Create Payment Transcript Gratis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

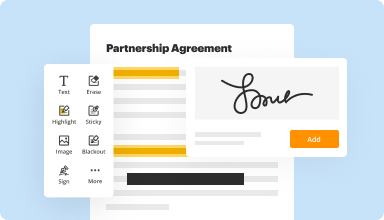

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

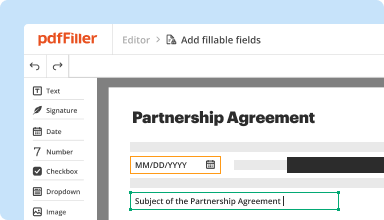

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

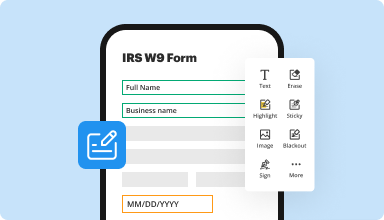

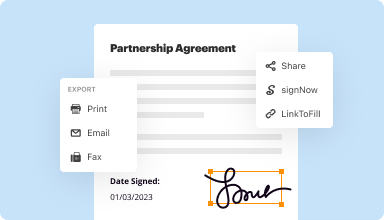

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

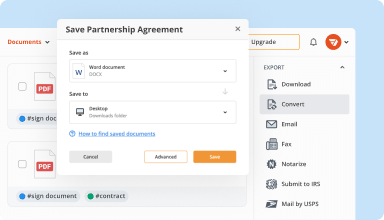

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

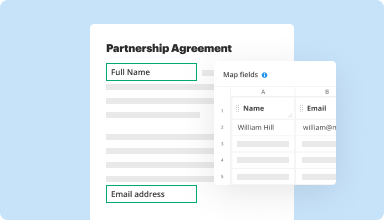

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

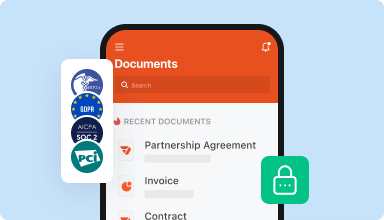

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Great experience, have to redo tax form sent and was not able to fill form out with other downloaded program. Have it done a printed now running to post office, needs sent out ASAP.

2015-01-27

It has a lot of features to available learn and the support is awesome! It's a little time consuming to learn on my own though but again if I can't find what I'm looking for on the videos or the help I email customer service and they respond within an hour or two and I'm back rolling.

2016-01-28

I have no interest in being on a webinar now or at any time in the near or distant future. Please stop insisting and asking me . The answer is NO to webinars.

2018-02-16

I have used it almost every day for over a week to fill out forms. I find it to be a bit awkward at times but I'm getting better at finding my way around. I will continue to use it.

2018-12-14

What do you like best?

It can edit and sigh.We can use it as daily works.

What do you dislike?

It can not merge more than two pages. If we have 2 or more pages to merge, it failed.

What problems are you solving with the product? What benefits have you realized?

None

It can edit and sigh.We can use it as daily works.

What do you dislike?

It can not merge more than two pages. If we have 2 or more pages to merge, it failed.

What problems are you solving with the product? What benefits have you realized?

None

2019-08-15

Great pdf editing software

PDF Filler is an awesome piece of software. It is so good being able to edit docs online and save them without having to worry about retyping information because the pdf provided was not able to be edited

There is no version history which means if you make changes to the pdf you can backtrack to an earlier version unless it was saved separately

2019-05-15

Love, Love, Love the PDF Filler

I recommend this product.

This program makes it so easy to fill out any PDF. It really helps in our office for everything to appear highly professional.

It is taking me awhile to learn this software, but I think that once I master it that it will be very helpful in our office.

2018-05-09

I needed a straightforward way to file…

I needed a straightforward way to file an extra tax form, and PDF Filler helped me out! Much easier than finding the form on the IRS website (somehow impossible?) and hoping for the best.

2021-10-12

What do you like best?

I love the fact that we can collect uploads AND money through filled PDFS

What do you dislike?

