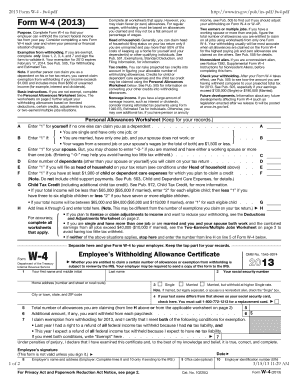

2013 W-4 Form

What is 2013 W-4 Form?

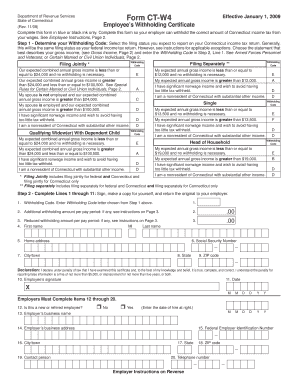

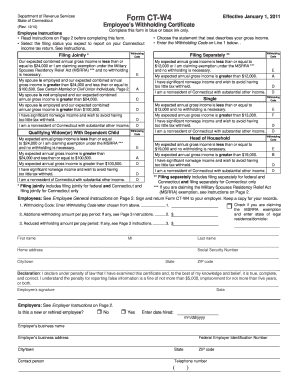

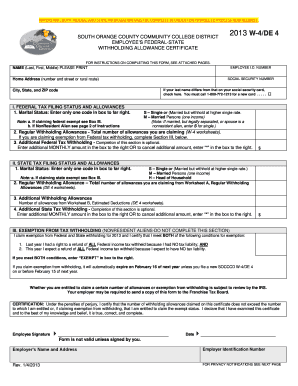

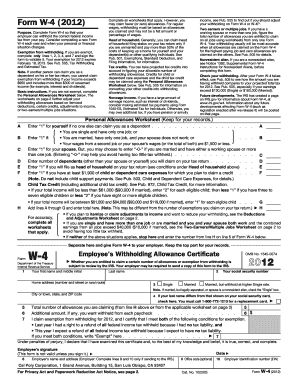

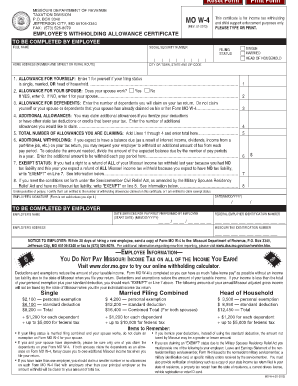

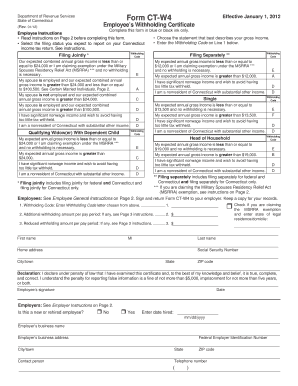

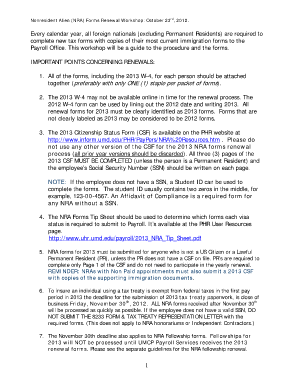

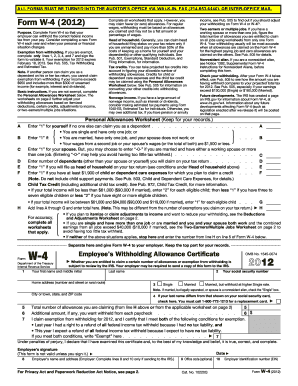

The 2013 W-4 Form is a document used by employees to indicate their withholding allowances for federal income tax purposes. It is completed by employees when they start a new job or when they want to make changes to their withholding status. By filling out this form correctly, employees can ensure that the right amount of federal income tax is withheld from their paychecks.

What are the types of 2013 W-4 Form?

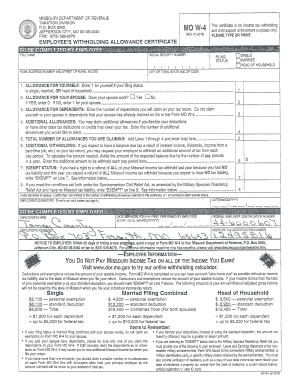

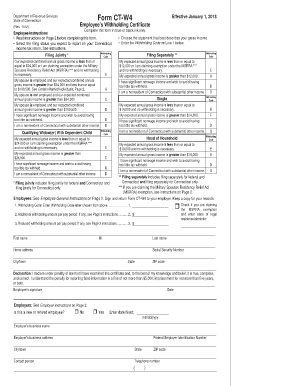

There are two types of 2013 W-4 Forms: the Employee's Withholding Allowance Certificate (Form W-4) and the Employee's Withholding Exemption Certificate (Form W-4E). The W-4 form is used by employees to declare their withholding allowances, while the W-4E form is used by employees who claim exemption from federal income tax withholding. It's important to use the correct form based on your specific situation to ensure accurate tax withholding.

How to complete 2013 W-4 Form

Completing the 2013 W-4 Form is a straightforward process. Here are the steps:

By following these steps and accurately completing the 2013 W-4 Form, you can ensure that your federal income tax withholding is calculated correctly and reflects your individual circumstances. Remember, if your personal or financial situation changes in the future, you can always update your W-4 form to reflect those changes.