Convert On Wage Release Gratis

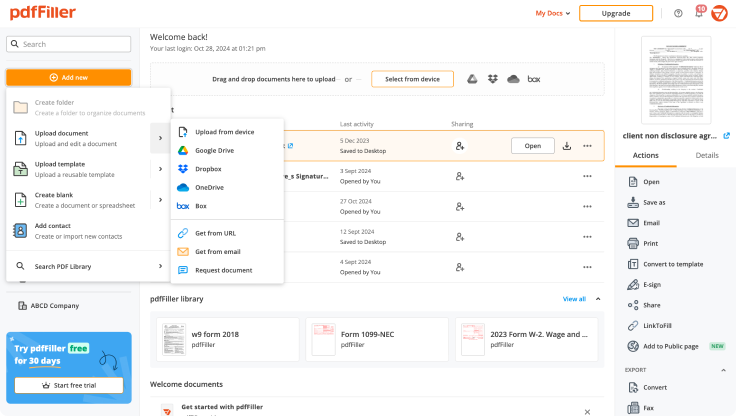

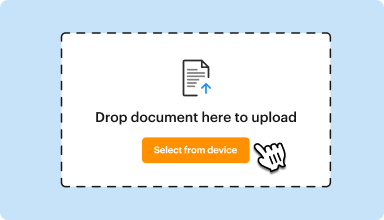

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

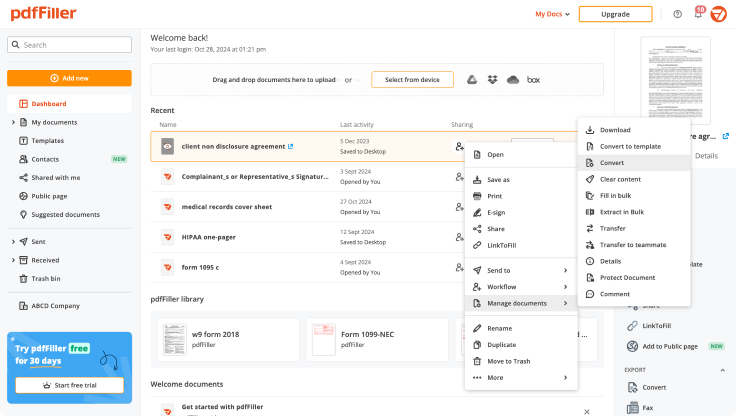

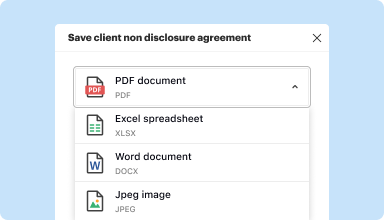

Edit, manage, and save documents in your preferred format

Convert documents with ease

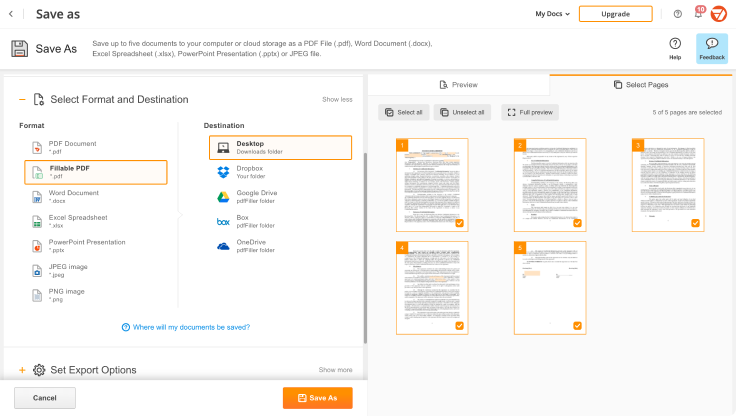

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

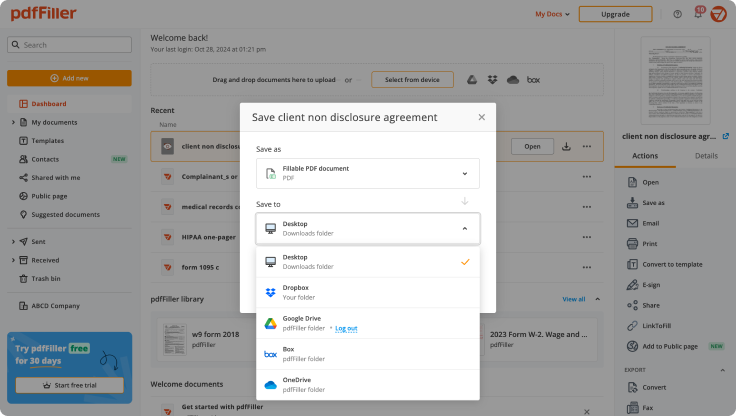

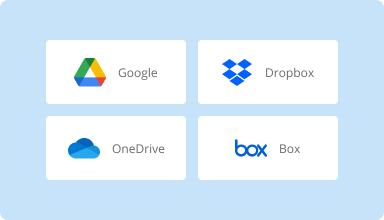

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

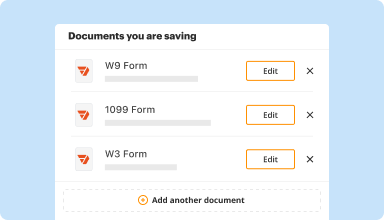

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

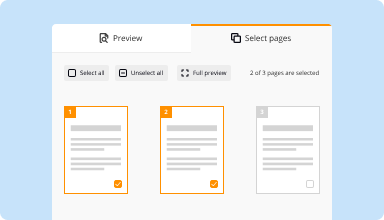

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

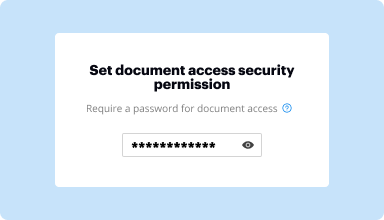

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

This program is awesome. A little difficult to look up forms at times - but overall experience was fantastic and the finished product looks clean and professional.

2014-12-18

Love it...with our computer system I can't figure out how to refile/reprint a claim with your PDFfiller form I can fill in the form print it and send it out.

2016-07-11

In my line of work (payroll) it's a lot easier to be able to fill out some of the paperwork that I need to send to employees/managers and attach it via email instead of handwriting it and scan it to them.

2017-06-13

Probably just me, but having trouble creating a fillable form and saving to my computer. Will keep exploring!

I have since figured out more basics!

2017-09-08

I originally downloaded Adobe Flash Player thinking I could make my own PDS I was wrong it was I'm no help. Just by doing a simple internet search. I came across your website it's amazing. It does everything I needed to do and more so happy I found it! I'm a landlord and now I can send applications online and fill out leases online so convenient.

2018-02-12

Excellent online software for filling in blank forms online instead of having to print and copy the document first.

Excellent! Best online software for filling in online PDF forms.

2020-03-10

My experience was excellent. As a first time user, the program was full featured and easy to use.

Ability to complete my tasks quickly and easily.

Ease of use. The program was very intuitive for me to use from the start and had all the features I needed to complete a complex form. It is an excellent piece of software.

2017-11-25

I have been using the services for a…

I have been using the services for a few years know and i can honestly say they have updated and made it very user friendly.

2024-06-30

I have used PDFfiller and it is a great time saver. By making any form to a can be filled. form online.. Its great to find a form that I need , but its not fillable, this fixs that... Their customer service is great, helped me the fist call..

2020-10-11

Convert On Wage Release Feature

The Convert On Wage Release feature streamlines your payroll process, ensuring you efficiently manage wage calculations and conversions. With this tool, you can easily convert pay rates when releasing employee wages, making your financial operations smoother than ever.

Key Features

Automatic conversion of pay rates upon wage release

Integration with existing payroll systems for seamless operation

