Separation Currency Diploma Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

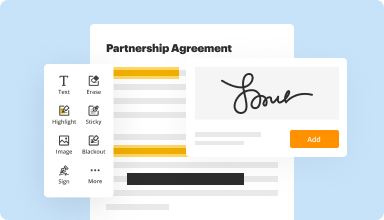

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

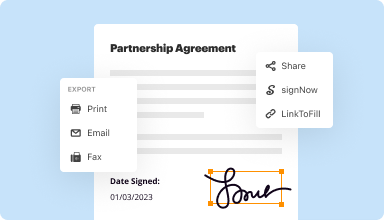

Fill out & sign PDF forms

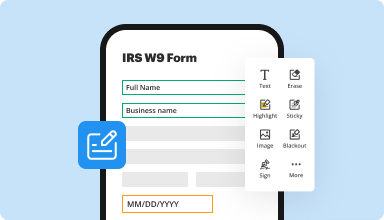

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

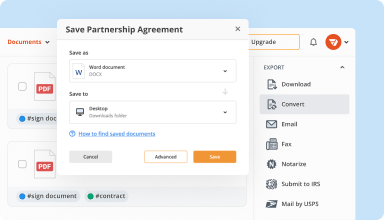

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

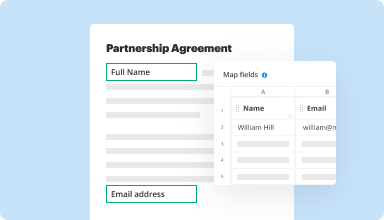

Collect data and approvals

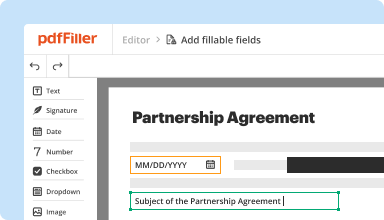

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

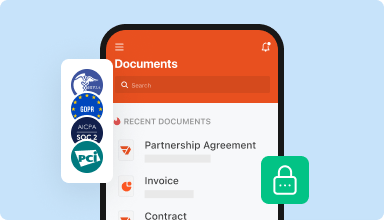

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I have just been informed by my college that I can't use this format. After paying for it and working with it for months, they prefer I use a format with expandable boxes for each indicator. This is a user friendly method but my only difficulty as been that the only information I can add to the PDF is what fits in the fixed boxes. This would be a suggestion in the formatting of this PDF.

2014-11-28

I wanted to improve the efficiency of filling out repetitive information on business documents and improve the readability of the documents... Mission Accomplished!

2016-07-10

It was easy to get started with PDFfiller. Importing the file was easy. Adding text or signatures was very intuitive. It does the job quickly and efficiently.

2018-02-13

It's a great program, but it can be a bit glitch-y when trying to fill in information. A minor problem, but it does get in the way of having an optimal user experience

2020-01-24

PDF Filler has been a great tool for my…

PDF Filler has been a great tool for my businees. I would like to see more paperless record keeping tools and options available in the future.

2019-11-22

PDF filer

Completing forms and getting them to whomever I choose.

Ease of use. I love this software. I have a health issue that makes filling out forms quite difficult. With this software, I am able to complete any document.

There is not much to dislike. So no comments on that.

2019-05-17

Tons of great features to streamline and especially for working with client signatures. Just discovered the document password protection, which is *******. Customer service is very efficient thru the chat.

2021-04-13

Quick to respond and follow through

I had an issue and emailed the company and not only did 2 different people respond immediately they resolved my issue within a few hours of me sending the email. I’ve never seen that quick of a response before. Very impressive.

2020-10-26

I had to do profit and loss statements for my boss but I did not know how to change the form itself as a template. I needed more time to get help but I was in a hurry.

2020-10-02

Separation Currency Diploma Feature

The Separation Currency Diploma is designed to help users understand and manage different currencies effectively. This feature offers a straightforward approach to mastering currency separation and will greatly benefit your financial planning.

Key Features

Comprehensive currency breakdown

User-friendly interface

Step-by-step guidance

Real-time exchange rate updates

Customizable reports

Potential Use Cases and Benefits

Learning currency management for personal finance

Improving accounting processes for small businesses

Gaining insights into foreign exchange markets for investments

Preparing for international travel and budgeting

Facilitating accurate reporting for financial audits

With the Separation Currency Diploma, you can efficiently address your currency management challenges. This feature empowers you to make informed decisions, streamline financial processes, and enhance your overall financial literacy. Start your journey towards mastering currency management today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How should I file my taxes if I am separated?

Legally separated filing options If tax law considers you “unmarried” because you got a decree of separation maintenance prior to December 31, you can file with “single” or “head of household” status. “Head of household” requires you to have a dependent and pay at least half of the expenses needed to maintain a home.

How do you file taxes if you are separated?

If you separate or divorce after December 31st, you will still have to file your income tax return as married. Until your divorce has been finalized, you will be required to file your tax return as separated and then as soon as your divorce agreement has been finalized, you can file your tax return as divorced.

Can I file legally separated on my taxes?

When it comes to taxes, once you get married, you won't file as single again. If you separate or divorce your spouse during the year, you need to be apart for 90 consecutive days, then you'd claim your status as separated or divorced.

Can I file single if my divorce is not final?

You probably can't file single, but it depends on the laws of your state. You are “considered unmarried” if you are divorced or legally separated under a qualifying court order. You do a mediated separation and then a final divorce order.) So probably you have to file as married filing separately.

What qualifies you as legally separated?

Legal Separation Being legally separated is a different legal status from being divorced or married you're no longer married, but you're not divorced either, and you can't remarry. Some consider a legal separation the same as a divorce for purposes of terminating health benefits.)

How do you file taxes if you get divorced in the middle of the year?

If you were divorced by midnight on December 31 of the tax year, you will file separately from your former spouse. If you are the custodial parent for your children, you may qualify for the favorable head of household status. If not, you will file as a single taxpayer even if you were married for part of the tax year.

When should married couples file taxes separately?

Income requirements for married filing separately So where a married couple who are both younger than 65 and filing jointly wouldn't have to file unless their gross income was at least $24,000, if the same couple decides to use the married filing separately status, they would be required to file.

When should married couples file separately?

Eligibility requirements for married filing separately If you're considered married on Dec. 31 of the tax year, then you may choose the married filing separately status for that entire tax year. If two spouses can't agree to file a joint return, then they'll generally have to use the married filing separately status.

#1 usability according to G2

Try the PDF solution that respects your time.