Convert On Sum Settlement Gratis

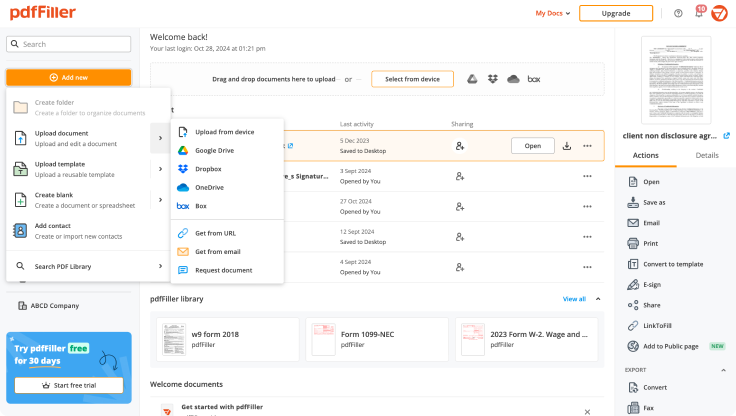

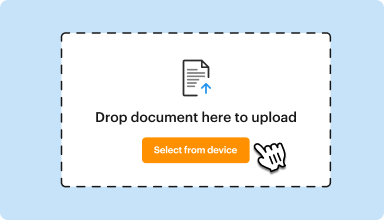

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

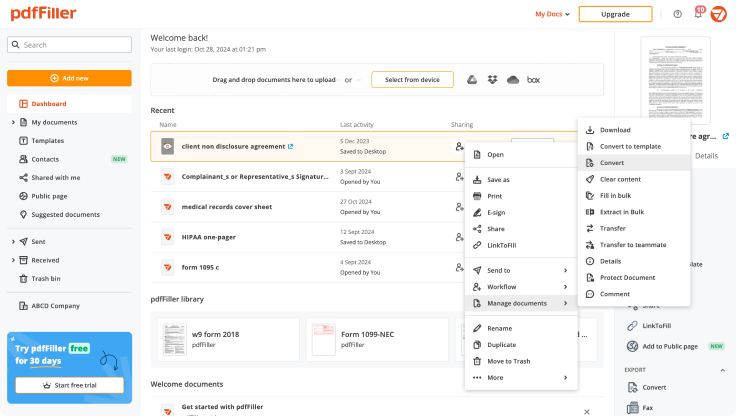

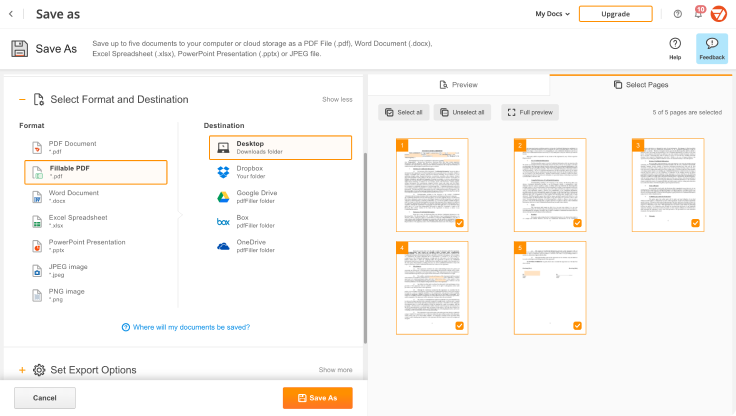

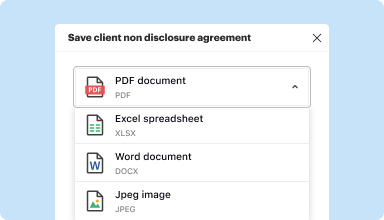

Edit, manage, and save documents in your preferred format

Convert documents with ease

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

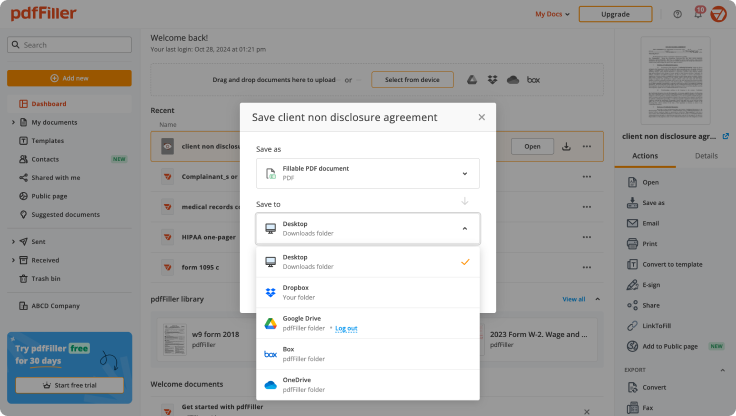

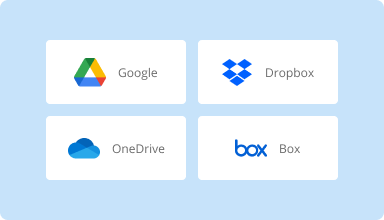

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

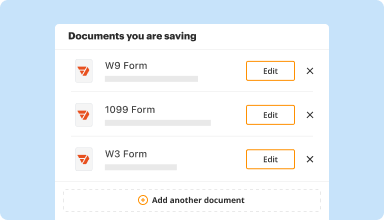

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

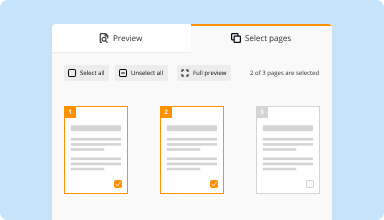

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

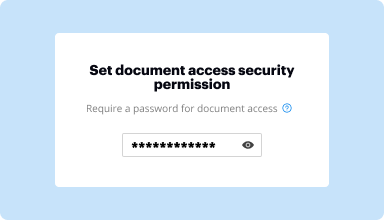

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

In ways its harder to use, does not put signs in for you and does not calculate for you like the regular form.. but this is the only way I can save my form and make copies and edit it so this kind of saved me a ton of time!

2014-06-28

The forms look much more professional when filled out in this manner, rather than a hand written form. Especially since typewriters are out of date. Thank You

2015-05-28

I am delighted that I found this PDF filler own line. I tried Adobe; however, I could not understand how it works. This is simple and easy to use. It is not difficult to drag and drop a file and then begin to fill in the proper document.

2017-02-25

I love PDF Filler; it makes my job so much easier. I am an income tax preparer volunteer, and I also have lots of legal papers for both me and kids and grandkids! Thank you for developing it.

2018-04-20

Don't quite understand how it works as I am not a computer person except to do genealogy, and write.

One cannot operate a computer without it. At least this is what I'm finding out.

It all seems automatic, I would like to know more about it's function, Why's and what-fores, instead of just logging on and it appears. All I know is that it is a major function for downloading photographs and some documents. There should be a tutorial offered to those who are senior citizens and so many things are automatic.

It takes understanding its function to a non-software-computer person. Guess more instruction would help.

2017-11-21

It's been great at helping me achieve my teaching goals! I've been able to confidently make lesson plans in a timely manner, and the easy-to-understand tools make it so much more relaxing to get done!

2024-03-19

Very useful program and easy to use

I found pdfFiller online to work with my Chrome browser for work-related documents. I have found it easy to use right away and so far it seems to handle all I need it for.

2023-08-13

What do you like best?

Easy to navigate the dashboard,easy to click on and move text items in documents.

What do you dislike?

The text type doesn't always match the font of the document I'm filling

What problems are you solving with the product? What benefits have you realized?

Quickly filling out forms and adding electronic signature.

2021-10-26

I had to ask for help in creating the 2020 form 1099.Anna was very helpful sent me the link to get the form. I still have problem saving the new form and renaming it.

2021-03-12

Convert On Sum Settlement Feature

The Convert On Sum Settlement feature offers users a straightforward solution for managing financial transactions. It simplifies the process of converting sums during settlement, making it easier for businesses to handle payments and calculations accurately.

Key Features

Automated calculation of settlement sums

Seamless integration with existing financial systems

Real-time updates on conversion rates

User-friendly interface for quick navigation

Supports multiple currencies for global transactions

Potential Use Cases and Benefits

Ideal for businesses dealing with international clients

Enhances efficiency in financial reporting

Reduces errors in manual calculations

Facilitates timely payments and settlements

Improves cash flow management

This feature addresses the common problem of complex settlement processes. By automating calculations and providing real-time data, it minimizes confusion and streamlines operations. Users can focus on growth rather than getting bogged down by financial details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I convert annuity to lump sum?

Establish where the lump sum payment is coming from: a qualified source or non-qualified source. Determine if you want the annuity to grow or to start an immediate income stream. Go to an annuity provider.

Can you take a lump sum from an annuity?

Lump-Sum Payment Taking out the assets in your annuity in one lump sum is usually not recommended because, in the year you take the lump sum, ordinary income taxes will be due on the entire investment-gain portion of your annuity.

Can you cash in an annuity?

It is possible to cash in your annuity but only if it's worth less than £10,000, and only if your provider allows you to do this. So if your annuity is very small, you could ask if this is an option and how much you would get in return.

Is it better to take an annuity or lump sum?

A lump sum is often a payment that is paid out at once rather than through multiple payments paid out over time. A lump sum allows you to collect all of your money at one time. An annuity is often a steady payment that is made at equal intervals, such as monthly or annually.

How can I get money from my annuity without penalty?

Review your annuity contract, and look at the clause covering surrender fees. Usually they start high, then decline over a period of years. Take your money piecemeal. Wait until you're 59 1/2 to withdraw from your annuity. Purchase a “no-surrender” annuity.

When can you withdraw money from an annuity?

Even if you're well past your contract's surrender period, if you take money out of an annuity before you reach the age of 59 1/2, you'll be assessed a 10% early withdrawal penalty -- the same penalty you'd face for making early withdrawals from a traditional IRA or 401(k) plan.

Is it better to take the annuity or lump sum?

When you take a lump-sum payment, it's typically a smaller amount than the reported jackpot. With annuity payments, you'll pay taxes as you go, and since you will receive a smaller amount during each tax year, at least some payments will be taxed at lower rates than if you take a lump sum all at once.

Is it better to take lump sum pension or annuity?

However, there are risks involved with a pension annuity. Typically, all of your monthly pension payment will be taxable. As we'll see later, that's better than paying tax on a lump sum all at once, but it's not necessarily as good as what can happen if you take a lump sum and use smart tax planning to manage it.

#1 usability according to G2

Try the PDF solution that respects your time.