EasySIGN Disbursement Information Gratis

Use pdfFiller instead of EasySIGN to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Laatst bijgewerkt op

Aug 16, 2021

Discover the simplicity of processing PDFs online

Upload your document in seconds

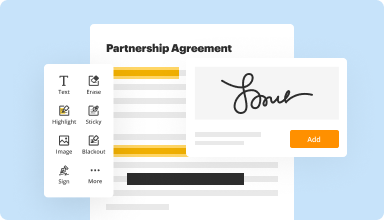

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

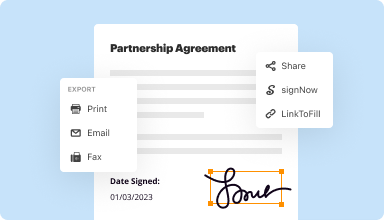

Fill out & sign PDF forms

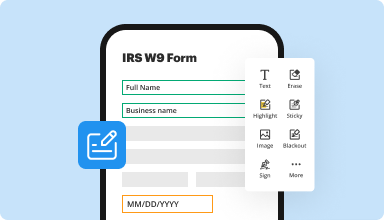

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

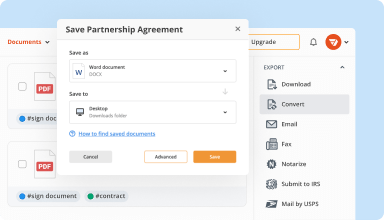

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

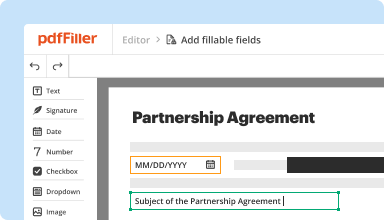

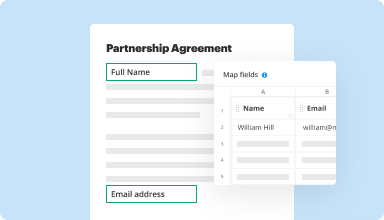

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

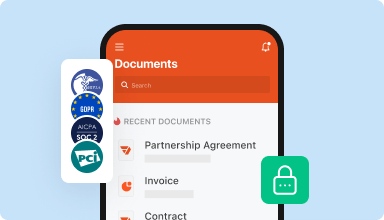

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I never used the internet to fill in forms and PDFfiller sure is a saver although I hever had any used of this type in the past, Thank you for making us illiterate users show us how to do it

2014-06-17

I've had a great experience using PDFfiller. Sometimes, I have single forms to complete, and I forget that I have the service. It's user-friendly. I need to make time to do a tutorial to learn more uses. Also, once I become better familiar, I'll be able to make referrals to sign-up for PDFfiller!

2018-08-17

All the features available are really useful.

My Only Request is if possible get an offline editor.

Overall , The Best Available Online PDF Editor.

2018-08-29

Fantastic at converting pdf to word and also editing a pdf file. Getting yourself around the menu's is a little clunky and takes a while to get used too.

2019-04-23

What do you like best?

Easy to learn and easy to use. I use it for filling in permit application forms from the county agencies we need to apply for permits from. They are extremely frustrating in redundancy, asking for the same information over and over. PDFFiller makes it easy to fill out these forms.

What do you dislike?

Some of the buttons seem a little clunky but they are easy to use.

Recommendations to others considering the product:

PDFFILLER is an inexpensive alternative to other vendors.

What problems are you solving with the product? What benefits have you realized?

Easy to fill PDF forms and easy to share them with other people.

Easy to learn and easy to use. I use it for filling in permit application forms from the county agencies we need to apply for permits from. They are extremely frustrating in redundancy, asking for the same information over and over. PDFFiller makes it easy to fill out these forms.

What do you dislike?

Some of the buttons seem a little clunky but they are easy to use.

Recommendations to others considering the product:

PDFFILLER is an inexpensive alternative to other vendors.

What problems are you solving with the product? What benefits have you realized?

Easy to fill PDF forms and easy to share them with other people.

2019-08-22

What do you like best?

