Store Wage License Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

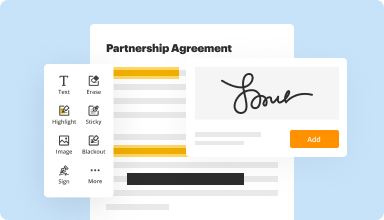

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

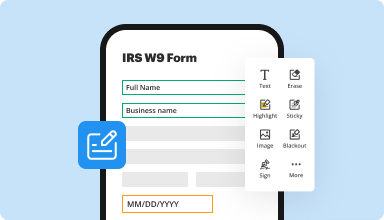

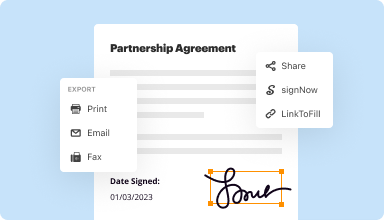

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

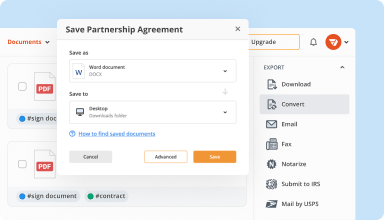

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

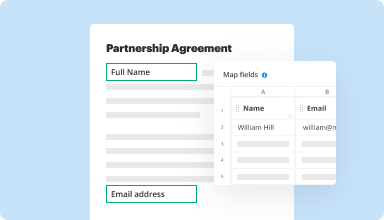

Collect data and approvals

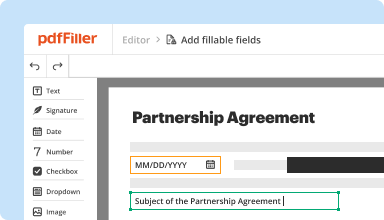

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

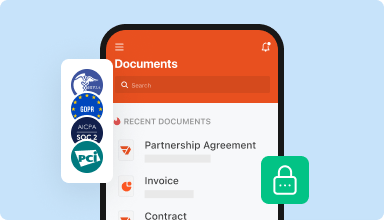

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I am so glad to become a member. I am a document preparer and PDFfiller makes it so much easier . I love it, especially because you can upload your own forms. Great.

2015-02-25

Answer to my prayers. TurboTax, IRS, other www sites gave me horrors. I started your site one day and somehow decided to leave and why I decided to go back to those other sites again was a HUGE mistake ... it all gave me horrors. I prayed again this morning and low and behold, your site was simple as apples to apples. I gave God the biggest smile and thank you for solving my nightmare to fill out the contractors 1099-misc for 2016. Late I am and was because of my health, and the contractor didn't sign the W-9 form which I had waited for which he finally emailed it to me. One question here with this form finished, do you send IRs their copy or do I need to do it myself? Pls respond a.s.a.p., I want to send it today if I need to do this. Thanks, Janet Mac Neal

2017-04-03

I have only recently signed on to complete medical referrals. But I would really benefit from a webinar! Sounds great.

I really do need a webinar.

2017-09-13

Amazing!!! this is truly a miracle come to pass in my business. So friendly user, can do so many task at once within PDFfiller at once. Life saver, definitely.

2018-08-29

Valuable service four our business

Great for completing and revising forms

Allows easy efficient revisions to forms that are not otherwise "fill-in" online forms

website can be slow and clunky at times, technical support is only available through on-line chat, no teleconference service

2019-01-29

Basic but good PDF editing. Reasonable support.

Basic but good PDF editing.

Writing this though cause their support is swift and reasonable.

I accidentally left my subscription running for 3 months after just using the free trial for 1 PDF edit.

After 1 email they refunded all 3 payments without making me jump through hoops.

Thanks guys.

2022-09-05

Really easy to use

The web interface is really easy to use.

The "wow" feature for me is that you can setup a default signature and copy and paste it on documents as you need.

This has saved me from losing time with some legal documents I need to sign while I'm away.

2022-09-01

Pdf filler review

So far so good

The software works great. Have little to no complaints overall

I would like it to have more templates for documents to choose from

2022-06-30

I used this PDFfiller for the 1st time…

I used this PDFfiller for the 1st time and it worked great. I was able to drag the document that was sent to me into the PDF filler and it opened all the fields so I could edit and resend.

2022-06-04

Store Wage License Feature

The Store Wage License feature empowers you to manage employee wages effectively. By automating wage calculations and ensuring compliance with regulations, this feature simplifies payroll processes, allowing you to focus on growing your business.

Key Features

Automated wage calculations

Compliance monitoring with labor laws

Customizable wage schedules

Integrated reporting tools

User-friendly interface

Potential Use Cases and Benefits

Ideal for businesses of all sizes aiming to streamline payroll management

Helps in maintaining compliance and reducing legal risks

Saves time spent on manual calculations, allowing for more focus on core operations

Facilitates easy adjustment of wages according to business needs

Provides clear insights into wage expenses through detailed reports

By using the Store Wage License feature, you eliminate wage-related stress. This tool addresses common challenges such as compliance issues and time-consuming calculations. With its effective automation and reporting capabilities, you can achieve peace of mind while ensuring your employees are compensated accurately and on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How long can you go without paying an employee?

Alberta's Employment Standards Code requires employers to pay employees at least once per month. Wages, overtime pay and general holiday pay must be paid within 10 consecutive days after the end of each pay period.

Is it illegal for an employer to pay late?

Under California employment law, all employers have a legal obligation to pay employees the entire amount of wages they've earned and to pay these wages on time. So, can an employer pay you late in California? The simple answer is no. California labor laws require most workers to be paid a minimum of twice per month.

What happens when you don't get paid on payday?

Many states have laws for when overtime wages are applicable as well. Employees who do not receive payment by the minimum payday required by state law can file a wage claim with their state labor department. The department can order the employer to pay the employee back wages and damages, if applicable.

Is it legal to not get paid on time?

Under California employment law, all employers have a legal obligation to pay employees the entire amount of wages they've earned and to pay these wages on time. So, can an employer pay you late in California? The simple answer is no. California labor laws require most workers to be paid a minimum of twice per month.

What time does an employer have to pay you on payday?

Rules for Final Paychecks If you quit your job and give your employer less than 72 hours' notice, your employer must pay you within 72 hours. If you give your employer at least 72 hours' notice, you must be paid immediately on your last day of work.

What is the penalty for unpaid wages?

If you aren't paid on time at the proper rate for all hours worked, the employer may have to pay a penalty of $100 for the first pay period and $200 for subsequent pay periods. This penalty is per employee. When you file as a private attorney general, the state gets 75% of the money you collect. You get the rest.

How long can you go without getting paid?

To discourage employers from delaying final paychecks, California allows an employee to collect a waiting time penalty in the amount of his or her daily average wage for every day that the check is late, up to a maximum of 30 days.

How long does an employer have to pay wages?

California Payday Laws Generally, California employees have the right to be paid at least twice a month. Compensation earned between the 1st and the 15th of the month must be paid no later than the 26th day of the same month.

#1 usability according to G2

Try the PDF solution that respects your time.