Itemize Tag Notice Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

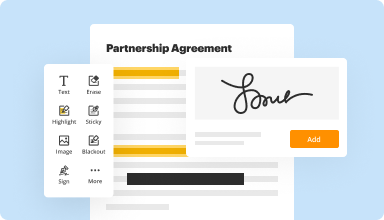

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

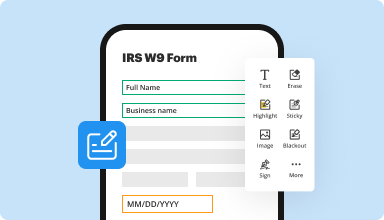

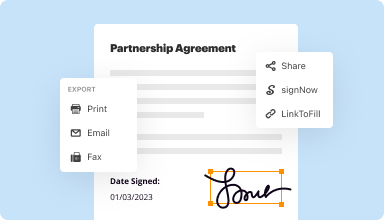

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

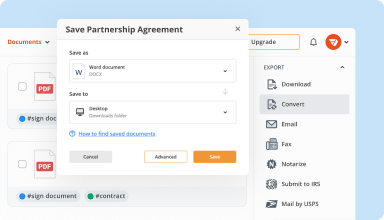

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

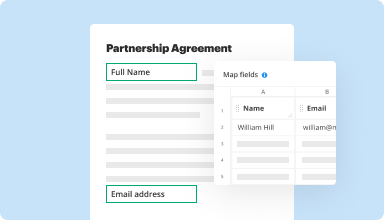

Collect data and approvals

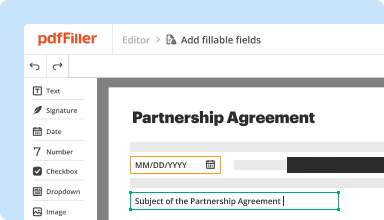

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

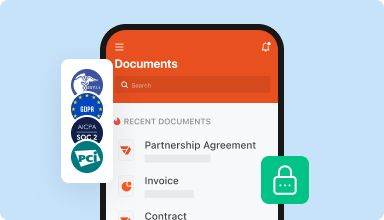

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

No issues once I contacted the support department who answered my questions. I understand that you are in business to make money on a service. I just felt it was costly for a piece of paper or two that would cost me 10. Cents at a FedEx or Office Max type business.

2016-08-11

Just getting use to this program

Just getting use to this program. Was having a hard time finding my form that I needed but I think I have it figured out now.

2020-01-22

Home Inspector

I still like the program albeit the script and font could use some improvements

Being able to fill reports online , print and send.

The script is hard to line up , checking off boxes is also difficult.

2019-09-18

Worth the money!

The software is very easy to use from a smartphone or computer. Most people don't own a fax machine, so this feature is very handy!

The subscription is necessary, but now with many places of business using editable PDFs, it's not needed as often as I'd like.

2019-03-12

This was my first experience with completing a 1099-NEC. It took me a while to figure out what to do. I really enjoyed it. I hope I haven't duplicated

2024-05-23

Anna was very helpful in resolving my billing issue

Anna was very helpful in resolving billing issue. She was immediately responsive to my inquiry and I will definitely recommend PDF Filler friends and colleagues! Thank you very much.

2022-05-01

The application is good and offers…

The application is good and offers trials time but charged your money straight away, luckily the support said the money will be refunded back into my bank account.

2022-03-31

Payment issue dealt with swiftly

After both my cards being declined to register my subscription, I went onto the online support chat. Kara was super helpful and quick to deal with my issue - very professional and friendly. Kara was very generous in giving me three free days and advised within that time to try my payment again after 24 hours. Thank you Kara for taking the stress away and resolving my issue fast. Morven

2021-09-16

Their customer service is great! Joyce helped me out and was super helpful and considerate! Best customer service experience I’ve had. Thanks for the quick response!

2020-05-03

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Are vehicle taxes deductible 2019?

Vehicle Registration Fees Only the portion that's based on the value of the property can be deducted for tax purposes. The IRS states in Publication 17: If the tax is partly based on value and partly based on other criteria, it may qualify in part.”

Are vehicle property taxes deductible?

To deduct the value-based portion of your registration fee, you must itemize your deductions using IRS Form Schedule A. Car fees go on the line for “personal property taxes.” Nevertheless, if the fee is value-based and assessed on a yearly basis, the IRS considers it a deductible personal property tax.

Are car property taxes deductible?

To deduct the value-based portion of your registration fee, you must itemize your deductions using IRS Form Schedule A. Car fees go on the line for “state and local personal property taxes.” Nevertheless, if the fee is value-based and assessed on a yearly basis, the IRS considers it a deductible personal property tax.

Are personal property taxes deductible in 2019?

Claiming a Deduction for Personal Property Taxes You can't claim the standard deduction for your filing status and itemize other deductions, too. So it only makes sense to claim the personal property tax deduction if the total of all your itemized deductions for the year exceeds the amount of your standard deduction.

How much of your property taxes are tax-deductible?

You can deduct annual real estate taxes based on the assessed value of your property by your city or state. Beginning in 2018, the total amount of state and local taxes, including property taxes, that you can deduct is limited to $10,000 per year.

What vehicle tax is deductible?

Annual car registration fees may be deductible on your federal income taxes, but only under certain circumstances. The portion of the registration fee that is charged based on the vehicle's value — as opposed to its size, age or other characteristics — can generally be claimed as a deduction.

What portion of vehicle registration is tax-deductible?

Yes, if it's a yearly fee based on the value of your vehicle, and you itemize your deductions. You can't deduct the total amount you paid, only the portion of the fee that's based on your vehicle's value. And, not all states have value-based registration fees.

Are vehicle registration fees deductible in 2019?

Vehicle Registration Fees Only the portion that's based on the value of the property can be deducted for tax purposes. The IRS states in Publication 17: If the tax is partly based on value and partly based on other criteria, it may qualify in part.”

#1 usability according to G2

Try the PDF solution that respects your time.