Making templates rewrite PDFs ease of use

What do you dislike?

Sometimes difficult to switch back to doc

What problems are you solving with the product? What benefits have you realized?

I've been able to recreate documents into templates and this way it is easy to fill out when they are used repeatedly. I also like the signature part makes signing docs very handy. I haven't used, but am excited about the notary part that was added.

Making templates rewrite PDFs ease of use

What do you dislike?

Sometimes difficult to switch back to doc

What problems are you solving with the product? What benefits have you realized?

I've been able to recreate documents into templates and this way it is easy to fill out when they are used repeatedly. I also like the signature part makes signing docs very handy. I haven't used, but am excited about the notary part that was added.

2020-02-04

The application software is a great…

The application software is a great tool. But, when I search for another fillable document of the same, it does not allow me to pull up a clean form fillable document, for example local tax forms. Thank you.

2021-03-23

Amazing software and Customer Service is responsive and HELPFUL!

I beta test software as part of my job at ************** and PDFfiller is top notch!

*** **** ******* ***** Psychologist

2020-05-25

pdfFiller’s customer service

pdfFiller’s customer service is exceptionally attentive to their customers. Their fast and prompt reply makes them a step above the rest.

2025-04-05

EasySIGN Disbursement Information Feature

The EasySIGN Disbursement Information feature streamlines the process of managing financial transactions. It offers a simple way for users to handle disbursement data efficiently and accurately, making it an essential tool for various businesses.

Key Features

Centralized tracking of disbursement data

Real-time updates and notifications

Customizable reporting options

User-friendly interface

Integration with existing financial systems

Potential Use Cases and Benefits

Ideal for businesses handling frequent transactions

Enhances financial transparency and accountability

Simplifies compliance with financial regulations

Improves team collaboration through shared access

Saves time with automated disbursement workflows

By leveraging the EasySIGN Disbursement Information feature, you can address the common issues of delayed transactions and lack of clarity in financial records. It helps you gain control over your disbursement processes, reduces errors, and ultimately promotes greater financial accuracy in your operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How does refund transfer work?

The Refund Transfer (RT)1is a bank product that allows tax preparation and other authorized fees to be deducted from your client's tax refund. In addition, the RT is also a method for clients who do not have bank accounts to receive their refunds with the speed of direct deposit instead of waiting for a mailed check.

How long does a refund transfer take?

The IRS issues most refunds within 21 days after IRS acceptance.

How long does it take for a refund to transfer?

The IRS states that most refunds are received within 21 days from the time a return has been accepted and a refund option is selected. State refund times does vary. The IRS starts accepting tax returns today on January 29, 2018.

How long does it take for SMTP to release funds?

According to the IRS, 90% of all refunds are released in 21 days or less, and here are a few things that are possible when your refund is delayed: The IRS may issue the refund shortly — The IRS issues refunds through the Bureau of the Fiscal Service and the direct deposit process takes 1-2 business days.

How long does it take for SBB to deposit refund?

Usually 1 to 2 days before a refund is scheduled to arrive, the IRS sends a pre-notification of the refund amount to TPG. The IRS does not deposit the money at this time, but it is only a notification that the refund is on its way.

How long after refund is sent will it be deposited?

The IRS states that nine out of 10 e-filed tax returns with direct deposit will be processed within 21 days of IRS e-file acceptance. Mailed paper returns: If you filed a paper return, please allow 4 weeks before checking the status. Refund processing time is 6 to 8 weeks from the date the IRS receives your tax return.

What is a refund transfer fee H&R Block?

H&R Block has a “Refund Transfer” service fee of $39.95 for clients who file their taxes at an H&R Block tax office. The cost is $34.95 for online filers. The refund is deposited into that account and then the paid preparer is able to deduct the fees from that account.

What is a refund transfer fee?

The Refund Transfer (RT)1 is a bank product that allows tax preparation and other authorized fees to be deducted from your client's tax refund. When tax refunds are issued by the IRS or states, the bank deducts all authorized fees from the refund and automatically forwards them to the appropriate parties.

#1 usability according to G2

Try the PDF solution that respects your time.