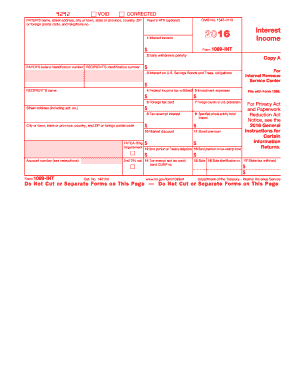

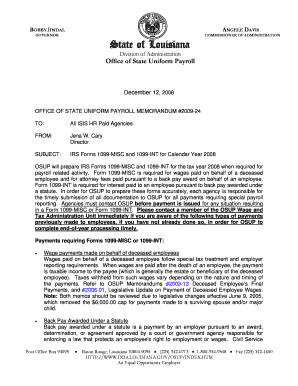

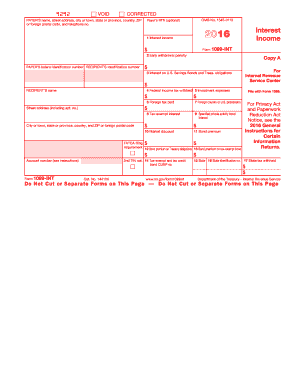

1099 Int 2016

What is 1099 int 2016?

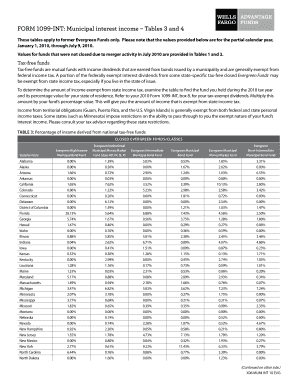

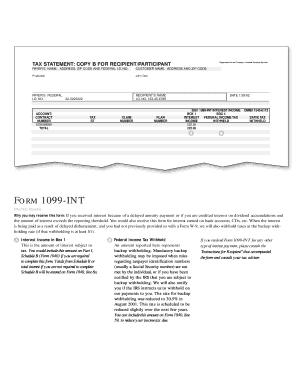

If you've come across the term '1099 int 2016' and wondered what it means, you've come to the right place. In simple terms, a 1099 int 2016 is a tax form used to report interest income earned throughout the year. This form is primarily used by individuals and businesses who have received interest payments of $10 or more from sources such as banks, financial institutions, or other entities.

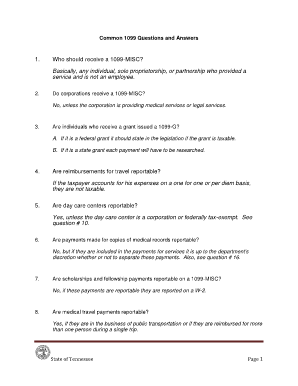

What are the types of 1099 int 2016?

When it comes to the types of 1099 int 2016 forms, there are mainly four categories:

How to complete 1099 int 2016

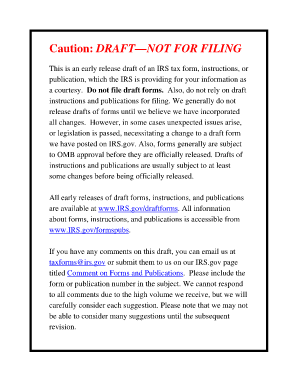

Filling out a 1099 int 2016 form may seem daunting at first, but with the right approach, it can be a straightforward process. Here are the steps you need to follow to complete the form:

By following these steps, you can ensure that your 1099 int 2016 form is completed accurately and submitted on time, avoiding any potential issues with the tax authorities. And remember, if you ever need assistance with creating, editing, and sharing your tax documents or any other type of document, pdfFiller is here to help. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effortlessly.