Protected Year Title Gratuit

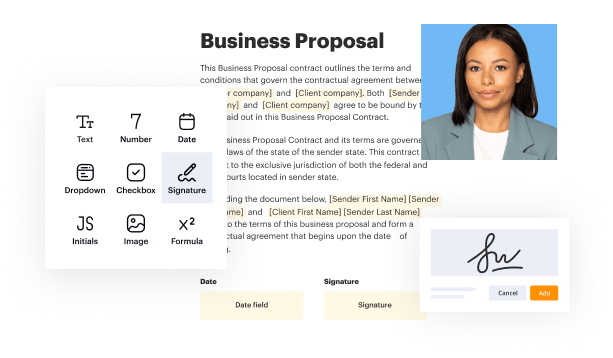

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

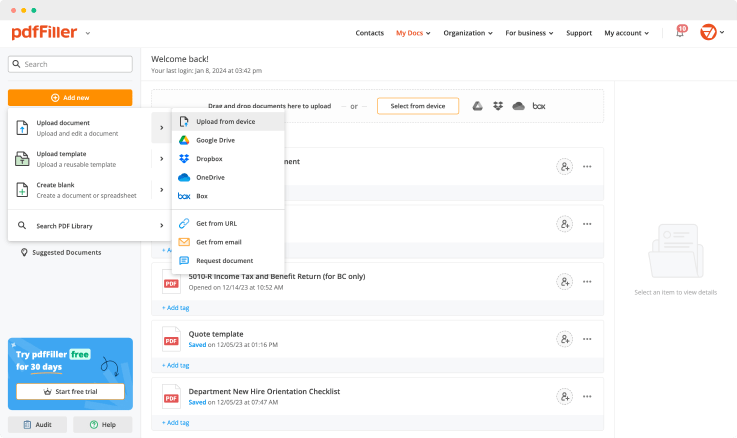

Upload a document

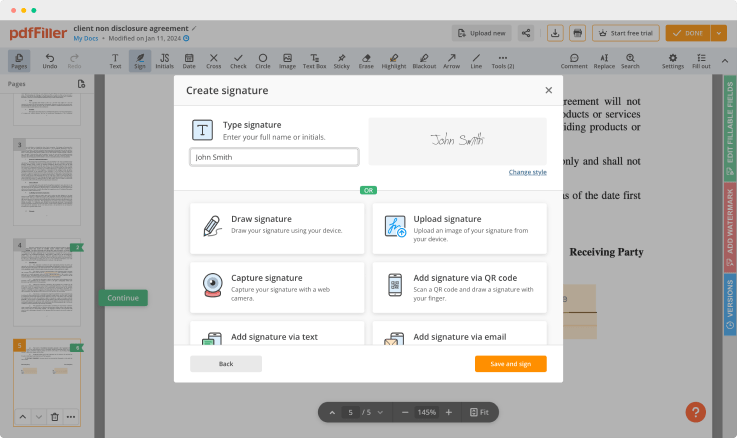

Generate your customized signature

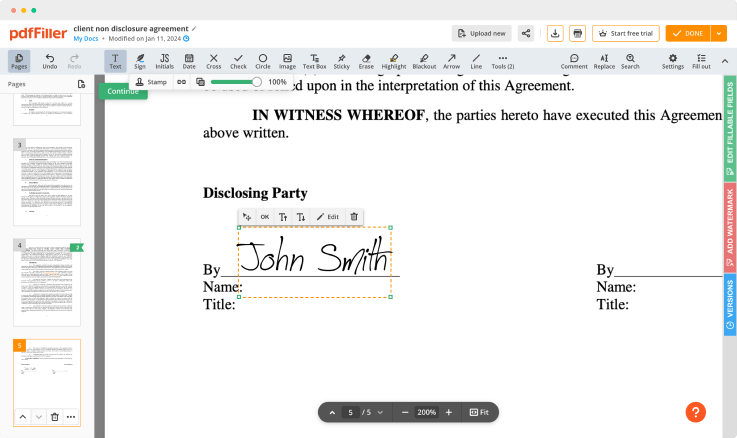

Adjust the size and placement of your signature

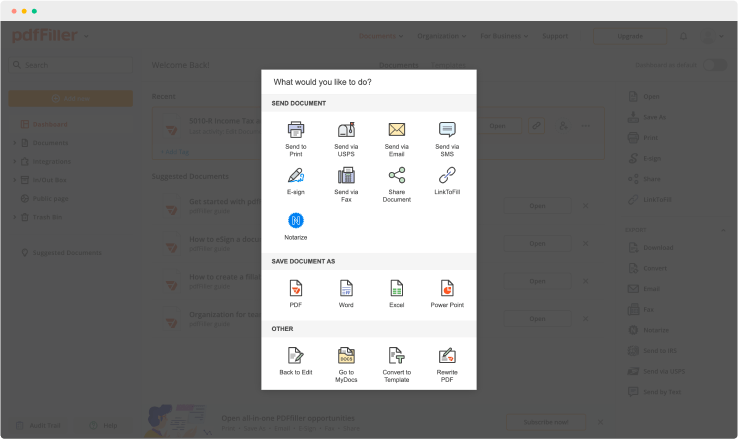

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Protected Year Title Feature

Introducing the Protected Year Title feature, designed to give you peace of mind while managing your projects. This feature ensures that your work remains secure and undisputed for a designated time period, allowing you to focus on your goals without worrying about title issues.

Key Features

Ensures title protection for a full year

Automatic renewal options available

Comprehensive documentation provided

User-friendly interface for easy access

Real-time updates on title status

Potential Use Cases and Benefits

Ideal for real estate investors securing property titles

Streamlines project management for developers

Protects intellectual property for creators

Provides peace of mind during contract negotiations

Highlights your commitment to transparency and security

The Protected Year Title feature addresses your need for security in an uncertain environment. By protecting your titles, you reduce the risk of disputes and safeguard your investments. This feature allows you to concentrate on what truly matters – achieving your objectives with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can someone steal the title to your home?

Home title fraud occurs when someone obtains the title of your property usually by stealing your identity to change ownership on your property title from your name to theirs. The fraudster can then secure as many loans as possible using your equity as collateral.

Is a home title lock necessary?

