401k Calculator

What is 401k Calculator?

A 401k Calculator is a financial tool that helps individuals estimate the future value of their retirement savings under a 401k plan. It takes into account various factors such as contribution amounts, the rate of return on investments, and the number of years until retirement. By using a 401k Calculator, users can get a clear understanding of how their savings will grow over time and make informed decisions about their retirement planning.

What are the types of 401k Calculator?

There are several types of 401k Calculators available to assist individuals in planning their retirement. These include: 1. Basic 401k Calculator: This type of calculator provides a simple estimation of future savings based on fixed contribution amounts and average market returns. 2. Advanced 401k Calculator: This calculator allows users to input more detailed information such as different contribution rates over time, bonuses or salary increases, and changes in investment strategies. 3. Retirement Income Calculator: This type of calculator focuses on estimating the income an individual can expect to receive from their 401k savings during retirement, taking into account factors such as life expectancy and expected inflation rates.

How to complete 401k Calculator

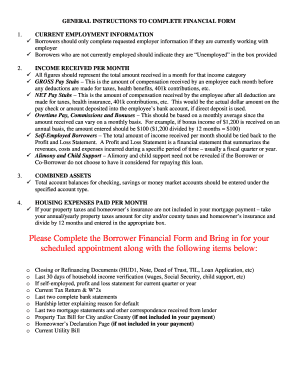

Completing a 401k Calculator is a straightforward process. Follow these steps to get started: 1. Gather the necessary information: You will need to know your current age, expected retirement age, current 401k balance, annual salary, contribution percentage, and expected rate of return. 2. Input the information: Enter the required data into the 401k Calculator. Make sure to double-check the accuracy of the information. 3. Review the results: After entering the information, the calculator will provide you with an estimate of your future savings and, if available, projected retirement income. 4. Analyze and adjust: Use the results to evaluate your current saving strategy and make any necessary adjustments to meet your retirement goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.