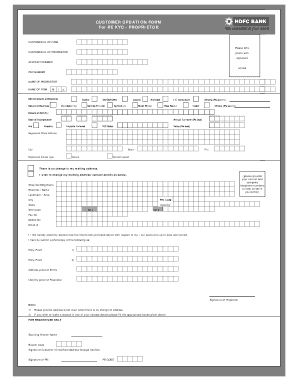

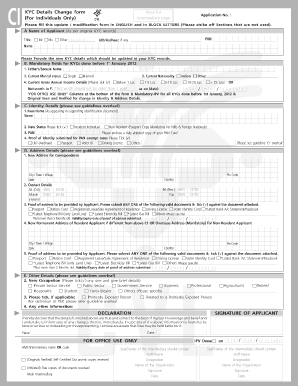

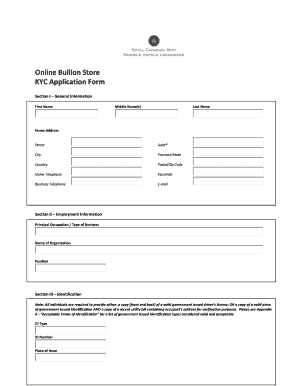

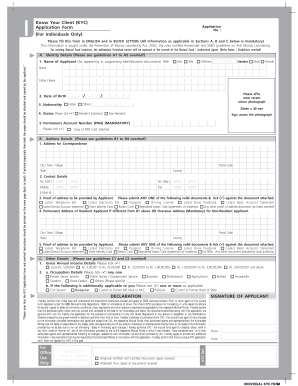

Kyc Form - Page 2

What is KYC form necessary for?

Know Your Client is a template used by most banks and financial institutions to collect the personal details of the customers. The form helps banks to avoid frauds, identity theft or funding for terrorism. It is obligatory to be completed and updated from time to time. Thus, do not be surprised if you will be asked to fill out it one more time. All the changes happening in your life somehow connected to your financial status should be provided to the respective institutions. These are the marital status change, new address or even getting a driver license.

If the information has not been changed, you can just put a checkmark to prove that the data you gave to the bank before, remains the same.

Do not forget to prepare all the identifying papers that should supply the data you have provided. Know Your Client can be submitted electronically on PDFfiller website, and copies of the supporting documents can be attached as well.

Submit KYC template in several minutes online

Any user can submit a PDF form electronically by uploading it to the PDFfiller profile. In addition to that, the file can be imported from e-mail or cloud storage. Open the file in the editor and follow such steps: