Simple Balance Sheet Template

What is Simple Balance Sheet Template?

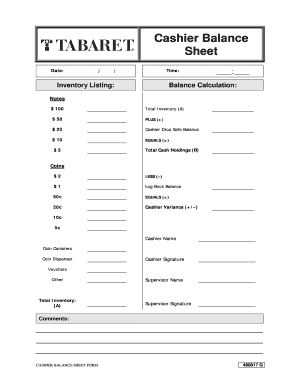

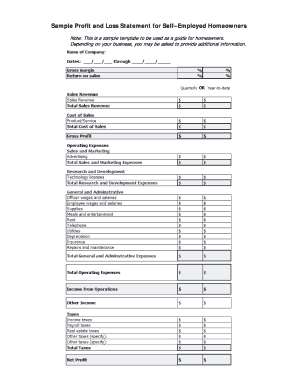

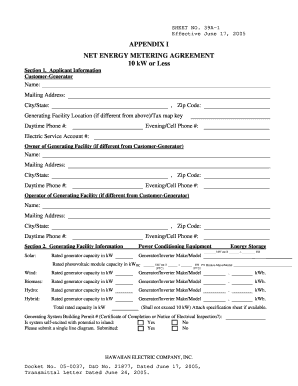

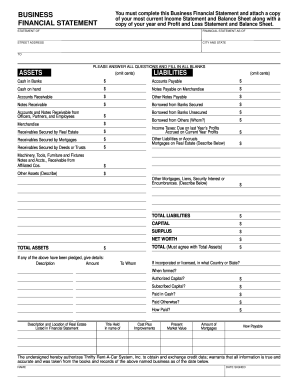

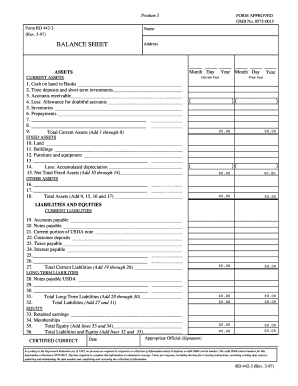

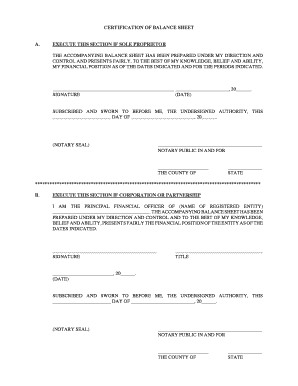

A Simple Balance Sheet Template is a financial statement that provides a summary of an organization's financial position. It presents a snapshot of assets, liabilities, and equity at a specific point in time. By using a balance sheet template, individuals or businesses can easily track their finances, make informed financial decisions, and assess their overall financial health.

What are the types of Simple Balance Sheet Template?

There are different types of Simple Balance Sheet Templates available depending on the purpose and complexity of the financial statement. Some common types include:

How to complete Simple Balance Sheet Template

Completing a Simple Balance Sheet Template involves a few key steps:

Using a Simple Balance Sheet Template can help individuals and businesses accurately assess their financial situation and make informed decisions. pdfFiller is an online platform that provides users with the tools they need to create, edit, and share documents, including unlimited fillable templates. With its powerful editing features, pdfFiller is the ultimate PDF editor that streamlines the document management process.