax year, you must make the change by 31 January 2019.

What happens if you make a mistake on your tax return?

If you made a mistake on your tax return, you need to correct it with the IRS. To correct the error, you would need to file an amended return with the IRS. If you fail to correct the mistake, you may be charged penalties and interest. You can file the amended return yourself or have a professional prepare it for you.

Is there a penalty for amending a tax return?

If you amend your return before it is due (before April 15), then your amendment is timely, and no interest or penalty will accrue. Also, the IRS can be quite reasonable, especially for a first-time mistake. Attach a statement with your amended return, and specifically ask for an “abatement” of any penalty.

How do I amend my 2019 tax return H&R Block?

If you've already e-filed or mailed your return to the IRS or state taxing authority, you'll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Additional fees may apply.

Video Review on How to H&R Block Edit PDF shortcut alternative

#1 usability according to G2

Try the PDF solution that respects your time.