Personal Loan Agreement Doc

What is personal loan agreement doc?

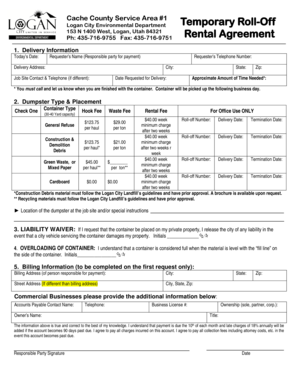

A personal loan agreement document is a legally binding contract between two parties that outlines the terms and conditions of a personal loan. It includes important details such as the loan amount, interest rate, repayment schedule, and any additional fees or penalties. This document serves as a written record of the agreement, protecting both the lender and the borrower in case of any disputes or misunderstandings.

What are the types of personal loan agreement doc?

There are various types of personal loan agreement documents that cater to different lending situations. Some common types include: 1. Secured Personal Loan Agreement: This type of agreement requires collateral, such as a property or vehicle, to secure the loan. 2. Unsecured Personal Loan Agreement: This agreement does not require collateral and is based solely on the borrower's creditworthiness. 3. Installment Loan Agreement: This agreement outlines a fixed repayment schedule with equal installments over a predetermined period of time. 4. Revolving Loan Agreement: This type of agreement allows the borrower to borrow, repay, and borrow again up to a certain credit limit. Each type of personal loan agreement has its own set of requirements and conditions, so it's important to choose the right agreement based on your specific needs and circumstances.

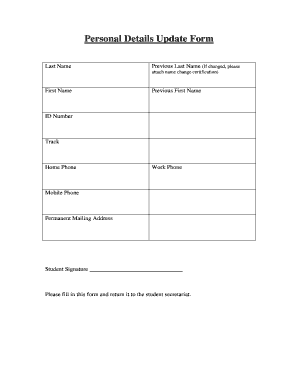

How to complete personal loan agreement doc

Completing a personal loan agreement document may seem daunting, but with the right guidance, it can be a straightforward process. Here are the steps to follow: 1. Gather necessary information: Collect all the required details for the agreement, including the borrower's and lender's names, contact information, and loan terms. 2. Use an online platform like pdfFiller: Take advantage of pdfFiller's user-friendly interface and powerful editing tools to create and fill out your personal loan agreement document. 3. Customize the agreement: Add specific terms and conditions that both parties agree upon, such as the loan amount, interest rate, repayment schedule, and any additional clauses. 4. Review and revise: Carefully review the document for accuracy and make any necessary revisions before finalizing it. 5. Sign and share: Once the document is complete, electronically sign it and share it with the other party. This ensures that all parties have a legally binding agreement.

With pdfFiller, users can easily create, edit, and share personal loan agreement documents online. Its unlimited fillable templates and powerful editing tools make it the go-to PDF editor for getting documents done efficiently and securely.