Excise Formula Notice Gratis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

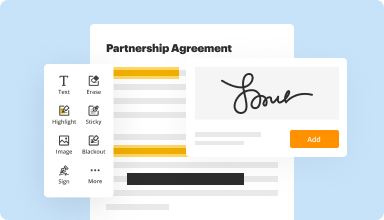

Fill out, edit, or eSign your PDF hassle-free

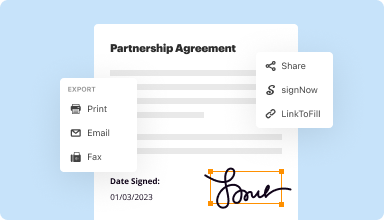

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

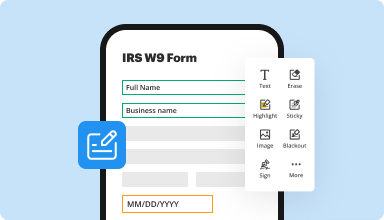

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

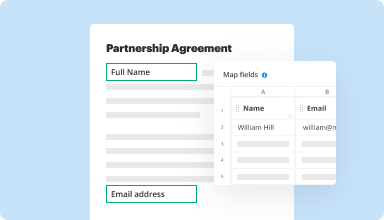

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

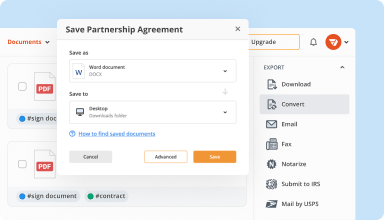

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

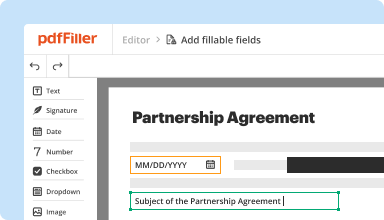

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

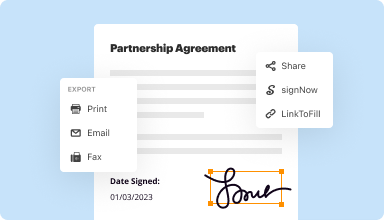

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Overall a good experience.

Sometimes the lack of features like aligning fields (i.e. Publisher) is frustrating: the ability to copy details from one field to another (drop downs and field attributes) making some forms with several fields that are the same. But I'm an old software designer so I'll take those frustrations and cherish all the good points of the software. I think its a good solution for my needs in the insurance industry.

2019-08-01

What do you like best?

The program is easy to use and super convenient. Your documents are always with you on the server PDFIller provides.

What do you dislike?

Getting in touch with a person in customer service is impossible and emails to cust. serv. have not been answered. I originally signed up as a single user; but then as my needs expanded at my office, I added and paid for three more users. For a while everything worked without issue, but then the other three users could not log-in and the different prompts in my dashboard were saying the subscriptions were active and to this day my office staff works through my sole account which can knock someone off in the middle of something.

What problems are you solving with the product? What benefits have you realized?

The fax benefit is awesome. I use the program with my insurance agency. It is way more user friendly than Adobe and you don't need a separate service to send a client a form to sign.

The program is easy to use and super convenient. Your documents are always with you on the server PDFIller provides.

What do you dislike?

Getting in touch with a person in customer service is impossible and emails to cust. serv. have not been answered. I originally signed up as a single user; but then as my needs expanded at my office, I added and paid for three more users. For a while everything worked without issue, but then the other three users could not log-in and the different prompts in my dashboard were saying the subscriptions were active and to this day my office staff works through my sole account which can knock someone off in the middle of something.

What problems are you solving with the product? What benefits have you realized?

The fax benefit is awesome. I use the program with my insurance agency. It is way more user friendly than Adobe and you don't need a separate service to send a client a form to sign.

2019-08-15

Customer service is A1!

Wow! Customer service is A1!I needed to fill out some forms for an outfit, a one-time thing, and signed up for the trial month.Later in the month I tried to cancel the trial period before my credit card was charged the $20, but I forgot which email account I'd used to sign up, so I was unable to log in to my PDFfiller account.Today, when I received the email saying my credit card was charged the $20, I was able to contact PDFfiller since I now knew which account I'd used. I contacted them via "Contact Support" in their website and explained my situation. OMG! When it said I should receive an email in 20 minutes or less, I was thinking, "Yeah, right!" but it was literally only minutes before I received an email saying they would be glad to cancel the subscription and refund my money.If I ever need this type of service on a more regular basis, I will definitely be signing up with this company!

2020-04-13

Immediate Payment Refund

Payment Refund Signed up for free trial with pdffiller and forgot to cancel. When I explained this to pdffiller my payment was returned to my account the same day.

