Direct Credit Definition

What is direct credit definition?

Direct credit definition refers to a financial transaction in which funds are electronically transferred directly from one bank account to another. This method of payment eliminates the need for cash or cheques, providing a convenient and secure way to transfer money.

What are the types of direct credit definition?

There are several types of direct credit definitions, including:

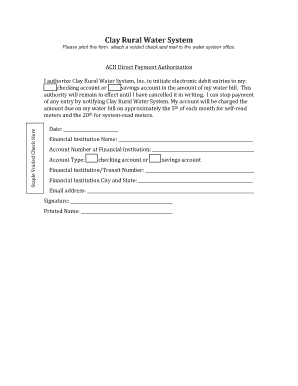

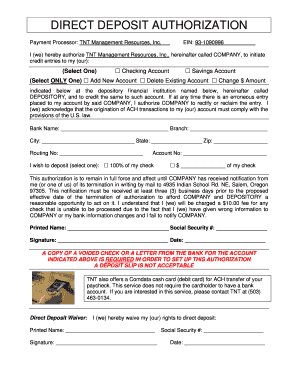

Direct deposit

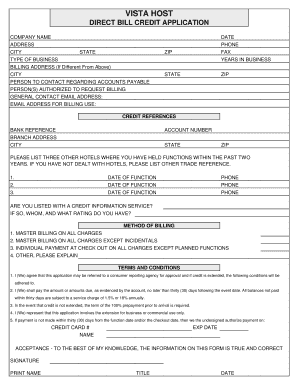

Automatic bill payments

Electronic funds transfer

How to complete direct credit definition

Completing a direct credit definition is simple and straightforward. Follow these steps:

01

Gather the necessary information, such as recipient's bank account details

02

Initiate the direct credit transaction through your bank or online banking platform

03

Verify the details and authorize the transfer

04

Confirm the successful completion of the direct credit definition

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out direct credit definition

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of direct deposit?

Payroll payments are an example of direct deposits. Employers can send funds to their employees' bank accounts on payday without delay or the risk of losing checks in the mail. Recipients also benefit from direct deposits, as the money is automatically added to their account balance with no action required.

Is direct credit a debit or credit?

What's the difference between Direct Debit and Direct Credit? Where Direct Debit is an electronic withdrawal from a customer's account, Direct Credit is an electronic deposit into an account. For example, Direct Debit can be used to take regular gym membership payments automatically from a member's bank account.

What is direct credit with example?

When you have funds paid directly into any of your Credit Union SA accounts from an external source, this facility is called a 'direct credit'. This could be your salary, for example, or a tax refund, share dividend, superannuation payment, social security payment or a pension.

What is Direct Debit with example?

These give a company permission to take money from your bank account on a date agreed with you. For example, you might use a Direct Debit to pay your gas and electricity bills. The company need to notify you of any change to the amount or date.

What is direct credit in bank reconciliation statement?

A direct credit is an electronic transfer of funds through the ACH (Automated Clearing House) system. The payment is initiated by the payer, which sends funds directly into the bank account of the payee. Settlement usually occurs within one or two business days.

What is direct credit and debit?

What's the difference between Direct Debit and Direct Credit? Where Direct Debit is an electronic withdrawal from a customer's account, Direct Credit is an electronic deposit into an account. For example, Direct Debit can be used to take regular gym membership payments automatically from a member's bank account.

Related templates