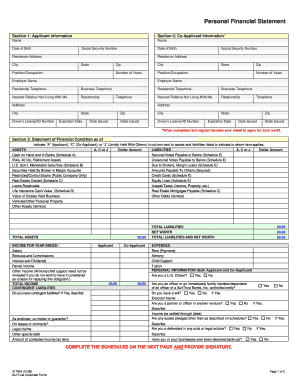

What is Basic Personal Financial Statement Form?

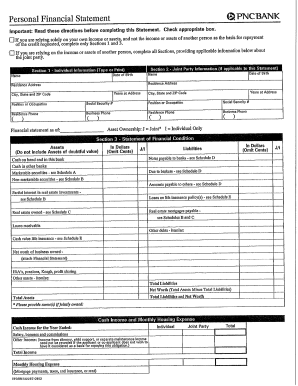

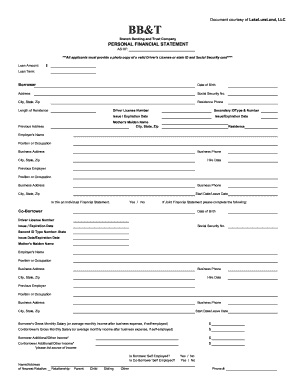

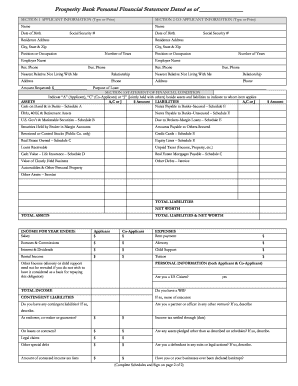

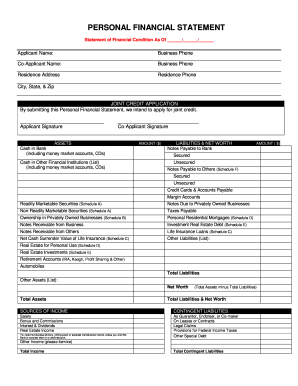

A Basic Personal Financial Statement Form is a document that provides a snapshot of an individual's financial situation. It includes information about their assets, liabilities, and net worth. This form is commonly used by individuals and businesses to assess their financial health and make informed decisions about budgeting, investing, and managing money.

What are the types of Basic Personal Financial Statement Form?

There are several types of Basic Personal Financial Statement Forms available, each catering to specific needs and requirements. Some common types include:

Simple Personal Financial Statement Form: This form provides a straightforward overview of an individual's financial status.

Income and Expense Statement Form: This form focuses on an individual's income and expenses, providing a detailed analysis of their financial activities.

Real Estate Financial Statement Form: This form is designed specifically for individuals who own or invest in real estate properties, allowing them to track their real estate holdings and related financials.

Business Personal Financial Statement Form: This form is tailored for business owners, enabling them to assess the financial health of their business and make informed decisions.

Retirement Personal Financial Statement Form: This form is designed to help individuals plan for their retirement by analyzing their current financial situation and estimating future income and expenses.

How to complete Basic Personal Financial Statement Form?

Completing a Basic Personal Financial Statement Form can seem daunting, but with pdfFiller's powerful tools, it becomes a breeze. Here is a step-by-step guide to help you:

01

Start by accessing pdfFiller's Basic Personal Financial Statement Form template.

02

Fill in your personal information, such as name, address, and contact details.

03

Provide details of your assets, including cash, investments, properties, and any other valuable possessions.

04

List down your liabilities, such as loans, credit card debts, and mortgages.

05

Calculate your net worth by subtracting your liabilities from your assets.

06

Review and double-check all the information you have provided.

07

Save the completed form as a PDF or share it directly with others using pdfFiller's sharing options.

With pdfFiller's intuitive interface and powerful features, completing a Basic Personal Financial Statement Form has never been easier. Sign up today and take control of your financial future!