2021-10-25

I needed a straightforward way to file…

I needed a straightforward way to file an extra tax form, and PDF Filler helped me out! Much easier than finding the form on the IRS website (somehow impossible?) and hoping for the best.

2021-10-12

I love it ! Ive had so problems tring to find a app that i actully could use .This app works great. Its saved me a huge headache

THANK YOU!!

2021-05-21

I used the pdfFiller product and it…

I used the pdfFiller product and it worked great. Later there was some miscommunication about payment. In less than an hour the matter was corrected.Very good group.Paul

2021-02-25

I loved this software and features

I loved this software and features. However it's just out of my budget right now. It would be helpful if there was a monthly subscription or payment plan. Instead of $96 all at once there should be an option to pay a monthly fee of $8.

2020-11-25

REAL EASY TO USE

REAL EASY TO USE, INTUITIVE, EASY TO FIND THE NEEDED OPTIONS.

ONE THING IT LACKS IS THE FEATURE TO COLUMISE THE TEXT. LIKE ALIGNING TO CENTER, LEFT, RIGHT. IT WOULD BE GOOD TO HAVE THE OPTION TO DO THAT. LIKE THE ONE MICROSOFT WORD HAS.

2024-12-13

Excise Formula Notice Feature

Introducing the Excise Formula Notice feature, designed to simplify your tax processes. This tool assists you in managing your excise duties more effectively, providing clarity and flexibility in handling complex tax calculations.

Key Features

Automated calculations for excise tax rates

Customizable formulas to fit your specific needs

Real-time updates for tax rate changes

User-friendly interface for easy navigation

Comprehensive reporting options to track expenses

Use Cases and Benefits

Streamlining tax management for businesses

Reducing errors in tax calculations

Enhancing compliance with changing regulations

Providing clear insights into excise tax obligations

Saving time and resources on manual calculations

With the Excise Formula Notice feature, you gain a reliable solution to your tax-related challenges. This tool helps you stay organized and ensures that you remain compliant with the latest regulations. By automating your tax calculations, it effectively reduces the risk of errors, allowing you to focus on your core business activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I calculate excise tax?

The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. The tax rate is fixed at $25 per one thousand dollars of value. The value of a vehicle is determined as a percentage of the manufacturer's suggested retail price for that vehicle based on the year of manufacture.

What percentage is excise tax?

Federal excise tax revenues collected mostly from sales of motor fuel, airline tickets, tobacco, alcohol, and health-related goods and services totaled $83.8 billion in 2017, or 2.5 percent of federal tax receipts. Excise taxes are narrowly based taxes on consumption, levied on specific goods, services, and activities.

How is excise tax calculated?

To calculate the excise tax amount, multiply the vehicle's purchase price by the excise tax percentage or millage rate. For example, a new car buyer in Maine pays a millage rate of. 0240. If the car costs $18,000, multiply $18,000 by.

What is subject to federal excise tax?

An excise tax is a legislated tax on specific goods or services at purchase such as fuel, tobacco, and alcohol. ... A federal excise tax is usually collected from motor fuel sales, airline tickets, tobacco, and other goods and services. Excise taxes are primarily for businesses.

What is the purpose of excise tax?

Excise taxes are most often levied upon cigarettes, alcohol, gasoline and gambling. These are often considered superfluous or unnecessary goods and services. To raise taxes on them is to raise their price and to reduce the amount they are used. In this context, excise taxes are sometimes known as “sin taxes.”

What items have an excise tax?

In the more narrow sense, taxes denominated as “excise” taxes are usually taxes on events, such as the purchase of a quantity of a particular item like gasoline, diesel fuel, beer, liquor, wine, cigarettes, airline tickets, tires, trucks, etc.

Do you pay excise tax every year?

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. You pay an excise instead of a personal property tax. If your vehicle isn't registered, you'll have to pay personal property taxes on it. ... You are taxed at a rate of $25 per thousand dollars of your car's value.

Do you have to pay vehicle tax every year?

Personal property tax These taxes are usually paid yearly based on the current value of your car. About half of all states charge a vehicle property tax, according to a 2019 Wallet article. Some municipalities also charge car owners annual taxes.

How do I find out my car excise tax?

The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. The tax rate is fixed at $25 per one thousand dollars of value. The value of a vehicle is determined as a percentage of the manufacturer's suggested retail price for that vehicle based on the year of manufacture.

Do you have to pay excise tax if you move?

If You've Moved The owner must pay the motor vehicle excise to the city or town in which he/she resided on January 1. If the owner moved before the first of the year, he/she must pay the tax to the new community to which the owner moved.

#1 usability according to G2

Try the PDF solution that respects your time.