What is credit application form pdf?

A credit application form pdf is a digital document that individuals or businesses can use to apply for credit from a lender. It allows applicants to provide all the necessary information required by the lender to assess their creditworthiness and make a decision on whether to grant them credit.

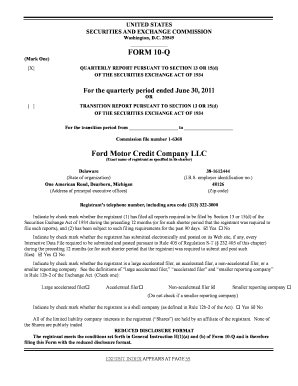

What are the types of credit application form pdf?

There are several types of credit application form pdf that cater to different purposes and industries. Some common types include:

Consumer credit application form: This is used by individuals applying for personal credit, such as credit cards, loans, or mortgages.

Business credit application form: This is used by businesses to apply for credit, typically for purchasing goods or services on credit terms.

Vendor credit application form: This is used by suppliers or vendors to vet potential customers and assess their creditworthiness before offering them credit terms.

Trade credit application form: This is used between businesses in the same industry to establish credit terms for the purchase and sale of goods or services.

Commercial credit application form: This is used by businesses to apply for lines of credit or business credit cards.

How to complete credit application form pdf

Completing a credit application form pdf is a straightforward process. Here are the steps to follow:

01

Open the credit application form pdf using a compatible PDF editor or viewer.

02

Carefully read the instructions and information provided on the form to ensure you understand what information is required.

03

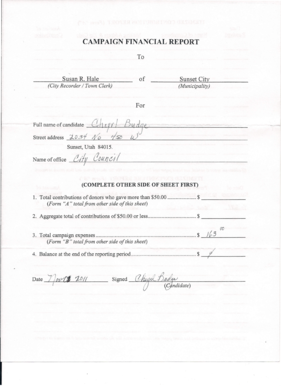

Fill in your personal or business information accurately, including your name, contact details, address, social security number or employer identification number, and financial details as requested.

04

Provide supporting documentation if required, such as bank statements, tax returns, or proof of income.

05

Review the completed form to make sure all the information is accurate and up to date.

06

Save a copy of the completed form for your records, and submit it to the lender as instructed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out credit application form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What credit application means?

A credit application fulfils two main purposes: It provides the lender with enough details to determine the borrower's likeliness to repay the loan. It provides the borrower with details to determine the cost of credit, such as interest rates and fees.

What is process credit application for purchase?

The present Unit on 'Process of Credit Application' covers various aspects like features and conditions for credit sales, identifying credit checks and getting authorisation, describing the process of credit requisitions, demonstrate the techniques for determining creditworthiness.

What are the steps in the credit application process?

While granting customer credit, the sales associate has to follow certain steps, which include creation of credit policy, obtaining credit application, checking customer references, getting a personal guarantee, run a credit check, setting limits of credit and payment terms.

What is a business credit application form?

A business credit application form is used by businesses to request funding or lines of credit with a bank through the business's website.

Why does a company need a credit application?

A well-defined credit application provides the basis for gathering information and implementing the company's policies. The credit application is the primary document which allows the credit professional to “Know Your Customer (KYC).” It may also serve as a contract.

How do you write a credit application?

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line.

Related templates