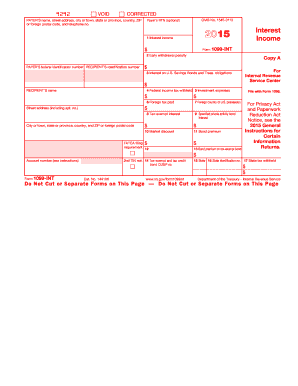

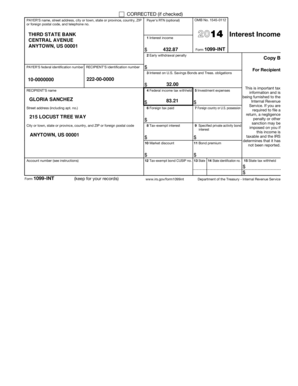

2015 1099-int

What is 2015 1099-int?

The 2015 1099-int is a tax form used to report interest income you received during the year. It is specifically designed for reporting interest earned from various sources, such as banks, credit unions, and other financial institutions. This form is essential for accurately reporting your income and ensuring compliance with tax laws.

What are the types of 2015 1099-int?

The types of 2015 1099-int forms depend on the sources from which you received interest income. Some common types include:

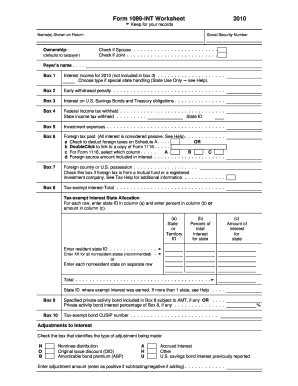

How to complete 2015 1099-int

Completing the 2015 1099-int form is important to accurately report your interest income. Here are the steps to complete the form:

By using pdfFiller, you can conveniently complete and submit your 2015 1099-int form online. With unlimited fillable templates and powerful editing tools, pdfFiller empowers you to efficiently handle your documents. Simplify your tax reporting process and ensure compliance with ease.