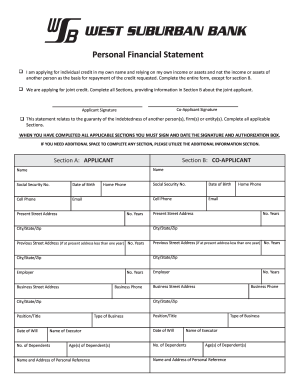

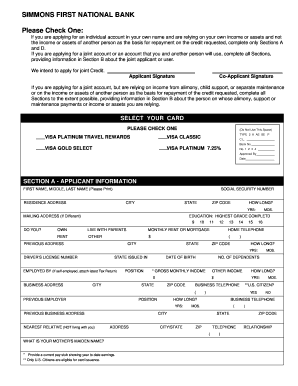

What is Personal Financial Statement Blank Form?

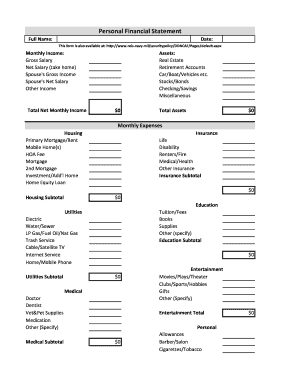

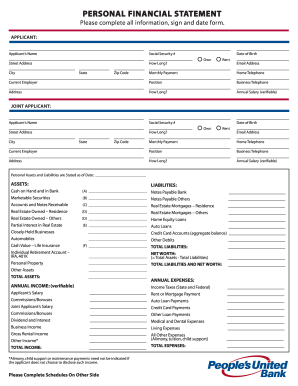

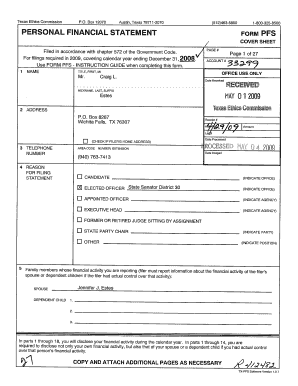

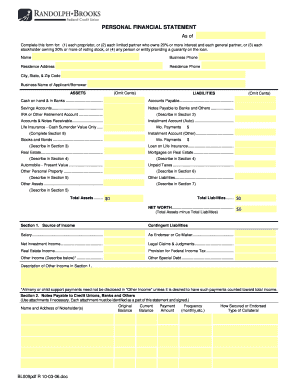

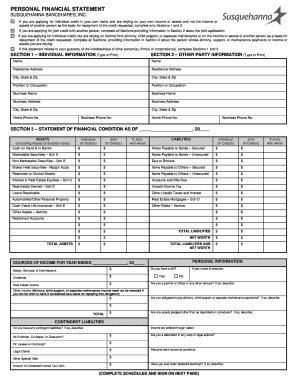

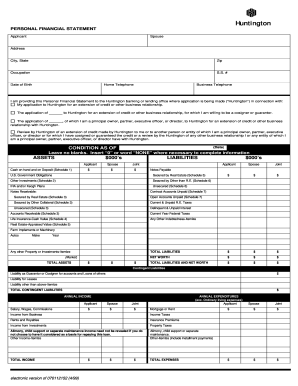

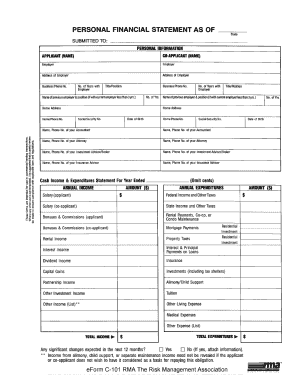

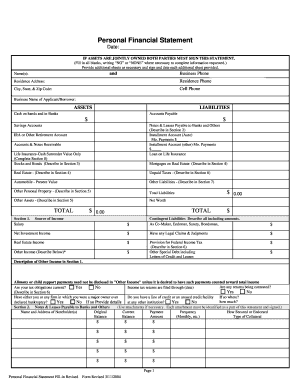

A Personal Financial Statement Blank Form is a document that provides a snapshot of an individual's financial situation. It includes information about their assets, liabilities, income, and expenses. This form is commonly used by individuals to assess their financial health and make informed decisions about their finances.

What are the types of Personal Financial Statement Blank Form?

There are various types of Personal Financial Statement Blank Forms available, depending on the specific purpose and requirements. Some common types include:

Personal Net Worth Statement: This form focuses on an individual's overall financial position, including their assets, liabilities, and net worth.

Income Statement: This form provides a detailed breakdown of an individual's income from various sources, such as employment, investments, and rental properties.

Expense Statement: This form lists an individual's regular and recurring expenses, such as mortgage payments, utility bills, and transportation costs.

How to complete Personal Financial Statement Blank Form

Completing a Personal Financial Statement Blank Form is a straightforward process. Here are the steps you can follow:

01

Gather all relevant financial documents, such as bank statements, investment statements, and tax returns.

02

Fill in your personal information, including your name, contact details, and social security number.

03

List your assets, including cash, investments, real estate, vehicles, and other valuable possessions.

04

Provide details about your liabilities, such as loans, mortgages, credit card debts, and other outstanding obligations.

05

Include information about your income from various sources, such as employment, self-employment, investments, and rental properties.

06

List your regular expenses, including housing costs, transportation expenses, utilities, insurance premiums, and other bills.

07

Calculate your net worth by subtracting your total liabilities from your total assets.

08

Review the completed form for accuracy and make any necessary adjustments.

09

Sign and date the form to finalize it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.