What is business budget planning?

Business budget planning refers to the process of creating a financial blueprint for a company's future activities and expenses. It involves estimating and allocating resources to different departments or projects, determining income and expenditure projections, and setting financial goals and targets. By carefully planning and managing their budget, businesses can optimize their financial resources, identify potential risks or opportunities, and make informed decisions that contribute to their overall success and growth. Effective budget planning helps businesses track their financial health, allocate funds efficiently, and ensure long-term sustainability and profitability.

What are the types of business budget planning?

There are several types of business budget planning that companies can employ, depending on their specific needs and objectives. These include:

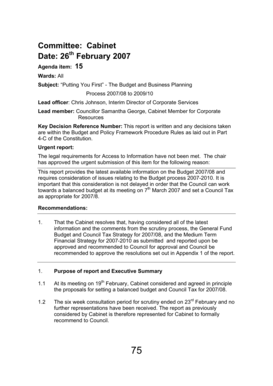

Strategic budget planning: This type of budget planning focuses on long-term financial goals and aligning them with the company's strategic objectives. It involves forecasting future revenue, analyzing market trends and competitive landscape, and developing strategies to achieve financial targets.

Operational budget planning: Operational budget planning involves estimating day-to-day expenses and allocating resources to different departments or activities. It covers costs such as salaries, utilities, supplies, and maintenance. This type of budget planning helps businesses manage their regular operations efficiently.

Capital budget planning: Capital budget planning focuses on large-scale investments, such as purchasing assets or expanding production facilities. It involves assessing the financial feasibility of these projects, calculating return on investment, and determining the funding sources.

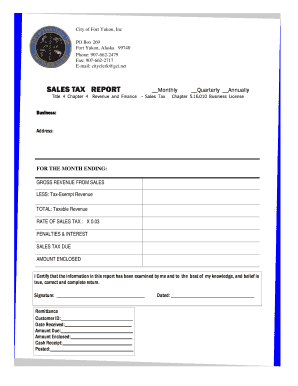

Cash flow budget planning: Cash flow budget planning helps businesses manage their cash inflows and outflows effectively. It involves estimating future cash inflows from sales or investments and planning for expenses such as vendor payments, loan repayments, and operating costs.

Zero-based budget planning: In zero-based budget planning, every expense and activity is reviewed and justified, starting from zero. It requires a thorough evaluation of each department's needs and costs, ensuring that the budget reflects the current priorities and objectives of the company.

How to complete business budget planning

Completing business budget planning involves several steps that help ensure accuracy and thoroughness. Here is a step-by-step guide for completing business budget planning:

01

Determine financial goals: Start by defining the financial goals and targets you want to achieve through budget planning. These goals should align with your overall business objectives.

02

Gather relevant financial data: Collect all the necessary financial data, including income statements, expense reports, sales data, and other financial records. This information will serve as the foundation for your budget planning.

03

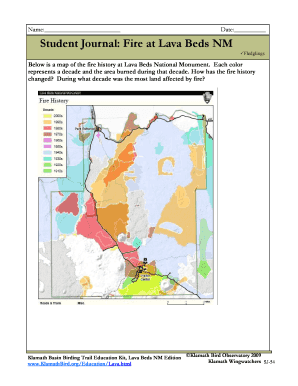

Forecast revenue and expenses: Based on historical data and market analysis, estimate your expected revenue and expenses for the budgeting period. Take into account factors such as industry trends, customer behavior, and any anticipated changes in the business environment.

04

Allocate resources: Once you have estimated your revenue and expenses, allocate resources to different departments or projects accordingly. This ensures that you have sufficient funds to support your operations and initiatives.

05

Set budget targets: Set specific targets for each department or project in terms of revenue generation, cost reduction, or resource optimization. These targets help track performance and provide benchmarks for evaluating the success of your budget planning.

06

Monitor and track budget: Regularly monitor and track your budget throughout the budgeting period. Compare the actual income and expenses against the projected amounts to identify any discrepancies or areas that require adjustments.

07

Adjust and revise as needed: As new information or circumstances arise, be flexible and willing to adjust your budget accordingly. Regularly evaluate the effectiveness of your budget planning and make revisions to ensure it remains aligned with your business goals.

08

Leverage tools and technology: Consider using budgeting software or online platforms like pdfFiller to streamline the budget planning process. These tools empower users to create, edit, and share documents online, making the budget planning process more efficient and collaborative.

By following these steps and utilizing resources like pdfFiller, businesses can complete their budget planning effectively, align their financial resources with their strategic objectives, and ensure long-term success.