Real-time updates to reflect the latest wage information

User-friendly interface for quick adjustments

Comprehensive reporting for better financial insights

Potential Use Cases and Benefits

Ideal for businesses with multiple pay rates and currencies

Helpful for HR departments managing diverse wage structures

Enhances accuracy in payroll processing, reducing errors

Saves time by automating wage conversion tasks

Supports compliance with wage regulations

This feature addresses common payroll challenges by simplifying the wage release process. By ensuring accurate conversions and reducing manual effort, you can focus on more important aspects of your business. In turn, your employees benefit from consistent and precise pay, leading to improved morale and productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you change hourly wage to salary?

Multiply the hourly wage by the number of hours the employee works per week to get the weekly salary rate. 2. Multiply the weekly salary rate by the number of weeks in a year to get the annual salary rate.

Can employer change hourly to salary?

An employer can change your wage or status as salaried or hourly going forward only — it cannot apply to hours already worked. To be salaried, an employee must meet one of the exemptions.

Can my employer change my contract and reduce my pay?

If your employer asks you to work fewer hours or take a pay cut, this is a change to your contract of employment. Any change to your contract of employment must be agreed by both you and your employer. If you don't accept a reduction in your working hours or pay, your employer may decide to make you redundant.

How do you convert an hourly employee to salary?

Multiply the hourly wage by the number of hours the employee works per week to get the weekly salary rate. 2. Multiply the weekly salary rate by the number of weeks in a year to get the annual salary rate. 3.

Why would a company switch from salary to hourly?

Even if the employee takes a partial day off, you must pay full salary for that day. Hourly employees are paid for the exact amount of hours they work during the pay period. Therefore, if they take partial days off and do not have benefit days to cover the hours, you do not have to pay them for the time taken.

Do salary employees get raises?

(a).) As of January 1, 2019, the minimum wage in California increased from $11.00 to $12.00 per hour for employers with 26 or more employees (the increase is from $10.50 per hour to $11.00 per hour for employers with 25 or fewer employees on January 1, 2019).

Which is better salary or hourly pay?

The benefits of hourly jobs are that you can sometimes earn even more than you would in a salaried job, especially if you work a lot of overtime. You also know that you will be compensated for every single hour you work, unlike a salaried job. However, hourly jobs do not always have the same benefits as salaried jobs.

What is better wages or salary?

A wage is paid on an hourly basis. If you work more than a certain number of hours, you get overtime pay. Workers that earn a salary often put in more than 40 hours per week, but get paid no overtime pay. However, salaries can be higher than what hourly workers earn including overtime.

#1 usability according to G2

Try the PDF solution that respects your time.