Loan Calculators

What is Loan Calculators?

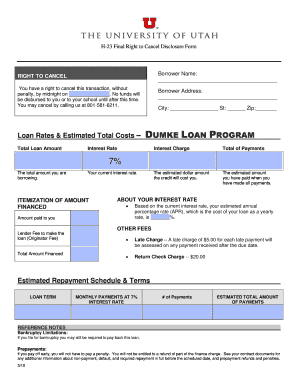

Loan calculators are tools that help users estimate the amount of money they will need to borrow and determine the monthly repayment amount for different types of loans. These calculators take into consideration factors such as interest rates, loan terms, and any additional fees to provide accurate repayment estimates.

What are the types of Loan Calculators?

There are various types of loan calculators available to assist users in different financial situations. Some common types include:

Mortgage Loan Calculator

Personal Loan Calculator

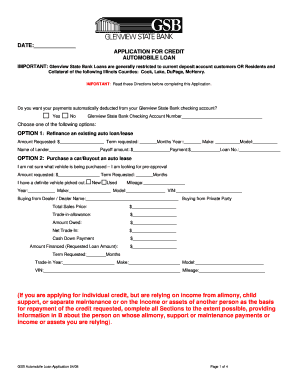

Auto Loan Calculator

Student Loan Calculator

How to complete Loan Calculators

Completing a loan calculator is a simple process. Follow these steps:

01

Enter the loan amount you wish to borrow.

02

Input the interest rate provided by the lender.

03

Choose the loan term in years or months.

04

Include any additional fees or charges.

05

Click on the 'Calculate' button to obtain the estimated monthly repayment amount.

By using loan calculators, users can easily determine the financial feasibility of their borrowing needs and plan their repayments accordingly.

Video Tutorial How to Fill Out Loan Calculators

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate loan amount in Excel?

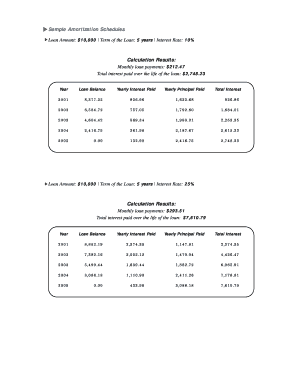

=PMT(17%/12,2*12,5400) The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. The NPER argument of 2*12 is the total number of payment periods for the loan. The PV or present value argument is 5400.

What is the formula of loan calculation?

Great question, the formula loan calculators use is I = P * r *T in layman's terms Interest equals the principal amount multiplied by your interest rate times the amount in years. Where: P is the principal amount, $3000.00. r is the interest rate, 4.99% per year, or in decimal form, 4.99/100=0.0499.

How do I create a loan sheet in Excel?

How to make a loan amortization schedule with extra payments in Excel Define input cells. As usual, begin with setting up the input cells. Calculate a scheduled payment. Set up the amortization table. Build formulas for amortization schedule with extra payments. Hide extra periods. Make a loan summary.

How do I track a loan on a spreadsheet?

If you prefer to create your own spreadsheet to track your equipment loan or line of credit, it's easy to do.Simply enter into a worksheet three pieces of information in the cells under one column: Initial amount of the loan (Present Value or PV) Payback term (Periods, such as 60 months) Interest rate.