2007 Forms

What are 2007 Forms?

2007 Forms are specific types of documents that are used to gather information or record details related to a particular subject. These forms are commonly used in various industries and sectors to streamline processes and ensure accurate record-keeping.

What are the types of 2007 Forms?

There are several types of 2007 Forms available, each tailored to different purposes and requirements. Some common types of 2007 Forms include:

Employee Information Form

Expense Report Form

Customer Feedback Form

Purchase Order Form

Incident Report Form

How to complete 2007 Forms

Completing 2007 Forms is a straightforward process that can be easily done by following these simple steps:

01

Gather all necessary information and documents required for the form.

02

Carefully read and understand each section of the form before filling it out.

03

Fill in the required fields accurately and double-check for any errors or omissions.

04

Review the completed form to ensure all information is accurate and complete.

05

Save or print a copy of the form for your records or submit it as required.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2007 Forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I get my form 7202?

▶ Go to .irs.gov/Form7202 for instructions and the latest information. For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions. self-employed individual because of certain coronavirus-related care you required or provided to another.

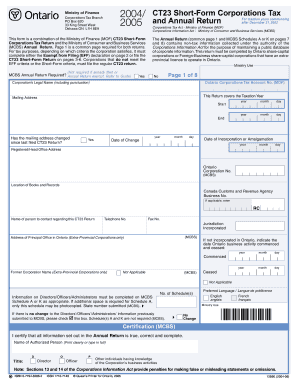

Can I file a 2007 tax return?

You can no longer claim a 2007 Tax Year Refund. To amend or change a 2007 accepted Federal Income Tax Return: Complete IRS Tax Amendment Form 1040X and mail it in any time.

What is IRS form 7200 used for?

Who May File Form 7200? Generally, employers that file Form(s) 941, 943, 944, or CT-1 may file Form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages, the employee retention credit, and/or the COBRA premium assistance credit.

How far back can you file old taxes?

You risk losing your refund if you don't file your return. If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

Can I file taxes from 20 years ago?

You can file back taxes for any past year, but the IRS usually considers you in good standing if you have filed the last six years of tax returns. If you qualified for federal tax credits or refunds in the past but didn't file tax returns, you may be able to collect the money by filing back taxes.

How do I get past 5 years of tax returns?

Taxpayers can request a copy of a tax return by completing and mailing Form 4506 to the IRS address listed on the form. There's a $43 fee for each copy and these are available for the current tax year and up to seven years prior.

Related templates