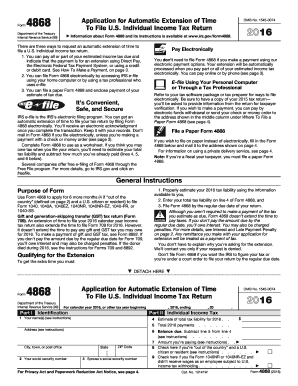

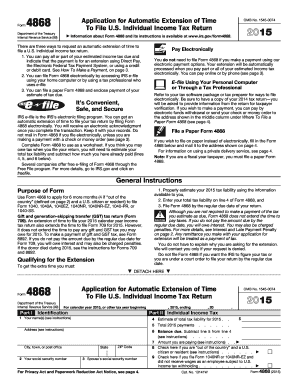

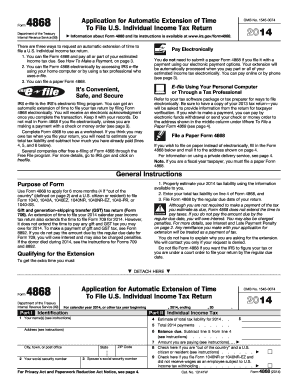

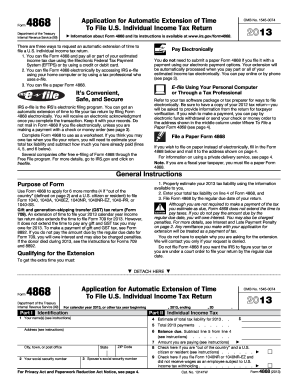

4868 Form

What is 4868 Form?

A 4868 Form, also known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is a document that allows individuals to request an extension for filing their federal income tax return. This form gives taxpayers an additional six months to file their return, moving the deadline from April 15th to October 15th.

What are the types of 4868 Form?

There are two types of 4868 Form. The first type is for individuals who need an extension to file their federal income tax return. The second type is for individuals who are outside the United States and Puerto Rico and qualify for an automatic two-month extension. This extension moves their deadline to June 15th.

How to complete 4868 Form

To complete the 4868 Form, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.