Direct Debit Set Up

What is direct debit set up?

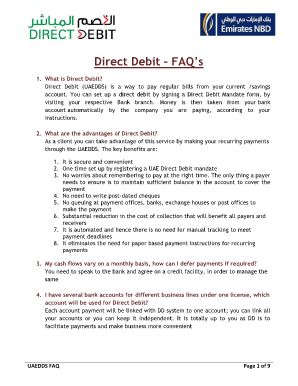

Direct debit set up is a process that allows individuals or businesses to authorize a third party to automatically withdraw funds from their bank account on a regular basis to pay for goods or services. It offers a convenient and automated way to make recurring payments without the need for manual intervention.

What are the types of direct debit set up?

There are two main types of direct debit set up:

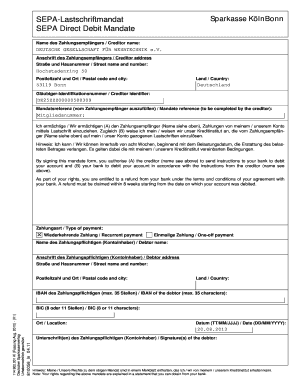

Single Direct Debit: This type of direct debit set up is used for one-time payments, where the amount is debited from the account only once.

Recurring Direct Debit: This type of direct debit set up is used for regular payments, such as monthly bills or subscriptions. The specified amount is debited from the account on a predetermined schedule, providing a hassle-free payment method.

How to complete direct debit set up

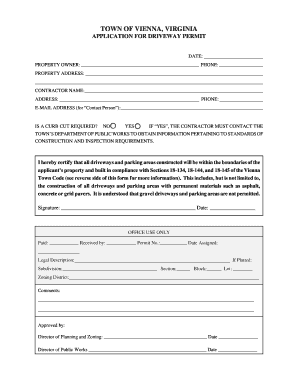

Completing the direct debit set up is a simple process that can be done in a few easy steps:

01

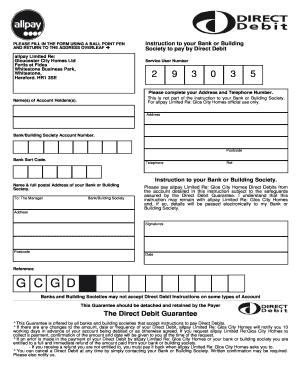

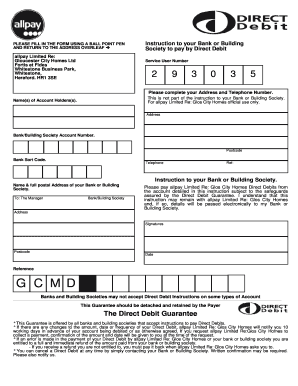

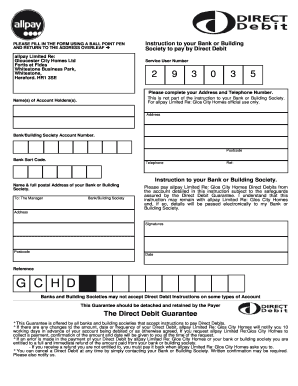

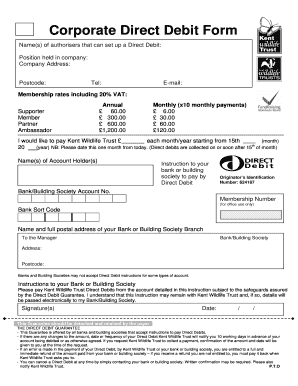

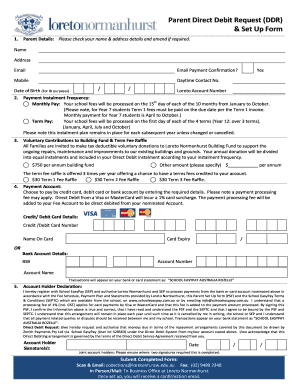

Obtain the direct debit authorization form from the company or organization you wish to set up the direct debit with.

02

Fill in the required details on the form, including your bank account information, the payment amount, and the frequency of the payments.

03

Sign the form to authorize the direct debit.

04

Submit the completed form to the company or organization either online or by mail.

05

Once the form is processed and approved, the direct debit set up will be active, and the payments will be automatically deducted from your bank account as per the specified schedule.

With pdfFiller, completing the direct debit set up becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out direct debit set up

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much does it cost to set up a Direct Debit?

I spoke to Bacs, the organisation which organises direct debits and payments, and it confirmed that there is no charge for setting up a direct debit. A spokesperson said: 'It is up to an organisation to choose to charge its customers for setting up a direct debit.

What is Direct Debit instructions?

A Direct Debit Instruction is an authorisation from your customer to collect future payments. The details of each authorisation are standardised: All future payments are authorised so you can collect any amount at any time from your customer. Your customer must be notified of each payment before it is collected.

What information do you need to give for a Direct Debit?

Setting up a Direct Debit Your name and address. The name and address of your bank or building society. Your bank or building society account number. The branch sort code of your bank or building society (see your debit card or banking app) The name(s) on the account.

How do I set up a Direct Debit?

How to set up a Direct Debit Step 1 - Contact the organisation you wish to pay. Get in touch with them and ask to set up a Direct Debit. Step 2 - Complete the Direct Debit Instruction. You'll need to provide: Step 3 - Check the advance notice details. Step 4 - Relax.

Can you create your own Direct Debit?

How do I set up a Direct Debit? You can complete a Direct Debit Instruction, obtained from the organisation you wish to pay, and return it to them. With many organisations, you can set up Direct Debits over the telephone or online.

What do you need to do to set up a Direct Debit?

How to set up a Direct Debit Step 1 - Contact the organisation you wish to pay. Step 2 - Complete the Direct Debit Instruction. Step 3 - Check the advance notice details. Step 4 - Relax.

Related templates