Why You Need Home Title Lock to Protect Your Property Thieves transfer you off your home's title and take out massive loans using your home's equity. You won't know until you get late payment notices. Identity theft programs, banks, and homeowner insurance policies DON'T protect you.

Do you need home title lock?

Why You Need Home Title Lock to Protect Your Property Thieves transfer you off your home's title and take out massive loans using your home's equity. You won't know until you get late payment notices. Identity theft programs, banks, and homeowner insurance policies DON'T protect you.

How much does home title lock cost?

Home Title Lock is a month-to-month subscription that sells for $14.99 (or $149 annually) and can be cancelled at anytime.

How can thieves steal your home title?

They say that thieves can steal our homes by forging our names on deeds, then resell the property or take out mortgage loans to drain its equity. They pocket the proceeds and stick us with any mortgage payments.

Can someone steal the equity in my home?

Home equity fraud is a type of real estate fraud. Real estate fraud occurs when one party intentionally uses false information or makes a false representation relating to real estate. In general, home equity fraud occurs when someone tries to steal the equity a homeowner has built up in her home.

How do I protect the equity in my home?

Maximize the Homestead Exemption. Protect the Home with Tenancy by the Entirety. Implement an Equity Stripping Plan. Create a Domestic Asset Protection Trust (ADAPT) Put the Home Title in the Low-Risk Spouse's Name. Purchase Umbrella Insurance.

Are Home Equity Loans public record?

A deed of entrust, including your home equity loan or line of credit (HELOT), is recorded for public record upon closing a loan, which means anyone, including a scam artist, can take a look at that record at your town hall.

Ready to try pdfFiller's? Protected Year Title Gratuit

Upload a document and create your digital autograph now.