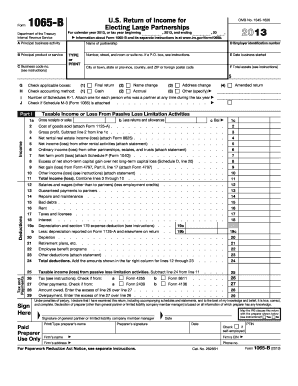

Form 1065

What is Form 1065?

Form 1065 is a tax return form used by partnerships to report their income, deductions, and other relevant information to the Internal Revenue Service (IRS). Partnerships are not taxed on their income, but rather pass-through the income to their partners who are personally responsible for reporting and paying taxes on their share of the partnership's income.

What are the types of Form 1065?

There are three types of Form 1065: general partnership (GP), limited partnership (LP), and limited liability partnership (LLP). A general partnership is a business structure where two or more partners own and manage the business. In a limited partnership, there are two types of partners: general partners who manage the business and are personally liable for its debts, and limited partners who are only liable for their investment in the partnership. A limited liability partnership combines the benefits of both general and limited partnerships, providing liability protection to all partners.

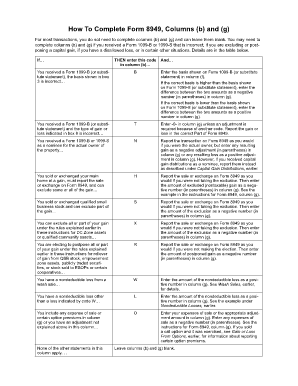

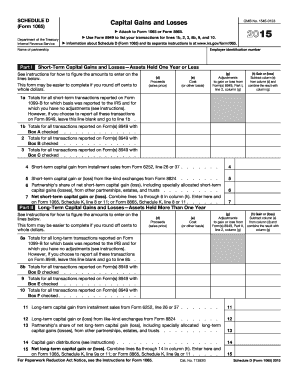

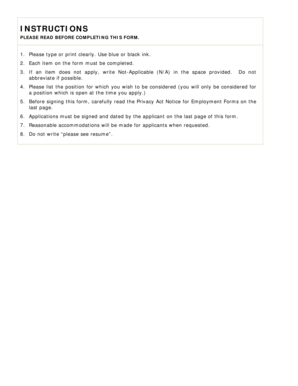

How to complete Form 1065

Completing Form 1065 involves several steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.