The entire site is very confusing and we have a hard time understanding where our active sheets are located within the site. We see things like "documents" and then we make a new template ... then lose which template is live and which one isn't. I also don't care for the fact that we cannot choose to have ZERO color in the field that the customer sees for filling in and I would love to be able to disable the "lock to grid" feature that is clearly on at all times.

Recommendations to others considering the product:

I recommend reading through the site, reading through all the tutorials you can and getting very organized about what you are going to do before getting started.

What problems are you solving with the product? What benefits have you realized?

We no longer have to deal with faxing our documents to customers to fill out, sign and fax back. We just tell them to go to our website . They are also so much more likely to complete the entire process including sending us pictures that we require and we no longer lose the pictures or get confused as to where everything is.

2020-08-07

Create Payment Transcript Feature

The Create Payment Transcript feature streamlines your payment tracking process. With this intuitive tool, you can easily generate clear and detailed payment records without hassle. It simplifies your financial management and enhances your transparency with clients or stakeholders.

Key Features

Generate comprehensive payment records

Supports multiple payment methods

Securely stores transaction data

Easy export to PDF or CSV formats

User-friendly interface for quick access

Potential Use Cases and Benefits

Businesses can track and verify payments efficiently

Freelancers can provide detailed invoices to clients

Accountants can simplify financial reporting

Non-profits can maintain transparent records for donations

Individuals can keep personal finances organized

This feature addresses your need for accurate documentation. By providing a straightforward way to create payment transcripts, it eliminates confusion during audits and disputes. You can focus more on your core activities, knowing your financial records are clear and accessible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I get my wage and income transcript?

You can get an IRS wage and income transcript online at www.irs.gov/Individuals/Get-Transcript. When you get wage and income transcript access, it will show you all the informational returns the IRS has received for your tax ID, like: W-2. Form 1099-INT.

What is the wage and income transcript?

IRS Definition A wage and income transcript shows data from information returns the IRS receives, such as Forms W-2, 1099, 1098 and Form 5498.

What is the difference between a tax return transcript and a tax account transcript?

A tax transcript is a summary of your tax return provided by the IRS. There are a few types of transcripts available. The most basic is the tax return transcript, which contains most line items from the tax return, including the adjusted gross income along with associated forms and schedules.

What is IRS transcript?

An IRS transcript is a record of your past tax returns. You can choose to receive them online or by mail. Request a transcript from the IRS website.

How can I get my tax transcript online immediately?

You can get your free transcripts immediately online. You can also get them by phone, by mail or by fax within five to 10 days from the time IRS receives your request. To view and print your transcripts online, go to IRS.gov and use the Get Transcript tool. To order by phone, call 800-908-9946 and follow the prompts.

How do I get my corporation tax transcript?

Please visit us at IRS.gov and click on Get a Tax Transcript... under Tools or call 1-800-908-9946. If you need a copy of your return, use Form 4506, Request for Copy of Tax Return. There is a fee to get a copy of your return.

Can you file taxes with a wage and income transcript?

The Wage & Income transcript reports only “data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498, IRA Contribution Information.” ... That is, the Wage and Income Transcript does not show your tax return, but the income forms that were copied to the IRS.

What is a wage and income transcript?

The IRS Wage & Income Transcript is a listing of all the information reports that the IRS has received for you. ... If you're wondering what the IRS does with this information, they build an annual file about you, and then they compare what they have received with your tax return.

Can I get a tax transcript if I didn't file?

This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T. Verification of Non-filing Letter — provides proof that the IRS has no record of a filed Form 1040, 1040A or 1040EZ for the year you requested. It doesn't indicate whether you were required to file a return for that year.

How can I get a copy of w2 quickly?

If you can't get your Form W-2 from your employer, and you previously attached it to your paper tax return, you can order a copy of the entire return from the IRS for a fee. Complete and mail Form 4506, Request for Copy of Tax Return along with the required fee. Allow 75 calendar days for us to process your request.

#1 usability according to G2

Try the PDF solution that respects your time.