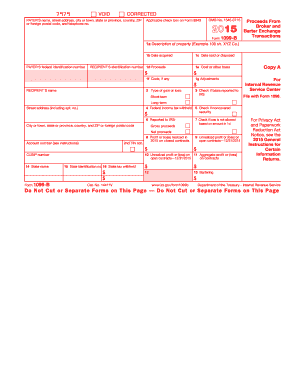

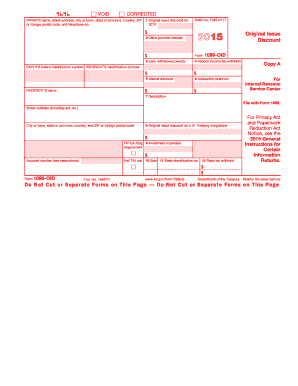

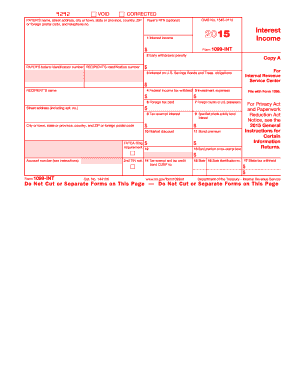

1099-int Template 2015 - Page 2

What is 1099-int Template 2015?

The 1099-int Template 2015 is a standardized form used by businesses and individuals to report interest income received from various sources during the year. It is an important document for tax purposes and must be completed accurately and submitted to the appropriate authorities.

What are the types of 1099-int Template 2015?

There are several types of 1099-int Template 2015, depending on the nature of the interest income received. The most common types include:

How to complete 1099-int Template 2015

Completing the 1099-int Template 2015 is a straightforward process, but it requires attention to detail. Here are the steps to follow:

With pdfFiller, completing the 1099-int Template 2015 becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.