What are Forms 2020?

Forms 2020 are the latest versions of standardized documents used for various purposes, such as tax filing, legal agreements, or surveys. These forms are designed to collect specific information and data efficiently.

What are the types of Forms 2020?

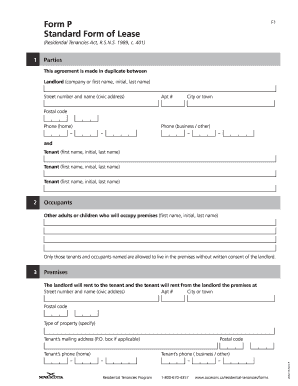

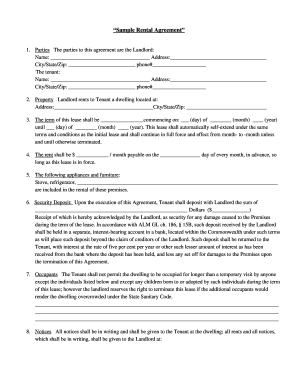

There are several types of Forms 2020 tailored to different needs and industries. Some common types include tax forms, employment forms, consent forms, and registration forms.

Tax forms

Employment forms

Consent forms

Registration forms

How to complete Forms 2020

Completing Forms 2020 can be a straightforward process if you follow these steps:

01

Gather all necessary information before starting the form

02

Read the instructions carefully to understand what is required

03

Fill in the form accurately and double-check for any mistakes before submitting

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Forms 2020

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

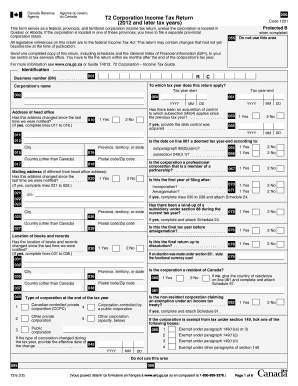

What is a 2020 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Where can I get a 2020 tax form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is Form 1040 ES V 2020?

Use Form 1040-ES to figure and pay your estimated tax for 2020. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What is a 2020 form?

Form 1040. 2020. U.S. Individual Income Tax Return.

Can I print 2020 tax forms?

We accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. This policy includes forms printed from IRS.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself.

How do I get my 2020 or 40 form?

Online payments: Visit our website at .oregon.gov/dor. Mailing your payment: Make your check or money order payable to the Oregon Department of Revenue. Write “2020 Oregon Form OR-40” and the last four digits of your SSN or ITIN on your check or money order.

Related templates