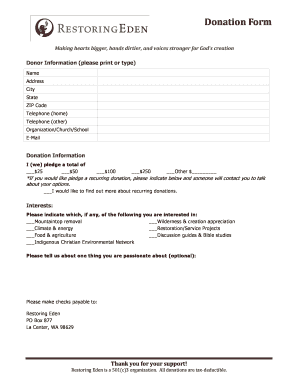

Donation Letter Format

What is donation letter format?

A donation letter format refers to the structure and layout of a letter that is written to request or acknowledge a donation. It is important to use a clear and concise format to ensure that the letter is professional and effective.

What are the types of donation letter format?

There are several types of donation letter formats that can be used depending on the purpose and audience of the letter. Some common types include:

Donation request letter format

Donation acknowledgement letter format

Thank you letter format for donations

How to complete donation letter format

Completing a donation letter format involves the following steps:

01

Start with a salutation

02

Introduce yourself and explain the purpose of the letter

03

Provide details about the donation and how it will be used

04

Thank the recipient and express gratitude

05

Close the letter with a proper closing and your contact information

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What do you write in a generous donation?

Focus more on them rather than what you or your organization does by using 'you' more than we/us. “Because of you” “Your contribution” “Thanks to your generosity” “You made it happen.” “We couldn't do it without you.”

What do you say in a donation message?

Dear [Donor Name], Today, I'm writing to ask you to support [cause]. By donating just [amount], you can [specific impact]. To donate, [specific action]. Thank you for joining [cause's] efforts during this [adjective] time—It's supporters like you that help us change the world every day.

How do you write a formal donation letter?

How To Write the Perfect Donation Request Letter Start with a greeting. Explain your mission. Describe the current project/campaign/event. Include why this project is in need and what you hope to accomplish. Make your donation ask with a specific amount correlated with that amount's impact.

How do you address a donation letter?

Donor Salutation: Address your donor by their preferred name. Decide whether you prefer a formal salutation such as “ Dear Mr. and Mrs. Richard Smith,” or a more informal one like “Hi Rick.”

What do you say to encourage donations?

Your donors want to know that they make a difference when they give.1. “You” You allowed us to employ 1000 homeless people last year. Your generosity is astonishing. Thank you for your leadership and support. With your help, we've funded 10,000 school supplies projects. Your commitment made this happen.

What is a donation letter?

A donor or donation acknowledgment letter, or charitable contribution acknowledgment letter, is a letter nonprofits send to thanking their donors for their gift. As we'll discuss below, it's also an opportunity for you to provide the official documentation required by the IRS to donors who have given a gift over $250.

Related templates