Put Line Settlement Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

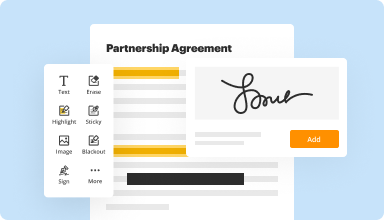

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

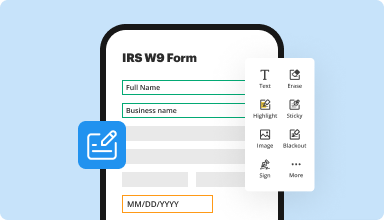

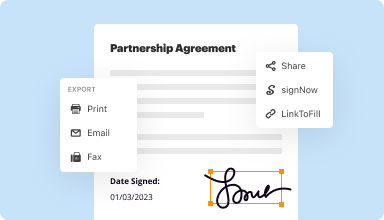

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

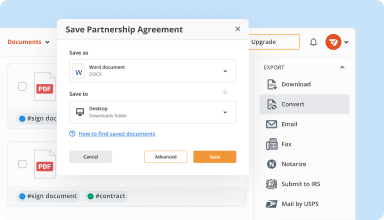

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

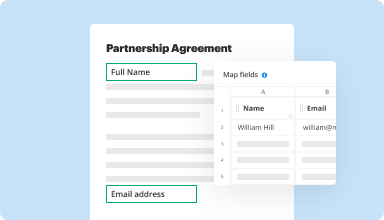

Collect data and approvals

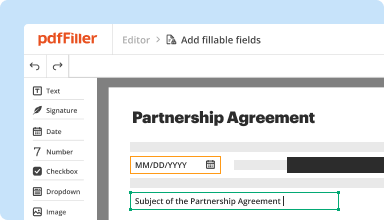

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

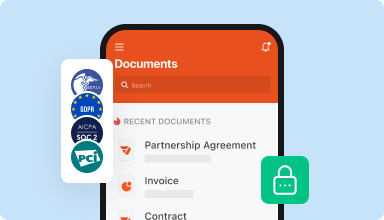

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

This is fabulous! I was using Nuance PDF Converter, which has worked fine for many years, but it couldn't handle a couple of the 2013 IRS forms...So I did them here. And it worked!

2014-11-02

I completed a passport application. The document was easy to fill & very professional in quality which made it very easy to be understood during processing.

2015-11-25

It meets my needs very well. If I could get my own fax number for less than $10/month I would add that. As it is now, I have a fax separate from this but only pay $8/month so will keep and use separately. Disappointed it was so much for the add on. Also, for the edit option. Many things to do but all as add ons. For now, I like what I can do, though.

2016-12-14

I like the system is very powerful and I can do a lot more things with formulas and programming features. I need to study deep your app and you have excellent support. I want to recognize for your work a Gilbie and I want to receive a manual or guide. I'm very happy and my imagination flies with your app to do a lot of applications.

2019-09-06

PDFfiller is an excellent product with…

PDFfiller is an excellent product with outstanding customer service. They're real and helpful and very very quick!

2019-08-30

It works well

Very easy to use and affordable, hasn't ever caused me an issue yet. I would recommend to anyone who needs to constantly convert files like I do

2023-10-25

It is an excellent experience with…

It is an excellent experience with pdFiller. I was attended to by an experienced customer advisor. The service I received is beyond my expectation. Please I will recommend pdFiller for your needs

2021-07-27

Easy to use with multi-functions

Very easy to use, several functions and formatting system. I have tried many PDF editors - this is the best of them all! Keep it up!

2020-10-21

No issues. Seamless experiences thus far.

Seamless and easy experience; live chat experience was seamless as well; the live chat operator was very helpful and courteous; my issue was resolved very quickly.

2020-06-24

Put Line Settlement Feature

The Put Line Settlement feature is designed to enhance your financial transactions. With simplicity at its core, this feature allows you to manage settlements effectively and efficiently, ensuring that your business runs smoothly.

Key Features

Streamlined transaction processing

Real-time updates on settlement status

User-friendly interface for easy navigation

Comprehensive reporting tools

Secure data handling and storage

Potential Use Cases and Benefits

Manage daily transactions with ease in retail environments

Support financial operations in service-based industries

Facilitate secure and accurate settlements for e-commerce platforms

Enhance cash flow management for small and medium businesses

Simplify reconciliation processes for accounting teams

By using the Put Line Settlement feature, you can address common challenges such as delayed transaction processing and lack of visibility into settlement status. This feature helps you streamline your operations, improve accuracy, and reduce the time spent on financial tasks. With its user-friendly functionalities and secure data management, you're equipped to make informed decisions and enhance your overall business efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do you have to pay taxes on lawsuit settlements?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. ... After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

Where do you report settlement income on 1040?

Punitive Damages: Punitive damages are taxable and should be reported as Other Income on line 21 of Form 1040, even if the punitive damages were received in a settlement for personal physical injuries or physical sickness.

Do you have to report settlement money on your taxes?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. ... After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

Are class action settlements taxable income?

Class-action settlement proceeds are treated like proceeds from any other lawsuit. The IRS treats settlements for physical injury or sickness as non-taxable as long as the claimant did not receive a tax benefit by deducting the related medical expenses on previous years' tax returns.

Are insurance settlements considered taxable income?

For the most part, insurance settlements for property damage and physical injuries are not taxable income. An insurance payment for property damage is considered compensation to restore your property to its prior condition before the accident.

How much tax do you pay on settlement money?

Taxes on Personal Injury Awards If you sue someone for causing you personal physical injury or physical sickness, any damages or settlement you receive to compensate you for your medical expenses, lost wages, and pain, suffering, and emotional distress is not included in income. The money you receive isn't taxed.

How much tax do I pay on a settlement?

It's Usually Ordinary Income The tax rate depends on your tax bracket. As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499, and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

#1 usability according to G2

Try the PDF solution that respects your time.