California Probate Waiver Of Accounting Form

What is california probate waiver of accounting form?

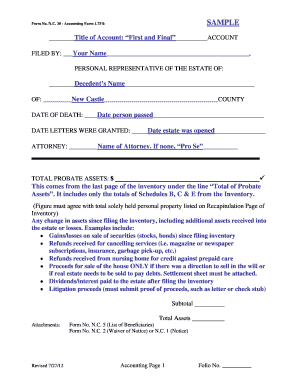

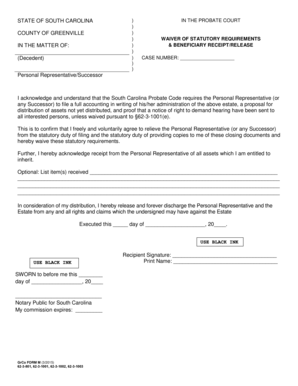

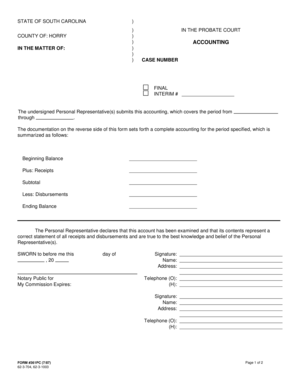

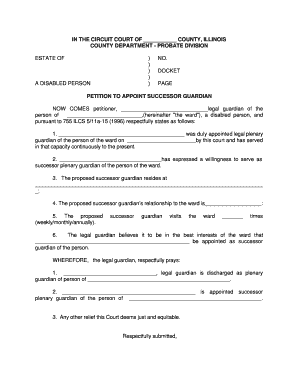

The California probate waiver of accounting form is a legal document used in the probate process. It allows a beneficiary to waive their right to receive an accounting of the estate's financial transactions.

What are the types of california probate waiver of accounting form?

There are two types of California probate waiver of accounting forms: 1. Waiver of Accounting by Beneficiary: This form is used when a beneficiary wants to waive their right to receive an accounting of the estate. 2. Waiver of Accounting by Personal Representative: This form is used when the personal representative wants to waive their obligation to provide an accounting of the estate's financial transactions.

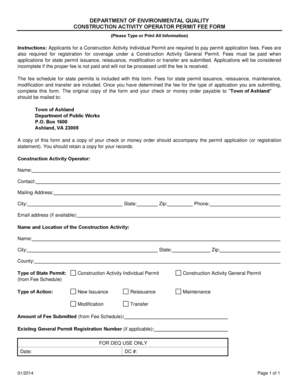

How to complete california probate waiver of accounting form

To complete the California probate waiver of accounting form, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.