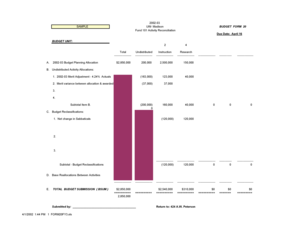

What is Sample Business Budget?

A Sample Business Budget is a financial plan that outlines the estimated income and expenses of a business over a specific period. It serves as a roadmap for managing the financial resources and achieving the desired financial goals for the business. By creating a Sample Business Budget, businesses can better understand their financial standing, make informed decisions, and identify areas for improvement.

What are the types of Sample Business Budget?

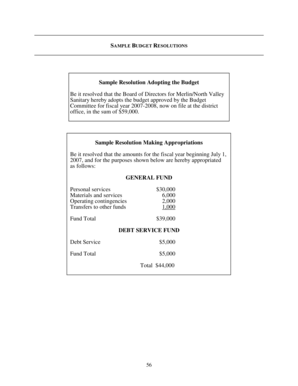

There are several types of Sample Business Budget that businesses can use based on their specific needs. Some common types of Sample Business Budget include:

Sales Budget: This budget focuses on estimating the sales revenue and sales volume for a specific period.

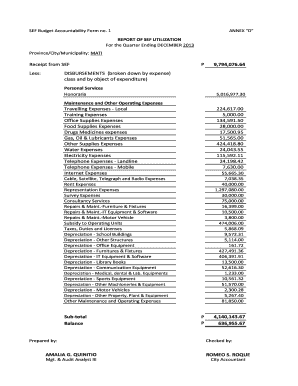

Operating Budget: This budget outlines the day-to-day expenses of the business, such as rent, utilities, and salaries.

Cash Flow Budget: This budget tracks the inflow and outflow of cash in the business to ensure a positive cash flow.

Capital Budget: This budget is used to plan and allocate funds for long-term investments, such as purchasing assets or expanding the business.

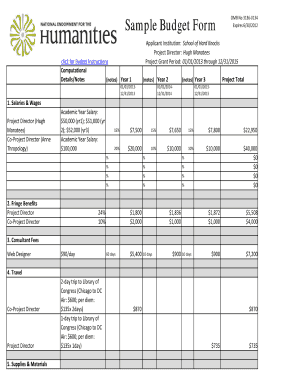

How to complete Sample Business Budget

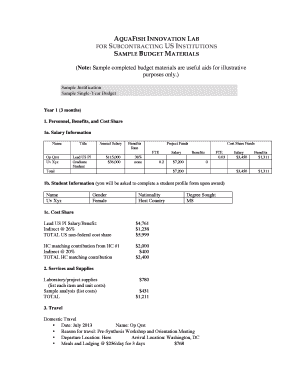

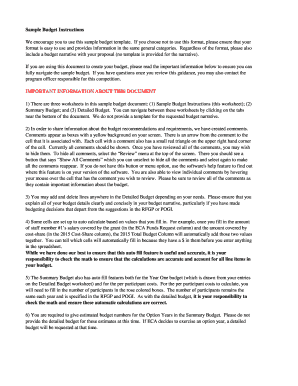

Completing a Sample Business Budget requires careful planning and attention to detail. Here are the steps to follow:

01

Identify your business goals and objectives.

02

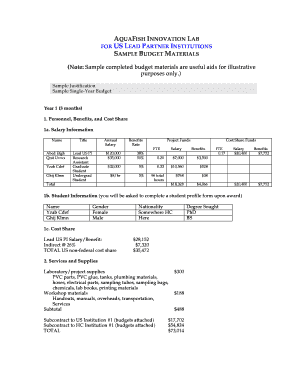

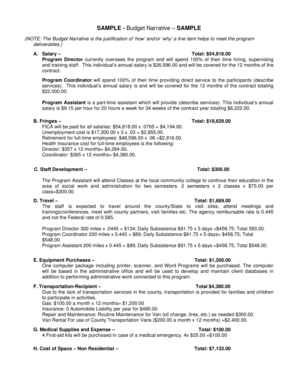

Estimate your income sources, such as sales revenue, investments, and loans.

03

Determine your fixed expenses, such as rent, utilities, and salaries.

04

Calculate your variable expenses, such as production costs and marketing expenses.

05

Consider any one-time or seasonal expenses.

06

Project your expected income and expenses for the budget period.

07

Review and adjust your budget periodically to reflect any changes in your business.

08

Use budgeting tools and software, such as pdfFiller, to streamline the budgeting process and ensure accuracy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.