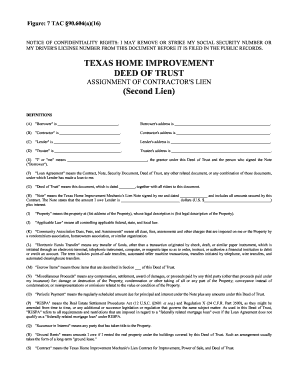

Deed Of Trust Form Texas

What is deed of trust form texas?

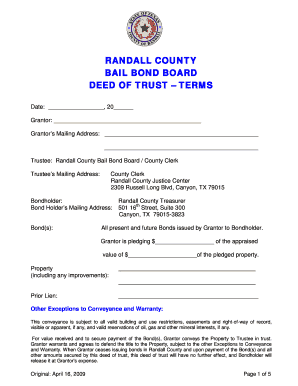

A deed of trust form in Texas is a legal document that outlines the terms of a real estate loan. It is an agreement between a borrower, a lender, and a third-party trustee. The borrower pledges their property as collateral for the loan, and the trustee holds the legal title until the loan is paid off. This form is commonly used in Texas to secure a mortgage or loan for the purchase of a property.

What are the types of deed of trust form texas?

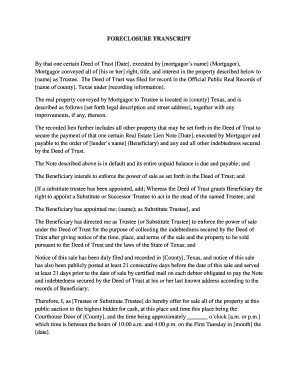

In Texas, there are generally two types of deed of trust forms: the standard deed of trust and the deed of trust with power of sale. The standard deed of trust is the most common form and allows the lender to foreclose on the property through a judicial process. The deed of trust with power of sale gives the lender the right to sell the property privately without going through the court system. Both forms provide the lender with a legal means to recover their investment if the borrower defaults on the loan.

How to complete deed of trust form texas

Completing a deed of trust form in Texas is a straightforward process. Here are the steps to follow:

By using pdfFiller, you can easily create, edit, and share your deed of trust form online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ideal PDF editor to help you get your legal documents done quickly and efficiently.