Direct Debit Advantages And Disadvantages

What is direct debit advantages and disadvantages?

Direct debit is a convenient method of payment that offers both advantages and disadvantages to users. It allows individuals to authorize automatic payments from their bank accounts to pay bills or make regular purchases. However, there are certain drawbacks to consider as well.

What are the types of direct debit advantages and disadvantages?

There are several types of advantages and disadvantages associated with direct debit. Let's explore them below:

Advantages:

Convenience: Direct debit eliminates the need to manually pay bills or remember payment due dates. It saves time and effort for users.

Automates payments: With direct debit, payments are automatically deducted from your bank account, ensuring timely payments and avoiding late fees.

Budgeting and planning: Direct debit provides a convenient way to manage your finances by setting up recurring payments and knowing exactly when money will be deducted.

Disadvantages:

Lack of control: Direct debit gives companies permission to withdraw funds from your account, which means you need to trust them with your financial information.

Potential overdraft fees: If there are insufficient funds in your account when a direct debit payment is due, you may incur overdraft fees.

Difficulty in canceling: Canceling direct debit payments can sometimes be challenging, especially if you need to coordinate with multiple companies or service providers.

How to complete direct debit advantages and disadvantages

To complete direct debit advantages and disadvantages, follow these steps:

01

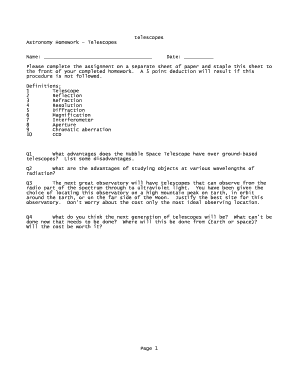

Research and understand the terms and conditions of direct debit with your bank or service provider.

02

Evaluate the benefits and drawbacks associated with direct debit for your specific situation.

03

Decide whether direct debit is the right payment method for you based on your financial needs and preferences.

04

If you choose to use direct debit, ensure that you have sufficient funds in your account and keep track of your transactions regularly.

05

Monitor your bank statements and be alert to any unauthorized or incorrect direct debit payments.

06

If you encounter any issues or have concerns, contact your bank or service provider promptly for assistance.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out direct debit advantages and disadvantages

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the risk of direct debit?

While overall, this payment method is safe, secure, and convenient, there are potential disadvantages of Direct Debit to be aware of. You can be charged overdraft or late fees: If there are insufficient funds in the buyer's account, the Direct Debit might still go through with overdraft protection.

What does a customer need to set up a Direct Debit?

The only thing the customers need to do is to ensure that they have sufficient funds in their account. Here's an illustration explaining the bank-to-bank transfer in Direct Debit. The business owner initiates the payment after setting up Direct Debit for their customer.

What are the advantages and disadvantages of Direct Debit?

Whereas card networks tend to cost around 3-5% for transactions, direct debit tends to be much cheaper at around 1%. There is a lower likelihood of payment failures. Card payments may fail due to expiry or cancellation, whereas direct debits are linked to bank details and therefore remove this possibility.

What are the disadvantages of setting up a Direct Debit?

Despite there being many advantages of Direct Debits, they do come with some downsides. One major disadvantage of Direct Debit is the time it takes to get paid for the first time. Payments work in set cycles, so you might have to wait to receive the initial payment. Failure of payment is also a possible disadvantage.

Is it better to pay by direct debit or card?

Once a Direct Debit is set up, it tends to have a longer retention rate as payments won't be interrupted when payment cards expire, change or are cancelled. Direct Debit reduces the chance of late or failed payments and avoids the higher transaction costs associated with card payments.

What are the advantages of direct debit?

The benefits of Direct Debit It spreads the costs. Paying your regular bills or business outgoings by Direct Debit allows you to spread costs over a period that you agree with the organisation you are paying. It's flexible. It's guaranteed. It can save you money. It gives you peace of mind. It saves you time.

Related templates