2017 Forms

What are 2017 Forms?

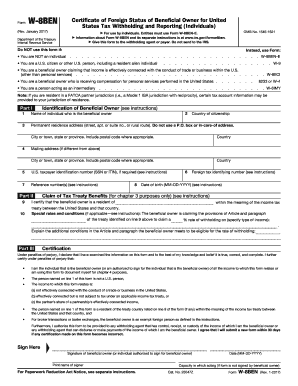

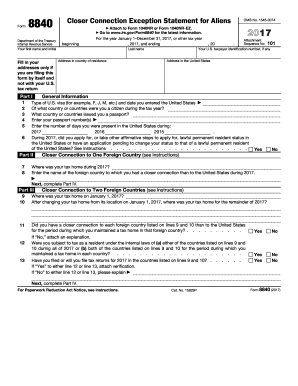

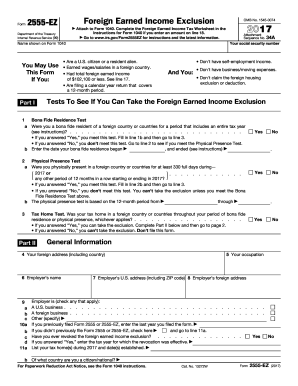

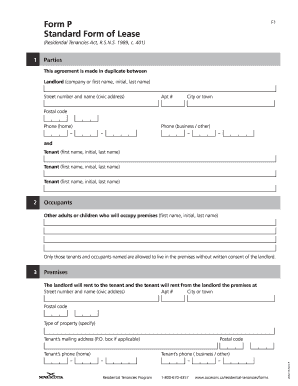

2017 Forms are documents used for reporting various types of information to the government, such as tax information, employment details, and financial data. These forms are typically required to be filed on an annual basis for record-keeping and compliance purposes.

What are the types of 2017 Forms?

There are several types of 2017 Forms that individuals and businesses may need to complete, including but not limited to: W-2 forms for reporting wages and taxes withheld, 1099 forms for reporting income other than wages, 1040 forms for individual income tax returns, and 1065 forms for partnership income tax returns.

How to complete 2017 Forms

Completing 2017 Forms can be a straightforward process if you follow these steps: 1. Gather all necessary information and documents. 2. Carefully review the instructions provided with the form. 3. Fill out the form accurately and completely. 4. Double-check your entries for any errors or omissions before submitting. 5. Submit the completed form by the deadline to the appropriate authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.